Is Canadian Household Debt Really At Risk?

Canada seems to be the favorite poster child for international financial agencies, as yet another report identifies Canada, along with China (and its sister territory, Hong Kong) as the “economies most at risk of a banking crisis”, according to the Bank of International Settlements (BIS).[1] The BIS says risks are growing in Canada because households have maxed-out credit cards along with mortgage debt driven by rising house prices.

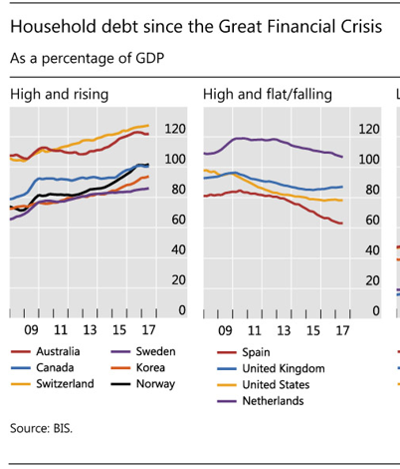

The BIS separated countries into groups based on the level and trend of household debt as a ratio to GDP (Figure 1). An especially significant group comprises those countries with debt ratios that are at a high level, that is over 60% of GDP since the 2008-financial crisis (GFC) and are trending higher. Although Canada is not the highest, the debt ratio continues to be quite elevated and upward sloping. In the United States, the level of debt has peaked and is trending slightly downward.

Figure 1 Household Debt, Various Countries

Debt to income ratios, while important for assessing the ability to service debt, are just part of the overall picture of debt in relation to a nation’s well-being. It is important to determine whether households have been accumulating assets sufficiently to weather a major downturn in the economy. Canadian households have seen the value and amount of their assets rise at faster rates than their income. Hence, balance sheets do not look as vulnerable.

A recent analysis conducted by Environics Analytics concluded that “Canadians increased their savings and investments last year {2016}—by 5.6 percent to $95,710 and by 13.2 percent to $182,238, respectively—while tempering their consumer and credit card debt, which grew by 2.6 percent and 3.3 percent, respectively.”[2]

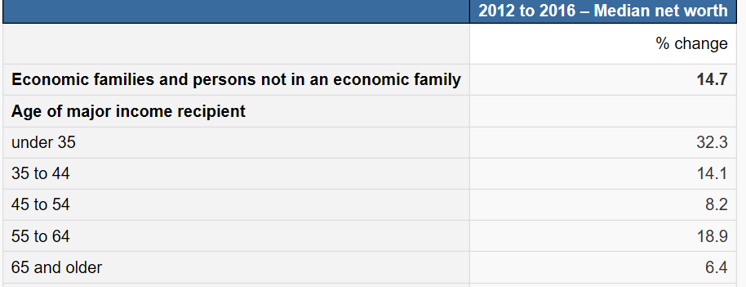

Figure 2 sets out the growth in net worth by various age categories over the period 2012-2016. Taking on the biggest debt loads are individuals in these ages groups - under 35, 35-44 and 45-54. Those individuals are buying homes, assuming mortgages and credit card debt that go along with expanding family units. Also, these groups are experiencing relatively higher rates of income growth as their jobs and careers mature. On balance, the groups with the highest debt ratios are also the groups with the greatest earning potential and are the ones whose assets are appreciating the fastest.

Figure 2 Growth in Medium Net Worth by Age Groups

Overall, Canadian debt levels do not pose a threat to economic stability as both assets and liabilities are well-matched. This is not to say that debt levels should be ignored at the macro level. The Bank of Canada has noted the vulnerability due to household debt and considers that to be one of the key factors that enter into its deliberations regarding the future path of interest rates.

[1] Inaki Aldasoro, Claudio Borio and Mathias Drehmann wrote in the BIS’s latest Quarterly Review, March, 2018

[2] ENVIRONICS ANALYTICS’ WEALTHSCAPES 2017 REVEALS CANADIANS’ FINANCIAL FORTUNES CONTINUE TO RISE, Sept 2017

I agree. Although a big downturn will hurt housing as always, Canada's debt levels are low and if inflation is the cause for a downturn their commodity based economy should weather the storm better than the US.

Good point on commodities