Indian Stocks: Nestle India

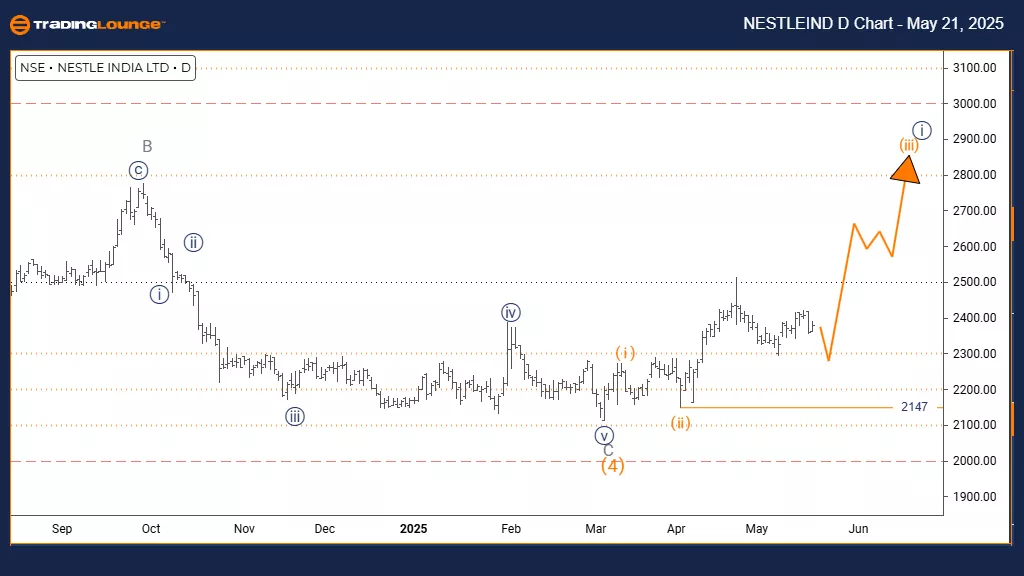

NESTLE INDIA – Elliott Wave Analysis | Trading Lounge Day Chart

NESTLE INDIA Elliott Wave Technical Analysis

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Orange wave 3

POSITION: Navy blue wave 1

DIRECTION NEXT HIGHER DEGREES: Orange wave 3 (in progress)

DETAILS: Orange wave 2 appears complete; orange wave 3 of 1 is now active.

Invalidation Level: 4147

The daily chart shows Nestle India in a clear bullish trend, with orange wave 3 forming as part of navy blue wave 1. This follows the completion of orange wave 2, signaling the start of a new upward impulse phase—typically the strongest part of an Elliott Wave pattern.

The ongoing wave structure reflects significant buying strength. Positioned within navy blue wave 1, the current momentum suggests strong continuation potential. A key level is identified at 4147; a breach would invalidate the current count, suggesting possible trend reevaluation.

This technical setup highlights a favorable phase for potential gains. The wave count implies the stock is poised for a strong advance. Investors should watch for signs of trend continuation, keeping in mind that a corrective wave will follow this phase.

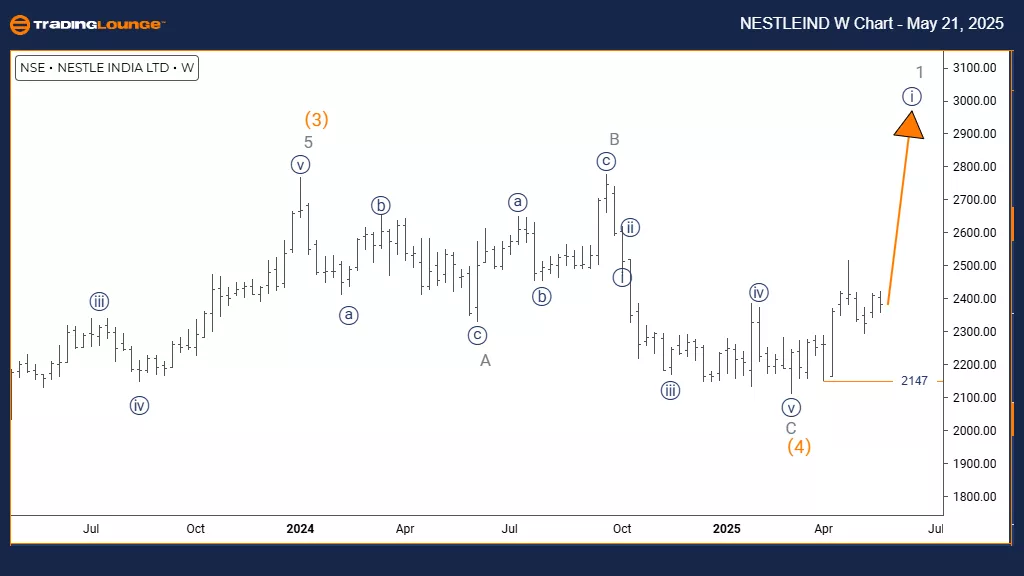

NESTLE INDIA – Elliott Wave Analysis | Trading Lounge Weekly Chart

NESTLE INDIA Elliott Wave Technical Analysis

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Navy blue wave 1

POSITION: Gray wave 1

DIRECTION NEXT LOWER DEGREES: Navy blue wave 2

DETAILS: Orange wave 4 appears complete; navy blue wave 1 of gray wave 1 is active.

Invalidation Level: 4147

The weekly chart analysis supports a bullish long-term view for Nestle India. The wave pattern shows navy blue wave 1 developing within gray wave 1, after the completion of orange wave 4. This marks the early stage of a larger uptrend.

The impulsive structure reflects solid upward momentum. Institutional buying is likely influencing this advance, with the 4147 level acting as a technical threshold for invalidation.

This structure suggests a long-duration upward trend may be forming, with navy blue wave 1 being just the beginning. The next phase will be navy blue wave 2—a correction that will follow once wave 1 completes.

Traders should track price action for confirmation of this bullish wave while managing risk if the key level is tested. The long-term setup indicates strong potential for continued gains.

Technical Analyst: Malik Awais

More By This Author:

Elliott Wave Technical Analysis: Bitcoin Crypto Price News For Wednesday, May 21

Elliott Wave Technical Forecast: Cochlear Limited - Tuesday, May 20

Elliott Wave Technical Analysis: Texas Instruments Inc. - Tuesday, May 20

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more