Indian Gold Demand Resilient Despite Record Prices

Image Source: Pixabay

Indian gold demand has remained resilient, despite record-high prices, driven by strong investment demand.

India ranks as the world’s second-largest gold market.

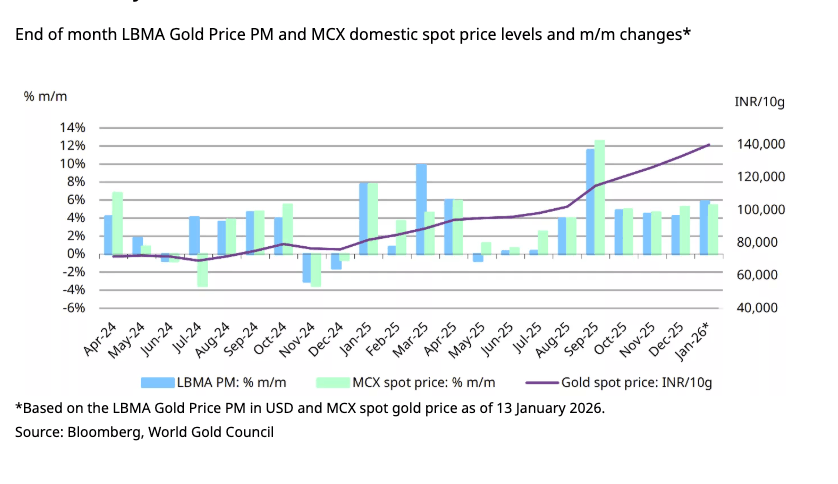

The gold price continued to surge in the final month of 2025, with domestic prices in India broadly tracking the global price.

Higher prices have created headwinds for Indian jewelry sales. Sales volumes are down. However, the value of jewelry sales is up thanks to the appreciating price. According to survey work by the World Gold Council, “Needs-based wedding purchases remain steady, providing key support to overall jewelry demand.”

While Indian consumers haven't sworn off gold, some have shifted toward lighter-weight pieces, and in some cases, lower-purity gold.

Historically, Indians have used gold jewelry as an investment as well as an adornment and have preferred 22-karat pieces. However, more consumers are now opting for 18 and 14k gold to economize.

Meanwhile, according to the WGC, “Exchange activity continues to be robust, highlighting value-conscious consumer behavior: some retailers report that over 40 percent of their jewelry sales are driven by old jewelry exchange.”

The drop in sales isn’t hurting retailers. They are making up for lower volume with higher prices. Listed Indian jewelry retailers reported strong revenue growth ranging from 37 percent to 51 percent on an annual basis in Q4, supported by festival and wedding demand.

While rising prices are creating headwinds for jewelry demand, it is boosting investment interest. Sales of gold bars and coins have been robust. The World Gold Council says the market is attracting new participants hoping to cash in on the price momentum.

Strong ETF growth also reflects growing Indian investment demand. Gold has flowed into Indian funds for eight straight months. Gold inflows set a record of ₹116 billion in December.

Cumulative holdings increased by a record 8.6 tonnes in December, lifting the 2025 total to a historic high of 95 tonnes.

According to the World Gold Council, “Investor appetite was supported by muted equity market performance and sustained gold price momentum, reinforcing the role of gold ETFs as a preferred portfolio diversifier.”

Indians have historically preferred physical gold, but interest in ETFs swelled last year. There was a 60 percent annual increase in accounts (folios). As of the end of December, there were 10.2 million Indian ETF accounts, with 3.8 million added last year.

A gold ETF is backed by a trust company that holds metal owned and stored by the trust. In most cases, investing in an ETF does not entitle you to any amount of physical gold. You own a share of the ETF, not gold itself. ETFs are a convenient way for investors to play the gold market, but owning ETF shares is not the same as holding physical gold.

There was also a healthy increase in digital gold purchases through the Unified Payments Interface (UPI). Transaction values nearly tripled last year, rising from ₹8 billion ($88 million) in January to ₹21 billion ($231 million) in December.

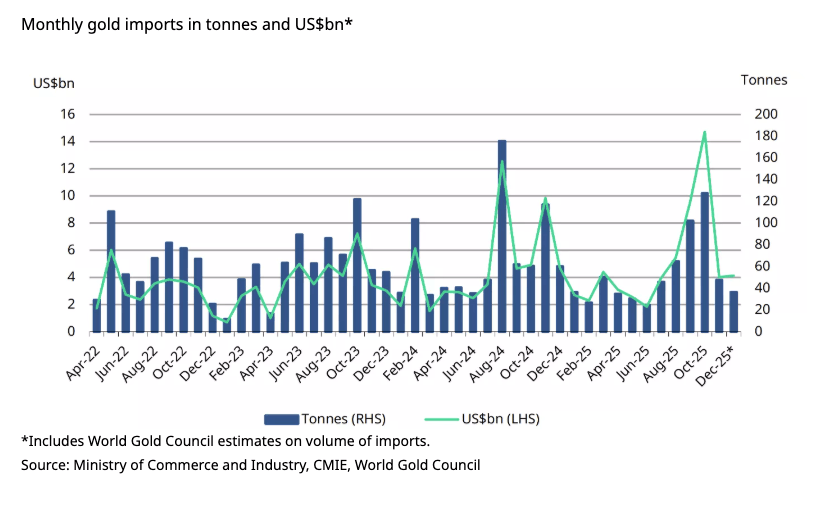

Indian gold imports grew by 3 percent in value terms month-on-month in December. However, the World Gold Council estimates import tonnage declined modestly from 48 tonnes in November to 35-40 tonnes last month.

Through 2025, the Indian gold import bill was similar to the previous year at around $59 billion. However, volumes declined by over 20 percent, reflecting higher gold prices.

Indians love gold for both cultural and economic reasons.

The yellow metal is deeply interwoven into India’s marriage ceremonies, along with its religious and cultural rituals. Festival seasons typically boost gold demand.

Indians also value the yellow metal as a store of wealth, especially in poorer rural regions. Around two-thirds of India’s gold demand comes from beyond the urban centers, where large numbers of people operate outside the tax system. Many Indians use gold jewelry not only as an adornment but as a way to preserve wealth.

In the West, gold is generally viewed as a luxury item.

Not in India. Even poor Indians buy gold.

According to a 2018 ICE360 survey, one in every two households in India had purchased gold within the last five years. Overall, 87 percent of Indian households own some gold. Even households at the lowest income levels in India hold some of the yellow metal. According to the survey, more than 75 percent of families in the bottom 10 percent of income managed to buy some gold.

The yellow metal was a lifeline for Indians buffeted by the economic storm caused by the government's response to COVID-19. After the Indian government locked down the country, banks tightened credit to mitigate the default risk. Unable to secure traditional loans, Indians used gold to secure financing. As Indians endured a second wave of lockdowns, many Indians resorted to selling gold outright to make ends meet.

More By This Author:

Silver Now Ranks As The Second-Most Valuable Asset In The World

The Debt Black Hole Claims Another Victim

Debt Data Continues To Signal Deep Consumer Stress