Silver Now Ranks As The Second-Most Valuable Asset In The World

Silver was up nearly 148 percent in 2025, and the price has continued to climb in the new year, trading over $90 an ounce.

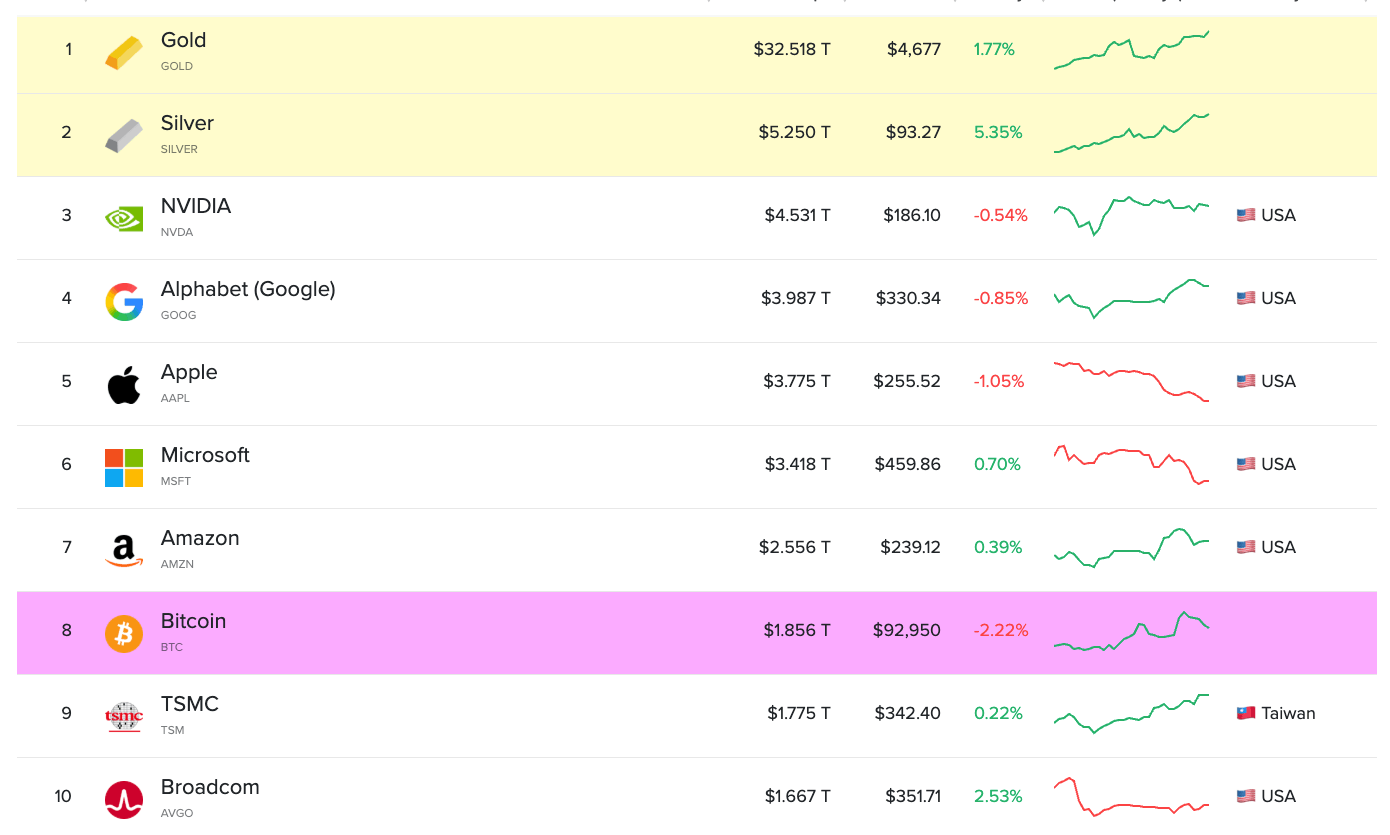

With the rapid gain, silver now ranks as the second-most valuable asset in the world with a market cap of $5.35 trillion.

The only asset more valuable than silver is gold, with a market cap of $32.5 trillion.

Last week, silver blew past AI chip giant Nvidia (market cap of $4.53 trillion). It has also surpassed stock market tech darlings Apple, Microsoft, Amazon, and Alphabet.

Several dynamics have converged to drive silver higher, including spillover effects from the gold bull market, steady industrial demand, surging investment demand, inflation, and geopolitical uncertainty. However, one factor is the key driver – there isn’t enough metal.

This has created a significant silver squeeze that continues to pressure prices higher.

The root of the problem is simple: there isn’t enough metal to meet demand.

Silver demand has outstripped supply for four straight years, and the Silver Institute projects that 2025 will be the fifth. The structural market deficit came in at 148.9 million ounces in 2024. That drove the four-year market shortfall to 678 million ounces. Including the projected 2025 shortfall, the market deficit will likely be well over 800 million ounces, an entire year of mining output.

With metal in short supply, silver users must source metal from existing above-ground stocks. People holding those stocks are reluctant to let their silver go, driving prices persistently higher.

Refiners are scrambling to keep up with demand.

Dillon Gage is a silver refinery in Texas. Company president Terry Hanlon said they are running three shifts, seven days a week.

“We can’t keep up.”

Former U.S. Mint president called the converging supply and demand dynamics a “perfect storm.”

“We have been in a long-term supply deficit, and it is just getting worse.”

Growing ETF demand also reflects a surge in interest in silver. Individual investors have poured a record $921million into silver-backed funds over the past 390 days, according to data from Vanda Research.

This underscores another problem. There is far more paper silver than actual metal.

According to analyst Faysal Amin, published by FXStreet, the current paper‑to‑physical ratio stands near 356:1. In other words, for every ounce of physical silver in the world, there are 356 paper ounces.

Some speculate that silver is in a bubble. It’s fair to worry that the metal might be oversold, and the market is certainly benefiting from “fear of missing out.” However, the scarcity of metal isn’t going to abate any time soon, leaving plenty of reasons to remain bullish on the metal.

More By This Author:

The Debt Black Hole Claims Another Victim

Debt Data Continues To Signal Deep Consumer Stress

U.S. Government Still Running Massive Deficit Despite Tariff Revenue