Growth Of The Public Sector Keeps The Canadian Economy Above Water

Image Source: Pexels

Economists at the major Canadian banks are searching high and low to find some positive news coming out of today’s GDP report for 2023 Q4. It is a tough assignment. Granted that overall GDP grew by an annualized rate of 1% in Q4, this figure is totally masked by an underlying weakness, especially in the private sector. Let’s look under the GDP hood for what really transpired in 2023 and what this might portend for the 2024.

To begin with, it is essential to separate “final demand” from GDP. Final demand considers the domestic economy only, exclusive of imports and exports and changes in the level of inventories. This distinction is important because it is a better measure of economic health and one that is more consistent, given there can be big swings in the trade sector due to external factors. For example, a series of wildfires in western Canada interfered with energy exports and the transportation of goods headed for overseas.

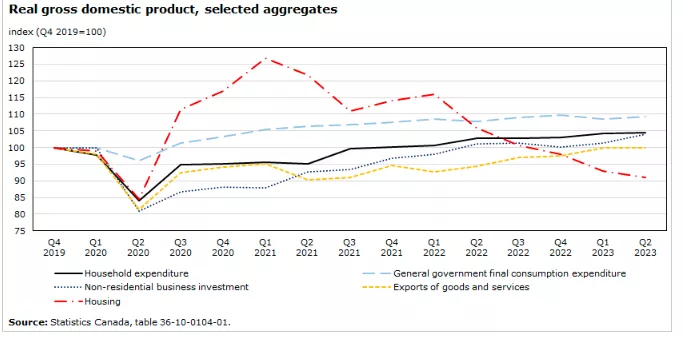

The accompanying chart clearly separates the major components that make up domestic demand. The continued decline in residential construction (red line) is a stark reminder of how monetary conditions are choking the housing supply at a very critical time when the demand for housing is being fuelled by population growth in excess of GDP growth. Similarly, non-residential business investment remains flat-lined, a condition that has existed since 2020. Household expenditures also have stagnated, as consumers contend with interest rate adjustments to their mortgages.

So, all eyes are on the expansion of the public sector (dashed blue line) which is growing at a rate of 2% yearly and remains the principal reason that the economy has not actually contracted.

An earlier blog dealt with the dramatic increase in loan loss provisions set aside by the commercial banks as a sign of recessionary conditions. The weakness in domestic demand in Q4 confirms that the banks are experiencing worsening credit conditions for their customers.

In its most recent report on the Canadian economy, the Bank of Canada set a very low bar regarding what it expects GDP to expand. Whether the economy is meeting or exceeding that bar is really beside the point. The simple fact remains the economy is performing poorly. It is high time to consider economic growth over achieving an arbitrary inflation target. Even if the Bank of Canada shifted towards easing lending conditions, the lags inherent are long and time is not on the Bank’s side.

More By This Author:

Canadian Recession Is Well Underway According To The Big Bank

Does Canada Have A Productivity Problem?

Interpreting Canadian Job Numbers Is In The Eye Of The Beholder