FTSE Prints Record Highs Before Pulling Back To Close Red On The Day

Image Source: Pexels

London's FTSE 100 made waves on Wednesday by hitting a record high, fuelled by positive corporate updates and expectations of further monetary policy support. These factors took the spotlight away from worries surrounding the tariffs declared by U.S. President Donald Trump. Initially, the blue-chip index surged by 0.3% in early trading before experiencing a reversal and dipping by 0.3%. The market's response demonstrates the delicate balance between economic factors and geopolitical developments that influence trading patterns and investor sentiment in the dynamic landscape of global finance. In a surprising turn of events, Britain faced a larger-than-expected budget deficit in December, propelled by significant debt interest costs and a unique purchase of military assets. The data shed light on the financial challenges confronting finance minister Rachel Reeves, emphasising the intricate balancing act required in managing the country's fiscal affairs. December witnessed public sector net borrowing soar to 17.8 billion pounds ($21.93 billion), surpassing the anticipated 14.1 billion pounds forecasted by economists surveyed by Reuters. This unforeseen scenario places added pressure on the chancellor to navigate the delicate balance between prudent financial management and stimulating economic growth. The evolving dynamics suggest that juggling these dual objectives simultaneously may prove to be a formidable task, underscoring the complexities inherent in steering the nation's economic course.

Single Stock Stories:

-

easyJet's stock has plummeted by 5% to 485.5p, marking its most substantial single-day decline since October 4, 2024. As the leading decliner on the FTSE 100 index, the British airline faces a challenging day despite the index edging up by 0.1%. easyJet attributes the moderation of its Q2 underlying unit revenue trends slightly below Q1 levels to investments in extended leisure routes. The company anticipates aligning with market expectations for a pre-tax profit of 709 million pounds (~$875 million) for the fiscal year 2025, based on consensus compiled by the company. Analysts at Jefferies interpret easyJet's reaffirmation of its profit forecast for FY25 as a signal that the company aims to reach its target by either boosting revenue (RASK) or cutting costs (CASK, excluding fuel expenses). The market is expected to respond neutrally to negatively, with a focus on the marginal decline in Q2 yields and its implications for consumer sentiment. Despite the current setbacks, easyJet had witnessed an impressive 11% rise in 2024.

-

Intermediate Capital Group's shares have surged by 5.6% to 2,236p, reflecting a positive market response. The UK-centered alternative asset manager has surpassed expectations with impressive fundraising numbers of $7.2 billion in Q3, outperforming Panmure Liberum's projection of $3.1 billion. Additionally, the firm's assets under management (AUM) for Q3 stood at $107 billion, marking a notable 5.1% increase from the previous year. Moreover, fee-earning AUM also witnessed growth, rising by 2.8% and reaching $71 billion. Intermediate Capital Group has demonstrated its resilience and growth potential, indicated by its shares climbing approximately 23% throughout 2024 and further advancing by about 8% year-to-date. This momentum underscores the company's robust performance and market confidence in its strategic direction.

Broker Updates:

-

Trainline, a prominent ticketing company, witnessed a notable 7% decline in its shares, settling at 364.8 pence, in the recent market activity. This drop positions the stock as one of the significant losers on the FTSE mid-cap index, which simultaneously experienced a 0.5% increase. The UK Department for Transport (DFT) has disclosed intentions for Great British Railways (GBR) to streamline online rail ticket sales by amalgamating the ticket platforms of various train operators. Trainline (TRNT) has voiced its endorsement of the government's move, emphasising the importance of fostering competition and ensuring a fair playing field by consolidating online ticket sales under Great British Railways. Stifel analyst Peter McNally has expressed reservations, contemplating whether this initiative will lead to a truly competitive offering or merely amalgamate existing individual operator websites into a unified platform to drive cost efficiencies. Despite the current market adjustment, TRNT had previously seen significant growth, with a remarkable increase of around 38% in 2024, showcasing its resilience and market appeal up to that point. This development underscores the evolving landscape of online ticketing and the strategic implications for industry players navigating these changes.

Technical & Trade View

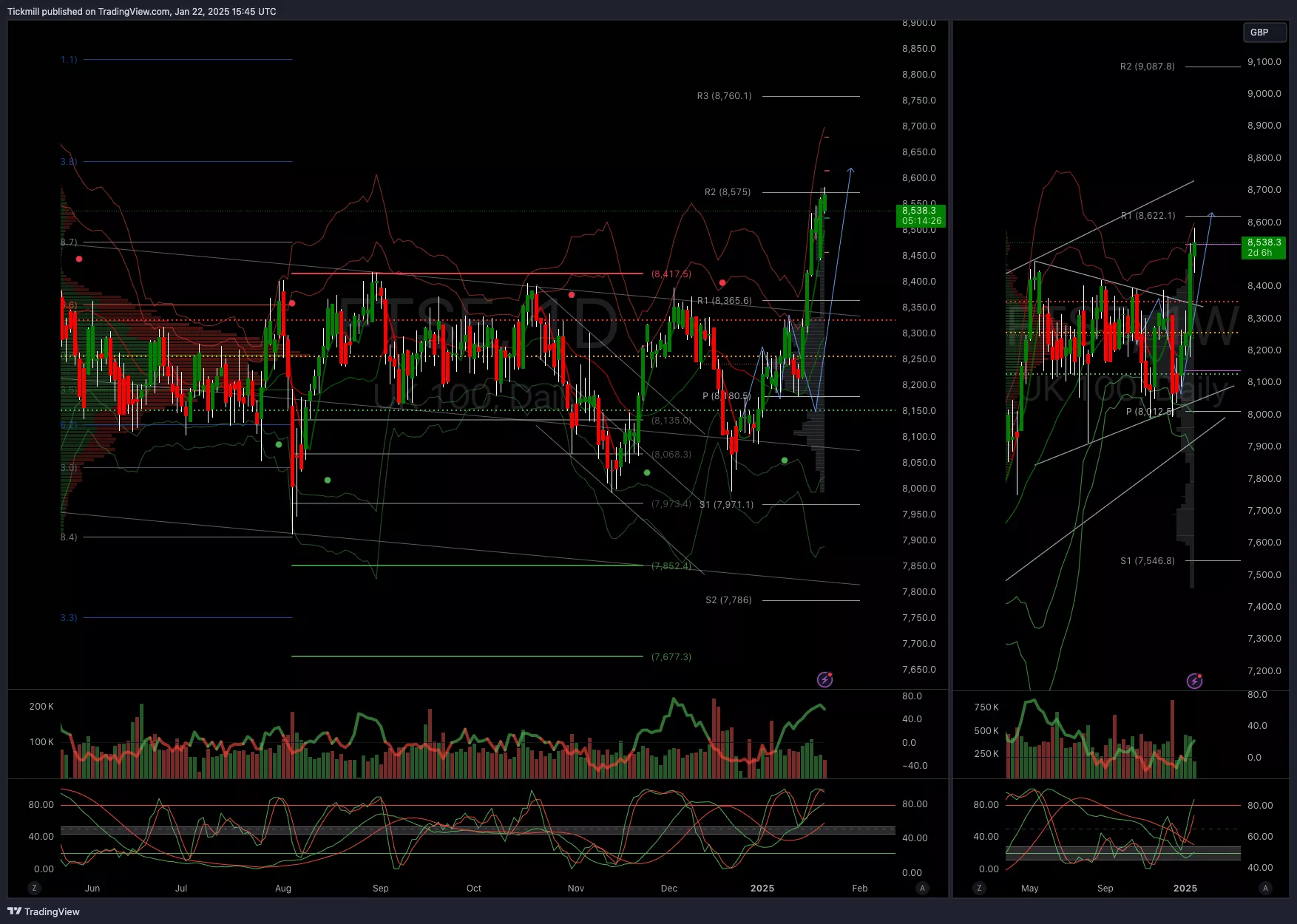

FTSE Bias: Bullish Above Bearish below 8400

- Primary support 8400

- Below 8400 opens 8225

- Primary objective 8600

- Daily VWAP Bullish

- Weekly VWAP Bullish

(Click on image to enlarge)

More By This Author:

Daily Market Outlook - Wednesday, Jan. 22

FTSE - UK Wage Growth Weighs On BoE Doves

Daily Market Outlook - Tuesday, Jan. 21