Daily Market Outlook - Wednesday, Jan. 22

Image Source: Pixabay

Asian markets posted gains as optimism over increased AI investments under Trump's administration outweighed concerns about potential tariffs on Chinese imports. OpenAI, SoftBank Group, and Oracle announced the formation of a venture named Stargate, with a plan to invest $500 billion in AI infrastructure in the United States. While it is unclear how much of this investment was already planned, the initiative is likely to bolster the U.S.'s competitive edge over China in the race for AI technological supremacy. The market reacted positively, with SoftBank's stock surging 10% in Asia, contributing to gains in the Nikkei index.Stocks in South Korea, and Taiwan also rose, buoyed by Trump's commitment to an AI investment initiative, which boosted regional tech companies. However, Chinese stocks lagged behind, with the CSI 300 Index declining up to 1.3% after Trump suggested he was still considering a 10% tariff on all Chinese imports. The contrasting performances across Asian markets reflect the challenges investors are likely to face as the Trump administration introduces significant policy changes in the coming months. The MSCI Asia Pacific Index rose nearly 0.1%. In the bond market, US 10-year Treasury yields edged up by one basis point following a five-basis-point decline in the prior session. The Dollar strengthened across G10 currencies, while both onshore and offshore Chinese Yuan faced pressure in the region's currency markets. Elsewhere in Asia, the Bank of Japan is expected to raise interest rates at its upcoming policy meeting, according to Kyodo News. This expectation coincides with projections of a 25-basis-point rate hike from the ECB, further adding to global monetary policy dynamics. Meanwhile, the Yen weakened against the Dollar. Shares of Netflix surged 14% in after-hours trading following the company’s announcement of a record subscriber increase last quarter. The strong performance enabled Netflix to raise prices for most of its service plans in the U.S. and other countries. This boost lent positive momentum to broader markets, with Nasdaq futures rising in Asia.

UK headline government borrowing is £4bn above plan for 2024-25. The ONS reported a December deficit of £17.8bn, exceeding the £14.6bn estimate from the October Budget. The cumulative deficit for 2024-25 is now £129.9bn, £4.1bn wider than anticipated. To meet the full-year target of £127.5bn, a surplus is needed in the final quarter. January's strong tax receipts from self-assessment payments offer hope for staying close to target. The cash requirement of £19.4bn in December aligns with expectations, totalling ~£168bn for the year, which is consistent with October's plans. However, Public Sector Net Borrowing figures indicate a risk of overshooting funding needs for 2024-25.

The data slate is scant today aside from monitoring Trump Tweets, Christine Lagarde, President of the European Central Bank, will attend the World Economic Forum in Davos, Switzerland, alongside ECB Governing Council member Francois Villeroy de Galhau, to discuss interest rates. Markets widely expect the ECB to cut its policy rate by 25 basis points next week, though questions persist about how much further rates can be reduced. Predicting the terminal rate remains difficult, as inflation stays above the ECB's target while economic growth faces mounting pressures, partly due to Trump’s America-first policies, which are impacting both European allies and global trade partners.

Overnight Newswire Updates of Note

- Trump Threatens EU Tariffs, Sets Feb 1 China Deadline

- Trump: SoftBank, OpenAI, Oracle To Invest $500B AI Fund In US

- Microsoft Changes OpenAI Pact To Allow Use Of Rival Cloud Services

- Netflix Shares Jump As It Adds Record Number Of Subscribers

- United Airlines First-Quarter Profit Outlook Outpaces Estimates

- Dollar Pushes Higher After Trump 10% Tariff Comments On China

- Chinese Stocks Drop After Trump Says 10% Tariffs Still On Table

- China’s Hopes Grow For Deal To Avert Trade War With Trump

- China’s Xi And Putin Discuss Relations With Trump, Ukraine, Taiwan

- BoJ Likely To Raise Rates In Absence Of Immediate Trump Tariffs

- NZ Annual Inflation Holds At 2.2% in Dec, Within RBNZ Target

(Sourced from reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.0300-05 (1.8BLN), 1.0345-50 (3.6BLN), 1.0375 (1BLN)

- 1.0400-10 (2BLN), 1.0500-10 (2.1BLN)

- USD/CHF: 0.9100 (261M). EUR/CHF: 0.9425 (240M)

- GBP/USD: 1.2250 (327M), 1.2350 (414M)

- AUD/USD: 0.6125 ( 350M), 0.6210 (2.2BLN), 0.6245 (538M), 0.6300 (260M)

- NZD/USD: 0.5475 (450M)

- USD/CAD: 1.4345-50 (882M),1.4360 (509M), 1.4370 (347M), 1.4390-1.4400 (503M)

- USD/JPY: 154.50-60 (1.1BLN), 154.75 (263M), 155.00 (325M), 155.50 (1.4BLN)

- 156.00 (300M), 156.45 (610M). EUR/JPY: 165.50 (765M)

CFTC Data As Of 17/1/25

This summary provides an overview of the trading positions held by equity fund managers and speculators in various futures markets as of the reporting period ending January 14:

-

S&P 500 Futures:

-

Equity fund managers reduced their net long positions by 70,424 contracts, leaving them with a total of 923,997 contracts. A "net long position" means they hold more contracts betting on a rise in the S&P 500 index compared to those betting on a decline.

-

Equity fund speculators reduced their net short positions by 38,472 contracts, bringing the total net short position down to 311,085 contracts. A net short position indicates that these speculators are betting on a decline in equity prices. The reduction in their positions suggests a lessened bearish outlook compared to previous levels.

-

-

Currency Positions:

-

Japanese Yen: Speculators have a net short position of 29,411 contracts, meaning they expect the Yen to weaken.

-

Euro: Net short position of 60,397 contracts, indicating expectations of a weakening Euro.

-

British Pound: A net long position of 438 contracts suggests a minor expectation for the Pound to strengthen.

-

Swiss Franc: A net short position of 38,701 contracts implies expectations of a weaker Franc.

-

Bitcoin: A net long position of 1,335 contracts shows a favorable outlook on Bitcoin’s price increasing.

-

-

CBOT US Treasury Futures:

-

Ultrabond: The net short position decreased by 4,966 contracts to 242,422, suggesting some reduction in bearish bets.

-

2-year Treasury: Increased net short position by 64,188 contracts to 1,257,206, indicating a stronger expectation for rising yields (or falling prices).

-

10-year Treasury: Net short position trimmed by 104,511 contracts to 567,935, showing reduced bearish sentiment.

-

5-year Treasury: Decreased net short position by 23,282 contracts to 1,777,621, also indicating less bearishness.

-

Treasury Bonds: Shifted from a net short position of 16,827 contracts to a net long position of 52, indicating a switch to an expectation of rising bond prices (or falling yields).

-

Technical & Trade Views

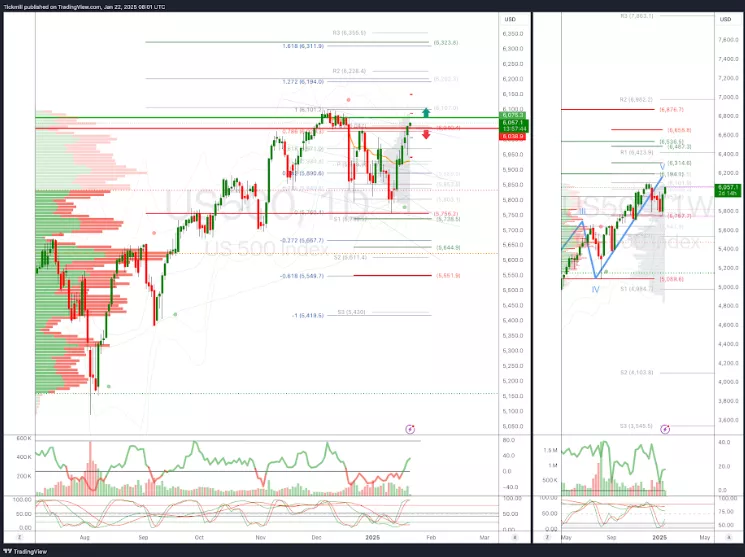

SP500 Pivot 6040

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests bullishness Into Feb 6th

- Long above 6075 target 6165

- Short Below 6045 target 5743

(Click on image to enlarge)

EURUSD Pivot 1.0435

- Daily VWAP bullish

- Weekly VWAP bearish

- Seasonality suggests bearishness into March 30th

- Above 1.0505 target 1.0634

- Below 1.0435 target 0.9758

(Click on image to enlarge)

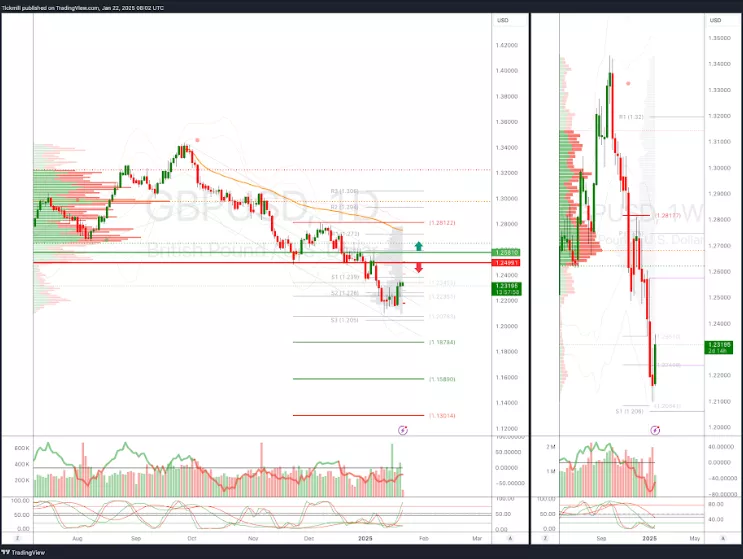

GBPUSD Pivot 1.2614

- Daily VWAP bullish

- Weekly VWAP bearish

- Seasonality suggests bearishness into March 10th

- Above 1.2685 target 1.2812

- Below 1.2615 target 1.1878

(Click on image to enlarge)

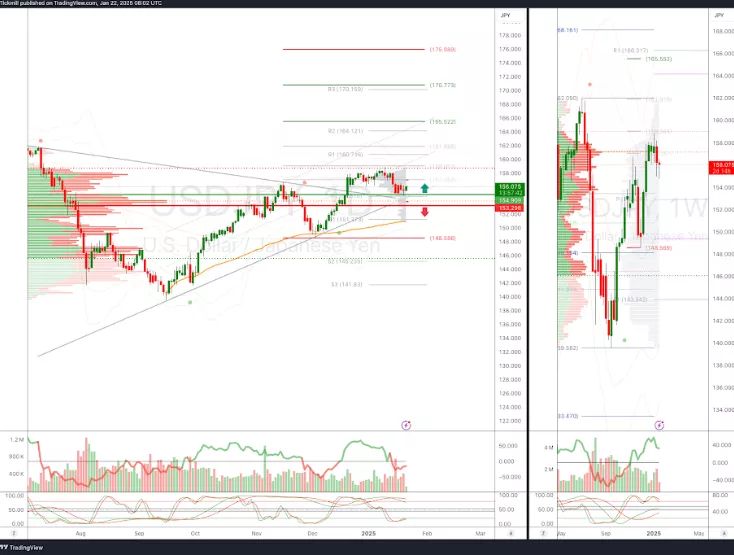

USDJPY Pivot 153.77

- Daily VWAP bearish

- Weekly VWAP bearish

- Seasonality suggests bearishness into jan 23rd

- Above 1.5377 target 165.50

- Below 152.41 target 150

(Click on image to enlarge)

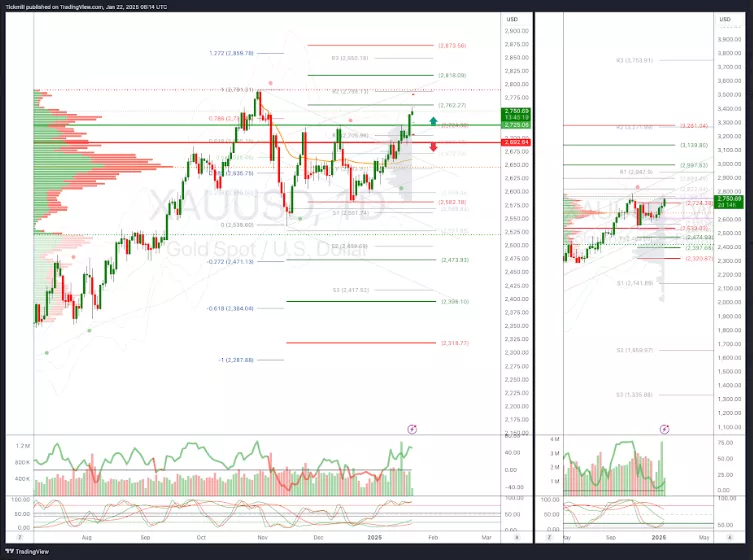

XAUUSD Pivot 2692

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests volatile bullishness into Feb 22nd

- Above 2725 target 2762

- Below 2692 target 2475

(Click on image to enlarge)

BTCUSD Pivot 101,960

- Daily VWAP bearish

- Weekly VWAP bullish

- Seasonality suggests bullishness into Apr 9th

- Above 104,020 target 110,000

- Below 101,942 target 86,266

(Click on image to enlarge)

More By This Author:

FTSE - UK Wage Growth Weighs On BoE Doves

Daily Market Outlook - Tuesday, Jan. 21

Daily Market Outlook - Friday, Jan. 17