Daily Market Outlook - Tuesday, Jan. 21

Image Source: Unsplash

Financial markets showed mixed responses on Trump's first day in office, with traders feeling relieved by the lack of immediate broad tariffs on all trading partners yet cautious about possible future actions. Chinese stocks led the gains in Asia after Trump opted not to impose extra tariffs on the country. At the same time, the Dollar gained strength as Trump revealed plans to implement punitive tariffs of up to 25% on imports from Canada and Mexico starting February 1st. Treasury yields increased, benefiting from diminished concerns about rising inflation due to the lack of significant new tariffs. The move reflects the uncertainty and market volatility characteristic of Trump's first term, where his unpredictability kept investors on edge. As before, many view Trump's statements as part of his negotiation tactics. Known for portraying himself as a dealmaker, Trump appeared to signal a willingness to negotiate, particularly in his comments on TikTok and China. However, he also issued a warning that tariffs would follow if Beijing resisted reaching an agreement. On the European Union, Trump reiterated that tariffs were one tool to address the trade deficit, suggesting that increased U.S. oil and gas exports could serve as an alternative solution. Still, he hesitated to push for a blanket tariff policy, stating, "we're not ready for that yet."

Currency markets responded with intense fluctuations over the past several hours. By midday in Asia, the U.S. dollar had rebounded against several major currencies, though it had not regained the strength it displayed earlier on Tuesday. Meanwhile, China's central bank acted to support the yuan by setting its strongest fixing since early November. Given China's central role in Trump's tariff threats, markets remain sceptical that the yuan's strength can be sustained. Commodity markets also exhibited varied reactions. Oil prices fell as traders evaluated Trump's numerous promises and executive actions, including plans to enhance domestic production. Iron ore prices soared, while Bitcoin continued to drift lower for a fourth consecutive day.

Today's data slate includes the release of the ZEW sentiment surveys from Germany, survey results are anticipated to show a continued decline in current conditions, following the 11-month low recorded in December. Although expectations for the next six months experienced a slight recovery in December, they remain fragile and are not expected to have seen significant improvement at the start of the year. EU finance ministers are convening in Brussels to talk about ways to enhance competitiveness. ECB Vice-President Luis de Guindos is participating in the ECOFIN meeting, also taking place in the Belgian capital. There are no scheduled Fed speakers this week, as officials are in a blackout period leading up to next week's policy meeting.

Overnight Newswire Updates of Note

- ECB’s Kazimir Sees Three To Four More Cuts Starting Next Week

- Scholz And Merz Take German Election Battle To The Davos Crowd

- US Share Of Global Foreign Direct Investment Surges To Record

- Trump’s Tariff Threats Signal New Era Of Global Trade Disruption

- NZ Services Sector Contracts Further In Dec; PSI Falls To 47.9

- Aussie Slid Heavy Near 0.6250 As Tariff Talks Spark Risk Aversion

- Dollar-Yen Dips Below 155.00 Amid Japanese Verbal Intervention

- Gold Buyers Look To $2,750 On Trump’s Tariff Threats

- Oil Majors Brace For Falls In LNG Revenues As Prices Stabilise

- Apple’s iPhone Sales In China Plunged 18% In Holiday Quarter

(Sourced from reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.0300-05 (2.5BLN), 1.0325 (5.3BLN), 1.0350 (1.5BLN)

- 1.0400 (4BLN), 1.0410-20 (2.7BLN), 1.0430 (630M), 1.0450 (1.9BLN)

- GBP/USD: 1.2375 (344M). EUR/GBP: 0.8350 (440M), 0.8370 (357M)

- AUD/USD: 0.6200 (780M), 0.6220-25 (651M), 0.6245-50 (1.1BLN), 0.6300 (570M)

- NZD/USD: 0.5600 (478M), 0.5635 (350M), 0.5660 (328M)

- AUD/NZD: 1.1065 (346M)

- USD/CAD: 1.4285 (703M), 1.4415 (465M), 1.4500 (537M)

- USD/JPY: 156.00-05 (2.5BLN), 156.50 (1.1BLN)

- EUR/JPY: 159.40 (1.3BLN), 162.00 (360M), 165.00 (360M), 166.20 (1.2BLN)

CFTC Data As Of 17/1/25

This summary provides an overview of the trading positions held by equity fund managers and speculators in various futures markets as of the reporting period ending January 14:

-

S&P 500 Futures:

-

Equity fund managers reduced their net long positions by 70,424 contracts, leaving them with a total of 923,997 contracts. A "net long position" means they hold more contracts betting on a rise in the S&P 500 index compared to those betting on a decline.

-

Equity fund speculators reduced their net short positions by 38,472 contracts, bringing the total net short position down to 311,085 contracts. A net short position indicates that these speculators are betting on a decline in equity prices. The reduction in their positions suggests a lessened bearish outlook compared to previous levels.

-

-

Currency Positions:

-

Japanese Yen: Speculators have a net short position of 29,411 contracts, meaning they expect the Yen to weaken.

-

Euro: Net short position of 60,397 contracts, indicating expectations of a weakening Euro.

-

British Pound: A net long position of 438 contracts suggests a minor expectation for the Pound to strengthen.

-

Swiss Franc: A net short position of 38,701 contracts implies expectations of a weaker Franc.

-

Bitcoin: A net long position of 1,335 contracts shows a favorable outlook on Bitcoin’s price increasing.

-

-

CBOT US Treasury Futures:

-

Ultrabond: The net short position decreased by 4,966 contracts to 242,422, suggesting some reduction in bearish bets.

-

2-year Treasury: Increased net short position by 64,188 contracts to 1,257,206, indicating a stronger expectation for rising yields (or falling prices).

-

10-year Treasury: Net short position trimmed by 104,511 contracts to 567,935, showing reduced bearish sentiment.

-

5-year Treasury: Decreased net short position by 23,282 contracts to 1,777,621, also indicating less bearishness.

-

Treasury Bonds: Shifted from a net short position of 16,827 contracts to a net long position of 52, indicating a switch to an expectation of rising bond prices (or falling yields).

-

Technical & Trade Views

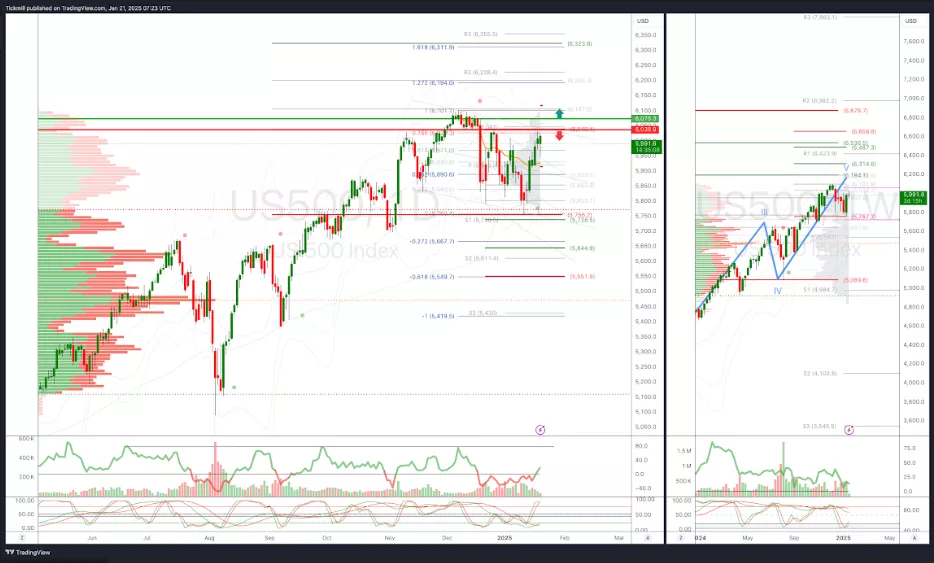

SP500 Pivot 6040

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests bullishness Into Feb 6th

- Long above 6075 target 6165

- Short Below 6045 target 5743

(Click on image to enlarge)

EURUSD Pivot 1.0435

- Daily VWAP bullish

- Weekly VWAP bearish

- Seasonality suggests bearishness into March 30th

- Above 1.0505 target 1.0634

- Below 1.0435 target 0.9758

(Click on image to enlarge)

GBPUSD Pivot 1.2614

- Daily VWAP bullish

- Weekly VWAP bearish

- Seasonality suggests bearishness into March 10th

- Above 1.2685 target 1.2812

- Below 1.2615 target 1.1878

(Click on image to enlarge)

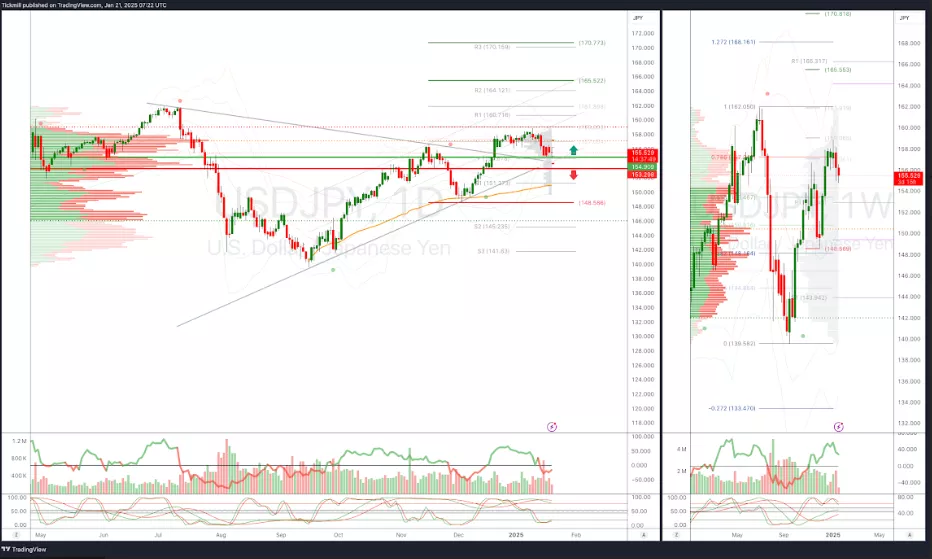

USDJPY Pivot 153.77

- Daily VWAP bearish

- Weekly VWAP bearish

- Seasonality suggests bearishness into jan 23rd

- Above 1.5377 target 165.50

- Below 152.41 target 150

(Click on image to enlarge)

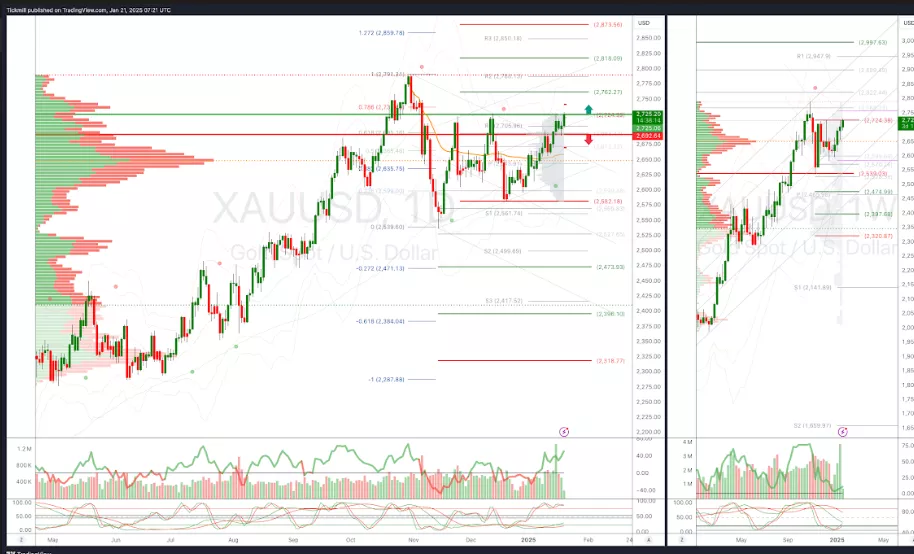

XAUUSD Pivot 2692

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests volatile bullishness into Feb 22nd

- Above 2725 target 2762

- Below 2692 target 2475

(Click on image to enlarge)

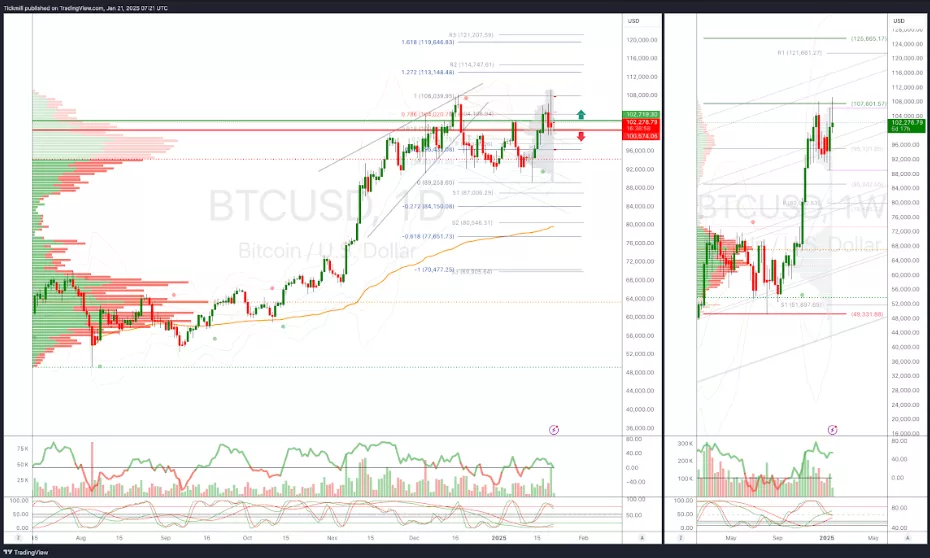

BTCUSD Pivot 101,960

- Daily VWAP bearish

- Weekly VWAP bullish

- Seasonality suggests bullishness into Apr 9th

- Above 104,020 target 110,000

- Below 101,942 target 86,266

(Click on image to enlarge)

More By This Author:

Daily Market Outlook - Friday, Jan. 17

FTSE Prints One Month Highs As Global Yields Retreat From Peaks

Daily Market Outlook - Thursday, Jan. 16