FTSE Hovering Around The Flatline Ahead Of BoE Deputy Governor Speech

Image Source: Unsplash

On Tuesday, UK shares saw a slight increase, driven by the rise in mining stocks and positive earnings reports. However, investors remained cautious as they awaited important inflation data from Europe and the U.S. later in the week. The FTSE 100 index, which is heavily influenced by resources, saw a small 0.05% increase. Although there is not much domestic economic data scheduled for this week, the consumer prices data from the U.S. and Europe will be closely monitored, potentially impacting global monetary policy decisions. Investors are also eager to hear from Bank of England Deputy Governor Dave Ramsden during his upcoming speech.

On the positive side of the ledger Smith+Nephew, a UK company, leads the FTSE 100 with a higher margin forecast and surpassing profit expectations for 2023. The company's shares are up 4.8%, outperforming London's blue-chip index and reaching their highest levels since July 2023. The medical equipment maker anticipates an improvement in profit margin and has exceeded market expectations for 2023 earnings. It expects a trading profit margin for 2024 of at least 18%, compared to 17.5% in 2023. The company reported a trading profit of $970 million for the year ended Dec. 31, surpassing analysts' expectations of $966 million. Despite inflationary pressure affecting margin expansion, productivity improvements have enabled management to achieve underlying operating margins of 17.5%, in line with expectations. The company has an average rating equivalent to 'buy' from 18 analysts, with 12 rating it as 'buy' or higher, and a median price target of 1,320 pence according to LSEG. The stock has experienced a decrease of approximately 7% in the last 12 months as of the last close.

On the negative side of the ledger Croda, a specialty chemicals group based in the UK, is the top loser on the FTSE 100 index with its shares down by 1.8% at 4,814p. The company forecasts a decrease in adjusted pretax profit for FY 2024 to a range of 260-300 million pounds from 308.8 million pounds in 2023. Additionally, it anticipates a 2-3 percentage point decrease in the Group's adjusted operating margin for 2024 compared to 2023. Croda also expects continued destocking in crop protection and weak demand in industrial specialties. The stock has experienced a 4.5% decline year-to-date, following a 23.5% drop in 2023 and approximately 35% decrease in 2022.

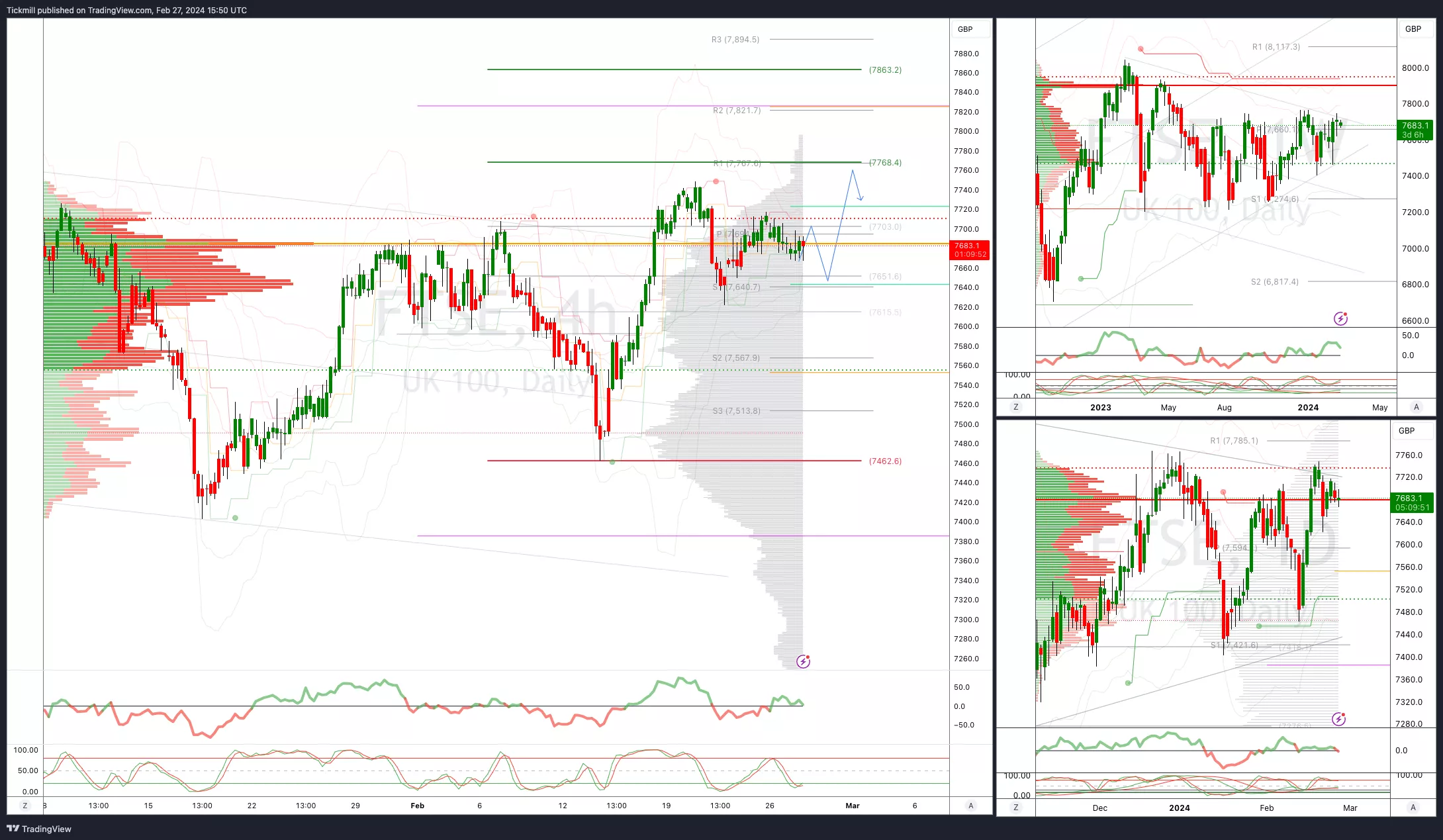

FTSE Bias: Bullish Above Bearish below 7650

- Below76200 opens 7560

- Primary support 7450

- Primary objective 7768

- 5 Day VWAP bullish

- 20 Day VWAP bullish

(Click on image to enlarge)

More By This Author:

Daily Market Outlook - Tuesday, February 27

Daily Market Outlook - Thursday, Feb. 22

The FTSE Finish Line: HSBC & Glencore Sour Sentiment As China Woes Weigh