FTSE Flatlining As Centrica Weighs On Buyback Disappointment

Image Source: Pexels

On Wednesday, British stocks were again rotating between small gains and losses, boosted by lower-than-anticipated U.S. labor figures, leading to expectations of a September interest rate reduction. Investors were also looking forward to the European Central Bank's decision on interest rates the following day. The FTSE 100 was up 0.03 following two days of declines, while the mid-cap FTSE 250 saw a slight increase. The decrease in job openings in the U.S. labor market, which was the lowest in over three years, further supported forecasts of a rate cut by the Federal Reserve in September. Traders are currently estimating a 65% likelihood of a rate cut by the Fed in September. Additionally, there was optimism about the expected 25 basis points cut by the ECB on Thursday. Analysts anticipate that the Bank of England will follow suit with similar moves. The British central bank is scheduled to meet in two weeks to make a decision on interest rates.

Centrica, the UK Gas owner, is experiencing a 2.6% decrease in its shares, currently trading at 138.6p, making it one of the top losers on the FTSE 100 index. The company expects its full-year adjusted EPS to be in line with consensus analyst expectations. However, there was no announcement of a share buyback, which J.P. Morgan analysts believe could disappoint investors. Centrica also stated that its profitability will be heavily weighted towards the first half of the year. Despite this news, the company's shares were up approximately 1% year-to-date as of the last close.

UK discount retailer B&M experiences a slip as its limited outlook fails to meet expectations. At 09:25, the British discount chain B&M is down 3% at 532p, making it the top percentage loser on the FTSE 100 index. Despite posting strong results, the lack of outlook and commentary for FY25 has caused the shares to fall. According to JPM, a 7% bottom line miss in the second half of 2024, combined with a vague FY25 outlook, is likely to lead to a sell-off of shares as an initial reaction. The shares have reached their lowest level since May 15, down 2% year-to-date.

Paragon Banking Group's shares surged to a 17-year high of 835p, marking an 8.4% increase, the highest level since June 2007. The company anticipates a rise in lending volumes for the remainder of the year following a strong recovery in customer demand during the first half of the year, with new business pipelines significantly exceeding levels from the previous year. Additionally, Paragon Banking Group has announced an increase in its share buyback program, now totaling up to 100 million pounds (~$128 million). The company reported a 13.5% increase in underlying profit to 146.3 million pounds for the six months ending on March 31, with a net interest margin of 3.19% compared to 2.95% year-on-year. Analysts at Jefferies have praised the company's strong financial performance amidst challenging conditions. As of the last close, the stock has risen by 10% year-to-date.

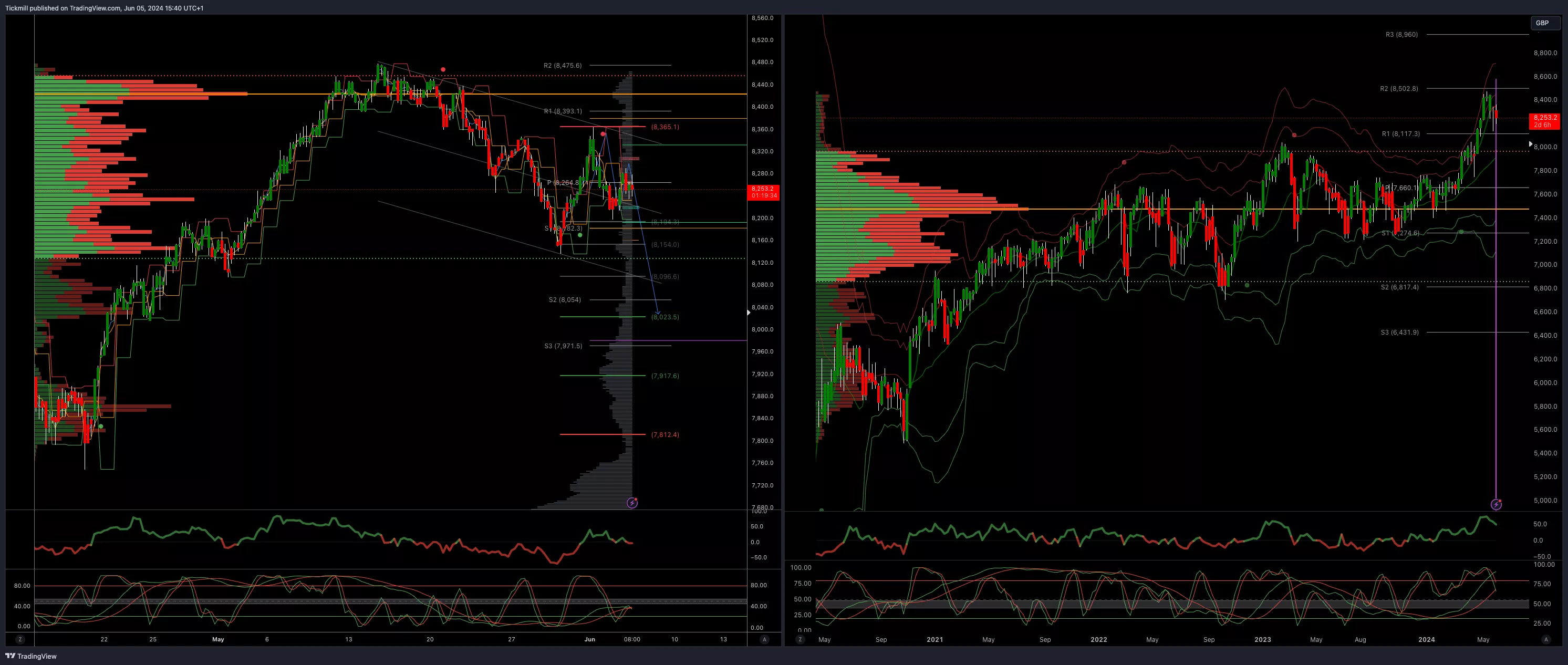

FTSE Bias: Bullish Above Bearish below 8365

- Above 8370 opens 8470

- Primary support 8000

- Primary objective 8023

- 5 Day VWAP bearish

- 20-Day VWAP bearish

(Click on image to enlarge)

More By This Author:

Daily Market Outlook - Wednesday, June 5

FTSE Flat On Energy Weakness And Geopolitical Uncertainty

Daily Market Outlook - Tuesday, June 4