FTSE Flat On Energy Weakness And Geopolitical Uncertainty

Image Source: Pexels

On Tuesday, London stocks declined as investors evaluated the possibility of an earlier U.S. interest rate cut amid weakening manufacturing activity that could impact corporate earnings. Meanwhile, energy stocks contributed to the losses. The FTSE 100 index and the FTSE 250 both fell modestly. BP and Shell, two energy stocks, saw declines of 3.4% and 1.9% respectively. Investors considered the potential impact of a September interest rate reduction by the Federal Reserve, while also taking into account a second consecutive decline in U.S. manufacturing activity that could negatively affect revenue for international companies listed on the benchmark index. Traders are currently estimating a 60% likelihood of a Fed rate cut in September. In addition, India's election results indicated that Prime Minister Narendra Modi's alliance may not achieve the anticipated overwhelming victory, contributing to a pessimistic outlook. The FTSE index, which includes major global companies, is affected by uncertainties regarding the future of India, a key driver of global economic growth.

BP's stock price decrease marked its lowest level since March 1 this year. This drop comes after S&P Global revised BP's credit outlook from "positive" to "stable", citing slower than expected debt reduction. Despite this, the agency maintained the company's "A-" long-term and "A-2" short-term issuer credit ratings. Additionally, Shell's stock has also decreased by 1.6% following a 1% drop in oil prices. Concerns about increasing supply later in the year, coupled with signs of weakening U.S. demand, have caused worry among investors. Furthermore, oil and gas producers Ithaca Energy and Harbour Energy have also experienced declines of more than 1%. As of the last close, BP's shares are down 2% year-to-date.

Melrose Industries, a UK-based company, saw a nearly 2% increase in its stock value to 627 pence after Stifel raised its earnings outlook and price target. The company's stock is one of the top performers on the FTSE 100 index. Stifel increased its full-year profit forecast for the British aerospace firm by approximately £11 million ($14.05 million) and also raised its price target for Melrose Industries to 700 pence from 690 pence while maintaining a 'buy' rating. The brokerage noted that the company's Q1 trading update and comments from industry peers indicate strong trading performance. Despite recent underperformance compared to its aerospace peers, Melrose's stock has seen an 8% increase year-to-date as of the last close.

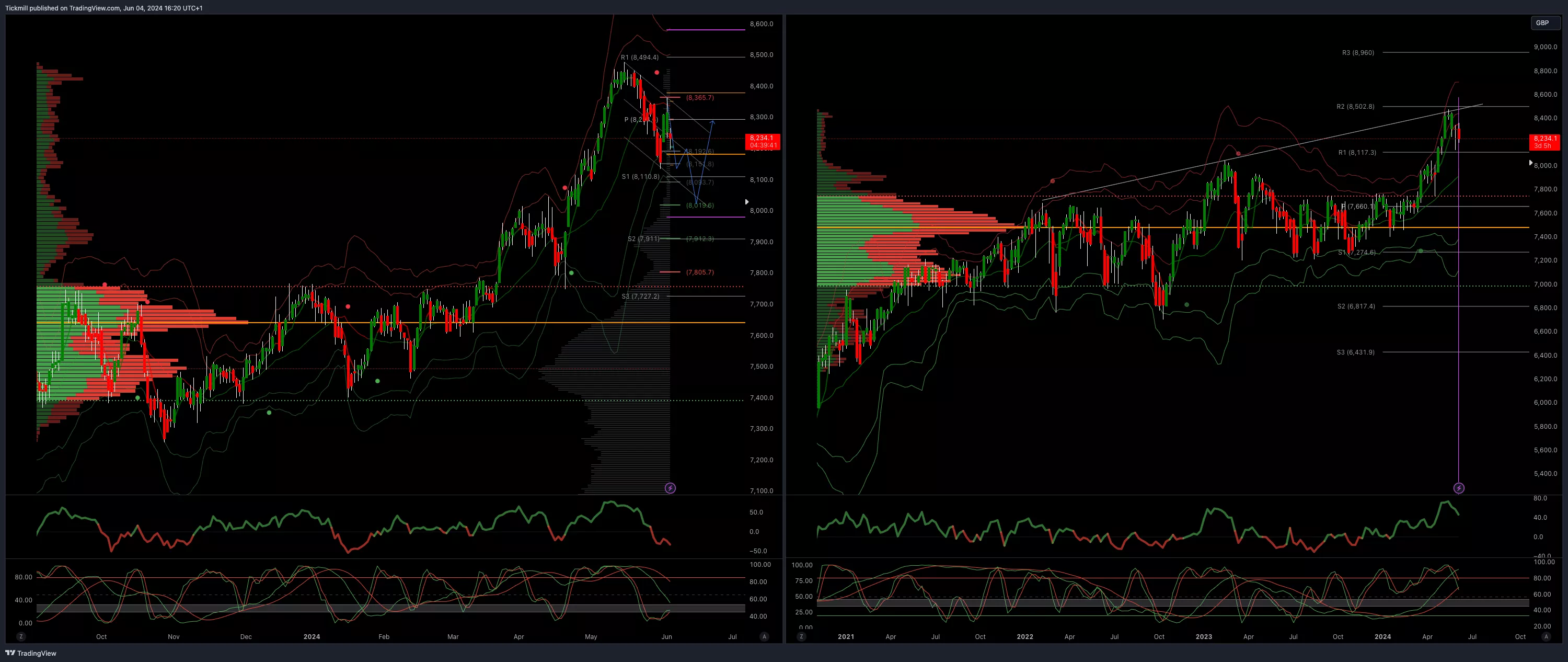

FTSE Bias: Bullish Above Bearish below 8365

- Above 8370 opens 8470

- Primary support 8000

- Primary objective 8023

- 5 Day VWAP bearish

- 20 Day VWAP bearish

(Click on image to enlarge)

More By This Author:

Daily Market Outlook - Tuesday, June 4FTSE Swoons On The First Trading Day Of June

Daily Market Outlook - Monday, June 3