FTSE 100 Pressurized By Resistance As The Fed Takes Center Stage

FED, BOE AND STOCKS – WHAT’S DRIVING MARKETS?

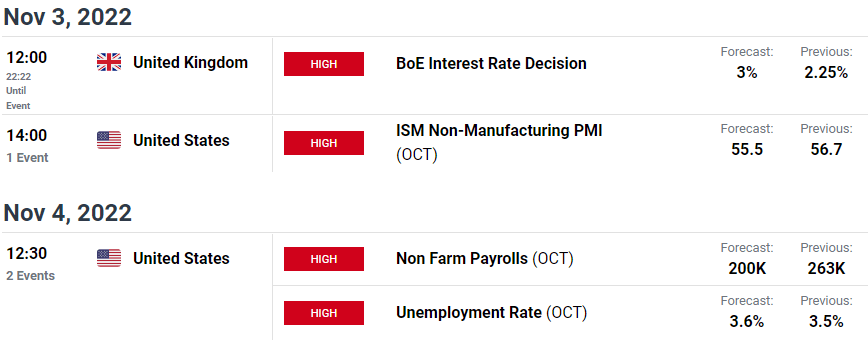

This week’s economic calendar has remained at the forefront of risk sentiment as investors look to the Federal Reserve and the Bank of England (BoE) for signs a potential deceleration in the pace of rate hikes.

Although fundamental risks have been priced in (to a large extent), the big question for market participants is whether or not this will be the last hawkish move from the central banks for the remainder of the year.

With the BoE (Bank of England) expected to raise rates by an additional 75 basis points tomorrow, US ISM data and Friday’s NFP (non-farm payroll report) may provide an additional catalyst for price action.

(Click on image to enlarge)

DailyFX Economic Calendar

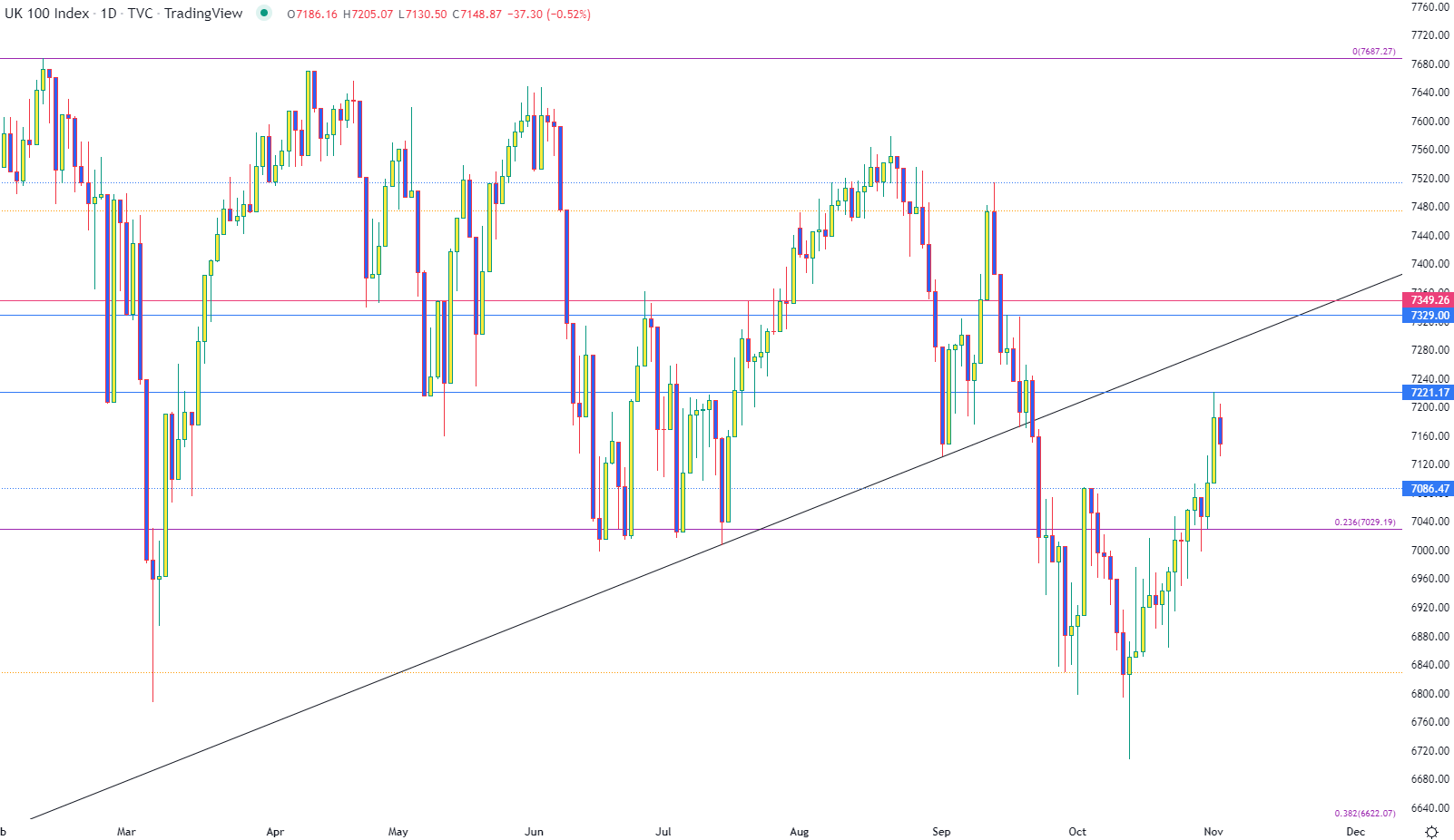

As the major UK stock index struggles to clear the 7200 psychological level, a brief retest of 7205 earlier today was met with swift retaliation from bears before temporarily stalling around 7130. While price action continues to search for a clear directional bias, the same levels that have been discussed throughout the week remain relevant for the short-term move.

FTSE 100 Daily Chart

(Click on image to enlarge)

Chart prepared by Tammy Da Costa using TradingView

But while FTSE remains above the 7000 handle, bullish continuation should not be ruled out. If prices manage to rise back above 7200, an increase in buying pressure could see drive the index to the next barrier of technical resistance at around 7258 and towards the 7329 mark last tested in mid-September.

However, with key psychological levels and trendline resistance from the October 2020 move still intact, an increase in bearish momentum below 7000 may provide sellers the opportunity to drive prices below 6825 paving the way for the next key zone of support at the September low of 6707.

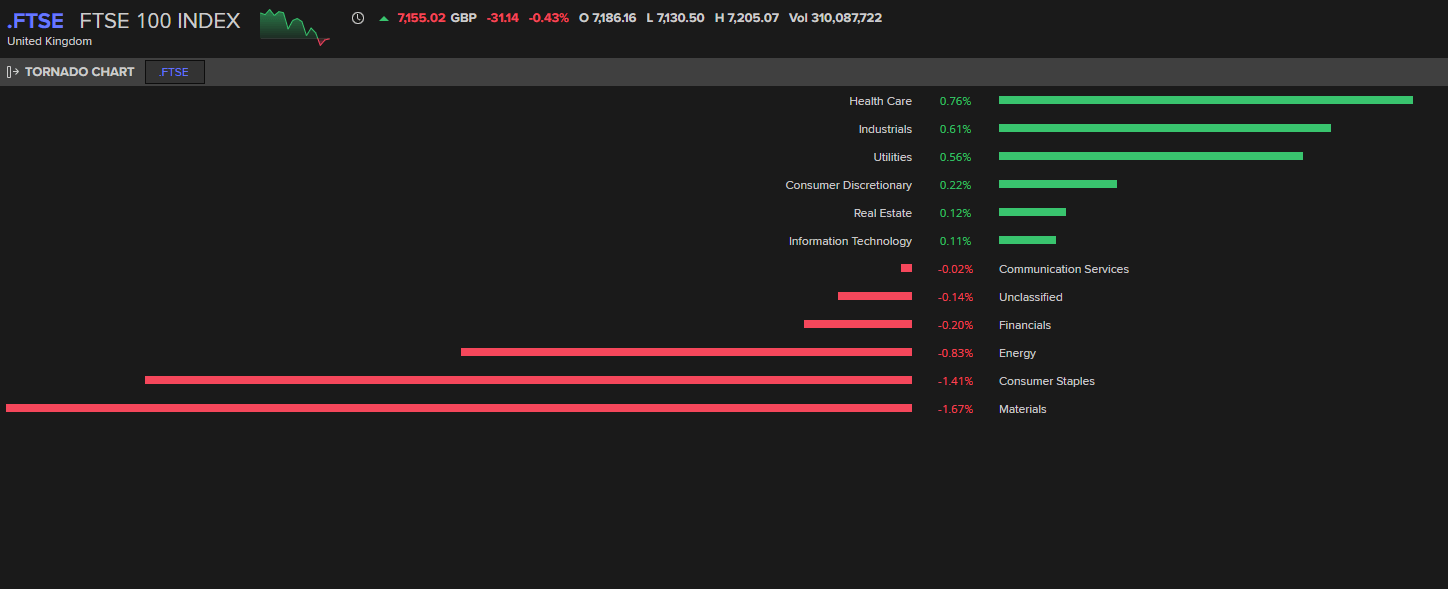

FTSE 100 Biggest Movers

At the time of writing, the FTSE 100 is trading 0.47% lower on the day, dragged down by materials and consumer staples. Despite a slight increase in healthcare and industrials, marginal gains have not been sufficient to drive the index higher.

(Click on image to enlarge)

Source: Refinitiv

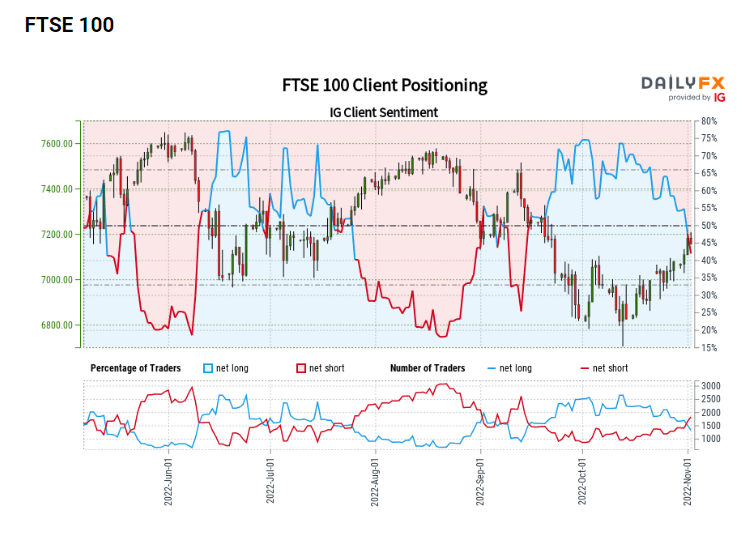

FTSE 100 Sentiment

(Click on image to enlarge)

Current retail trader data shows 43.62% of traders are net-long FTSE 100 with the ratio of traders short to long at 1.29 to 1.

Positioning is less net-short than yesterday but more net-short from last week. The combination of current sentiment and recent changes gives us a further mixed FTSE 100 trading bias.

More By This Author:

German DAX Breaks Major Resistance But Bullish Momentum Stalls

Bitcoin Prices Stumble Into Technical Support Ahead Of FOMC

DAX, FTSE Boom Faces Resistance After Strong Week Of Gains

Disclosure: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more