Bitcoin Prices Stumble Into Technical Support Ahead Of FOMC

It’s been nearly a year since Federal Reserve Chairman Jerome Powell removed the word ‘transitory’ from the inflation narrative and Bitcoin peaked at a record $69000. Although the low interest rate environment was conducive for cryptocurrency throughout last year, a significant change in the geopolitical backdrop has provided immense challenges for speculative assets in 2022.

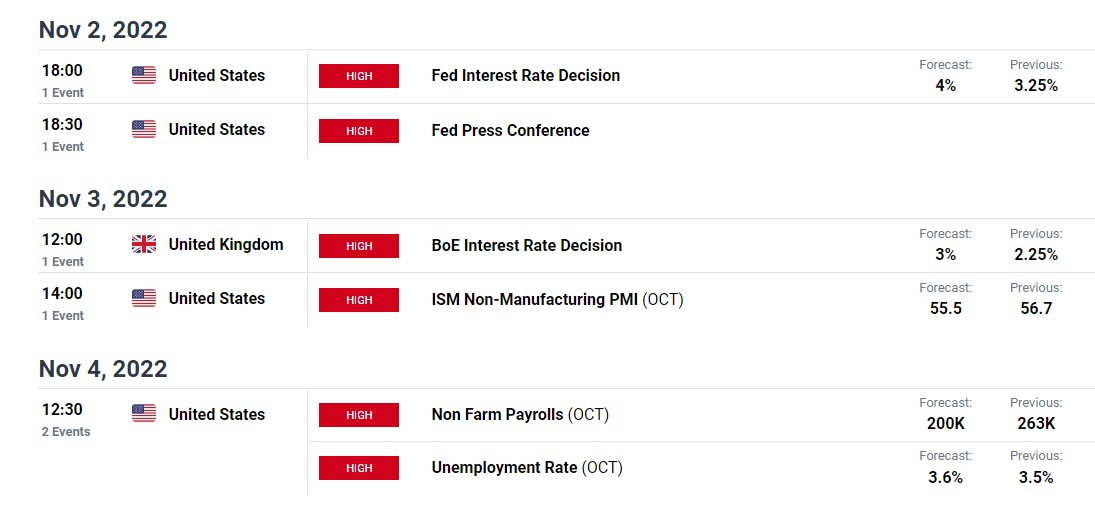

With the Fed interest rate decision on the horizon, a fourth consecutive 75 basis point increase is expected to be announced tomorrow while the BoE (Bank of England) gears up for their rate decision on Thursday. Although fundamental factors continue to get priced in, the non-farm payroll report (NFP) on Friday could provide an additional catalyst for price action as investors continue to search for signs of a potential Fed pivot (when the Federal Reserve will begin slowing down the pace of rate hikes).

DailyFX Economic Calendar

FX traders can monitor central bank announcements via the central bank calendar

Bitcoin (BTC/USD) Technical Analysis

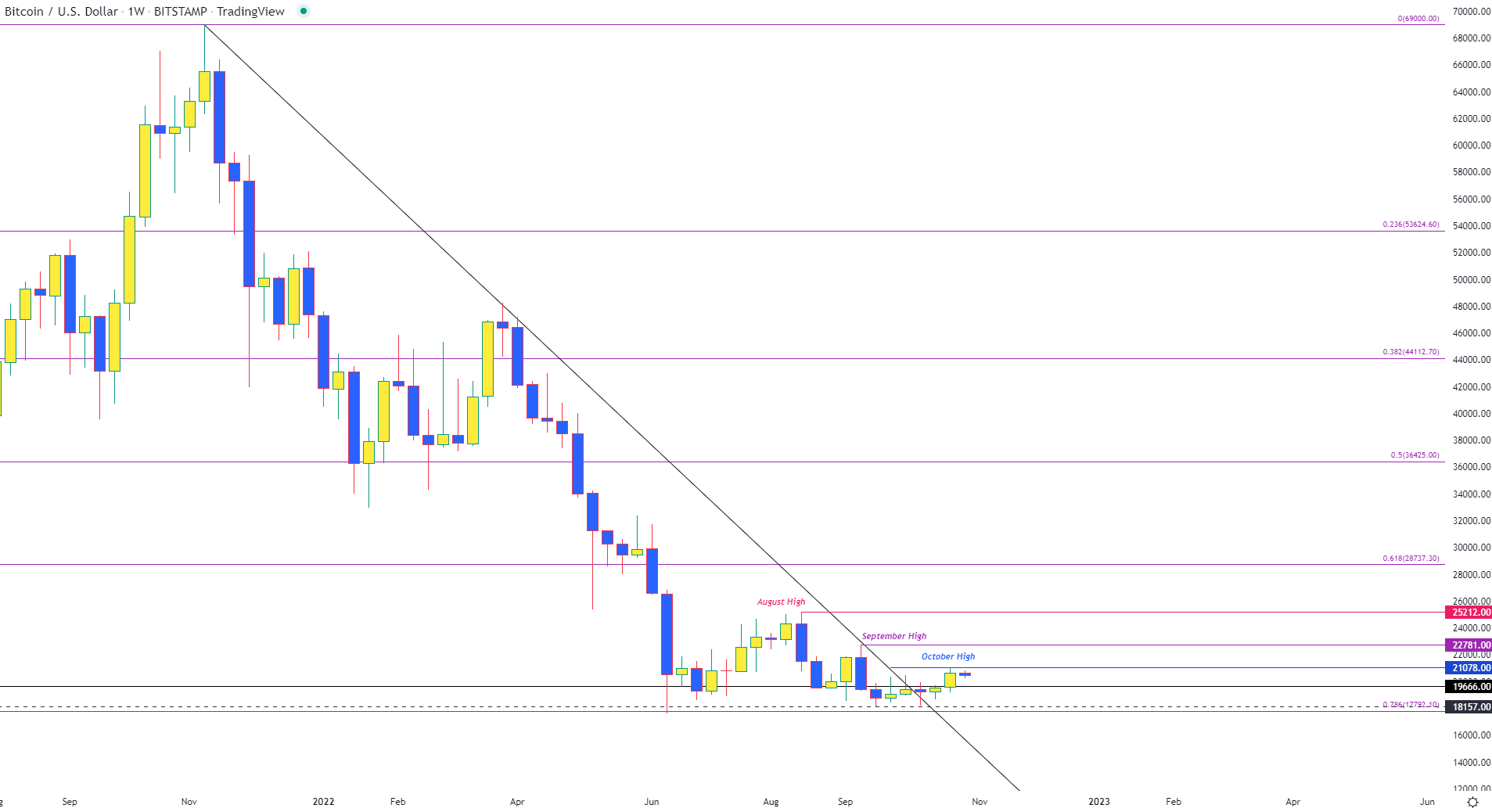

Although macro-fundamentals remain the prominent driver of price action, the steep sell-off in Bitcoin was temporarily muted after BTC/USD dropped to a low of $17592.78 in June. With prices making limited movement since, failure to gain traction above $25212 in August drove the original cryptocurrency into a well-defined range that continues to hold.

As the 78.6% Fibonacci retracement of the 2020 – 2021 move provides additional support for the longer-term trend at around $17792, the September high has formed an additional zone of resistance at $22781.

Bitcoin (BTC/USD) Weekly Chart

Chart prepared by Tammy Da Costa using TradingView

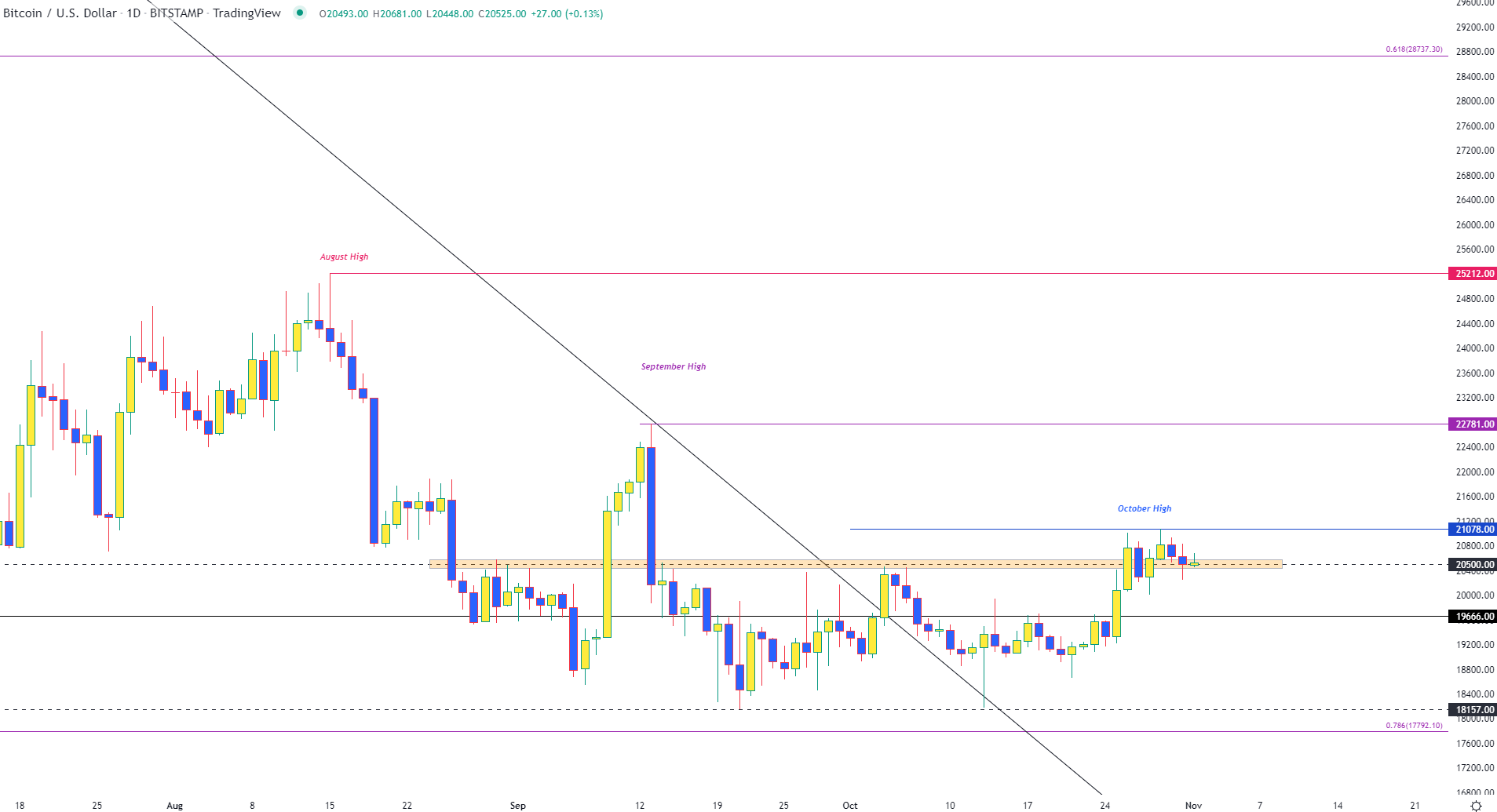

With the October high now holding as imminent resistance at $21078, another layer of horizonal support has formed around the $20500 mark. While technical and psychological levels assist in establishing firm levels of support and resistance, a clear break of the above-mentioned levels may be necessary for either bulls or bears to gain momentum. If prices fall below $20000, the next zone of support remains at the December 2017 high of $19666 with a break below bringing the September low back into the spotlight at $18157 which could provide opportunity for bearish continuation and a potential retest of the June low at $17792.

Bitcoin (BTC/USD) Daily Chart

Chart prepared by Tammy Da Costa using TradingView

However, if BTC is able to rise above $21072, a retest of the September high ($22781) could see Bitcoin prices rise back towards the next barrier of resistance at the August high of $25212.

More By This Author:

USD/JPY Slips Back As Market Looks To Fed Chair Powell

British Pound News: GBP Dictated By USD Ahead Of FOMC

GBP/USD’s Outlook Remains Bleak Ahead Of BoE’s November Meeting

Disclosure: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more