EUR/USD Churned Below 1.0800 As Upside Momentum Remained Thin

Image Source: Pexels

- The EUR/USD currency pair continued to test a near-term ceiling at 1.0780 on Friday.

- European PMI data are slated for next Thursday. There will be thin data until then.

- US PPI numbers rose on Friday, pinning markets into the mid-range throughout the day.

The EUR/USD currency pair was seen spinning in place on Friday after a brief test into the low side, but tepid markets kept the pair hamstrung near the day’s opening bids.

The euro will see thin economic data until next week’s Purchasing Manager’s Index (PMI) figures. Additionally, US data gave traders little to chew on after the US Producer’s Price Index (PPI) rose on Friday. US markets will be dark on Monday for the President’s Day holiday, and traders will be waiting until Wednesday’s Federal Reserve (Fed) Meeting Minutes for hints about how close (or far) the US central bank is from trimming interest rates.

Market Movers: EUR/USD Struggled to Break Out of Near-Term Congestion

- US Core annualized PPI rose to 2.0% for the year ended in January, climbing over the forecasted 1.6% and the previous period’s 1.7% (revised from 1.8%).

- Month-over-month US PPI rose by 0.3% in January, accelerating above the forecasted rebound to 0.1% from the previous month’s -0.1%.

- The Michigan Consumer Sentiment Index rose to 79.6 for February, but less than the forecasted 80.0 from January’s 79.0.

- The University of Michigan’s five-year Consumer Inflation Expectations survey held steady at 2.9% in February.

- Still-high inflation expectations and rising producer-level inflation continued to vex investors hungry for rate cuts from the Fed.

- Next week sees the Federal Open Market Committee’s (FOMC) latest Meeting Minutes, slated to release on Wednesday.

- The euro will only see light data on the calendar until next Thursday’s Purchasing Manager’s Index print.

- The pan-European HCOB Composite is expected to rise slightly to 48.5 in February from January’s 47.9.

- Europe’s HCOB Composite PMI has been in contraction territory below 50.0 since July of last year.

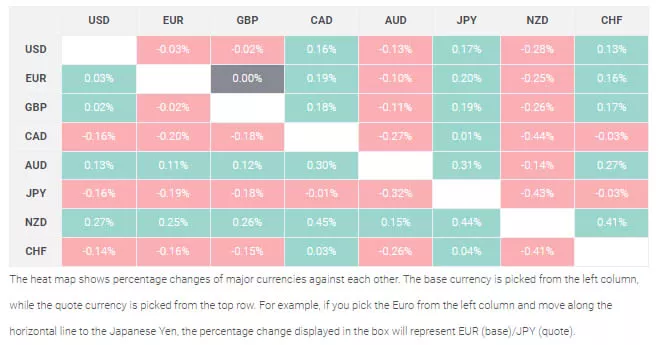

Euro Price on Friday

The table below shows the percentage change of the euro against major currencies on Friday. The euro was the strongest against the New Zealand dollar.

Technical Analysis: EUR/USD Struggled to Build Bullish Momentum, 1.0800 Remained the Level to Beat

The EUR/USD currency pair appeared to be stuck churning around the 200-hour Simple Moving Average (SMA) near 1.0760, as the pair struggled to find the topside momentum needed to reclaim the 1.0800 handle. The pair was tested in both directions on Friday.

The EUR/USD pair looked to be on pace to close on the down side of the 200-day SMA near the 1.0830 level for the tenth consecutive trading day. Unfortunately, the pair often gets plagued by regular bearish shocks, and bidders were struggling to dig their heels in and prevent further downside. The pair was still down over 3% from December’s peak bids near the 1.1140 mark.

EUR/USD Hourly Chart

(Click on image to enlarge)

EUR/USD Daily Chart

(Click on image to enlarge)

More By This Author:

Crude Oil Tests Higher On Friday, WTI Explores Territory North Of $78.00

Gold Price Forecast: XAU/USD Hit Three-Day High Amid Inflation Concerns

USD/JPY Price Analysis: Held Above 150.00 Ahead Of The Weekend

Disclosure: Information on this article contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes ...

more