Gold Price Forecast: XAU/USD Hit Three-Day High Amid Inflation Concerns

Image Source: Unsplash

- The price of gold recently hit the $2015 mark, benefiting from a softer dollar and higher US Treasury yields amid persistent inflation signs.

- US PPI and Core PPI data surpassed forecasts, indicating ongoing inflation and complicating the Fed's targets.

- The hints of future rate cuts from Fed officials swayed the market's outlook, enhancing gold's attractiveness as a hedge against policy ambiguity.

The price of gold extended its gains for two straight days, hitting a three-day high at $2015 as the greenback tumbled, despite the rise in US Treasury yields. Recent US economic data seemed to suggest that inflation may be stickier than expected, though Federal Reserve officials appeared to have opened the door to ease policy.

XAU/USD Rose as US Data Highlighted Inflation Persistence, Fed Officials Suggested Patience is Required

The XAU/USD cross recently exchanged hands at around $2012.14, up 0.39%. US data from the US Department of Labor revealed that prices paid by producers rose above estimates, indicating that the US Federal Reserve still has work to do to curb inflation. The Producer Price Index (PPI) in January came in at 0.9%, above estimates but shy of December’s 1%. Core PPI jumped sharply by 2%, exceeding the consensus and the previous month's data.

At the same time, US housing data witnessed Housing Starts plummeting -14.8%, from 1.562 million to 1.331 million, while Building Permits slumped -1.5%.

Meanwhile, the first Consumer Sentiment poll by the University of Michigan (UoM) noted that Americans have remained optimistic about economic conditions. The index improved from 79.0 to 79.6, while inflation expectations for one year edged up to 3%, while for a five-year period, it stood unchanged at 2.9%.

The non-yielding metal edged higher, even though US Treasury bond yields, namely the 10-year benchmark note rate, rose six basis points to 4.29%, as it was failing to underpin the greenback.

Meanwhile, Federal Reserve officials crossed the wires, with Atlanta’s Fed President Raphael Bostic and San Francisco Fed President Mary Daly leading the pack. Bostic said patience is required and foresees two rate cuts, which could begin in the summer if the data justifies it. Daly commented there’s work to do, adding, “We will need to resist the temptation to act quickly when patience is needed and be prepared to respond agilely as the economy evolves.”

Both acknowledged that inflation has a downward trend, but they remained cautious about the timeline of easing policy.

Given the fundamental backdrop, the price of gold could likely remain adrift to the outlook of the US economy. If inflation picks up, that could spark a jump in US Treasury bond yields. Therefore, further XAU/USD downside could be expected. Conversely, if inflation continues to converge to the Fed’s 2% goal, that could open the door to rate cuts, which would weigh on the greenback’s appeal. This means that XAU/USD upside could be expected.

XAU/USD Price Analysis: Technical Outlook

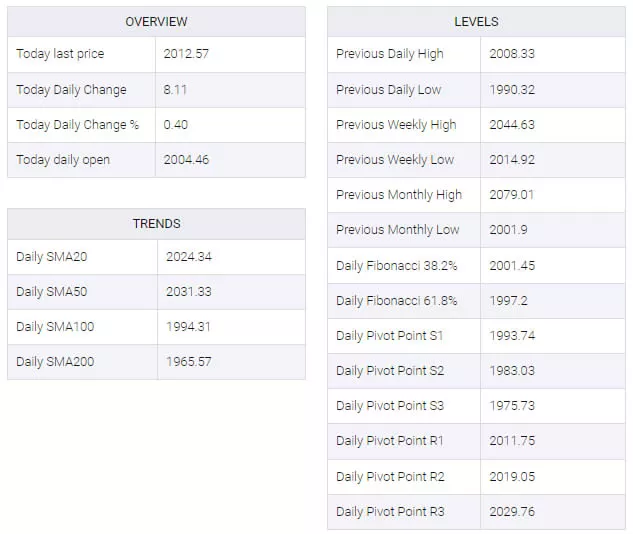

The price of gold appeared set to finish the week with losses, even though it had recovered some ground throughout the week. According to the daily moving averages (DMAs), gold appeared to be upward-biased. However, since reaching the $2088 mark on Dec. 28, it has printed a successive series of lower highs/lows, opening the door for further downside.

If XAU/USD could print a daily close below $2000, that could sponsor a leg-down to the 100-DMA at $1996.10, followed by the Dec. 13 low of $1973.13. A breach of the latter would expose the 200-DMA at $1965.46. On the upside, the first level of resistance could emerge at the 50-DMA at $2031.98.

(Click on image to enlarge)

XAU/USD Technical Levels

More By This Author:

USD/JPY Price Analysis: Held Above 150.00 Ahead Of The WeekendEUR/USD dips as PPI signals extended Fed tightening

EUR/USD Grapples To Extend Gains Ahead Of US PPI, Hovers Above 1.0770

Disclosure: Information on this article contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes ...

more