Europe Sinks Into Crisis

Europe’s economic situation is a matter of growing concern. Once a symbol of prosperity and cooperation, the European Union is now weakened by major economic and energy challenges. The continent’s two traditional pillars, France and Germany, are facing difficulties that could have profound repercussions for the entire bloc.

Last February, I wrote that Europe was paralyzed by an unprecedented inflationary shock, marked by falling retail sales in Germany and general impoverishment due to falling real wages. Despite a slight easing in inflation, the impasse between economic stability and price recovery undermined monetary and social policy.

Ten months later, the observation is clear: Europe is bogged down, and Germany is struggling to get back on track.

In November, economic activity in the Eurozone contracted sharply, with the services sector joining manufacturing in a contractionary trend.

The Eurozone PMI index fell to 48.3 in November, from 50.0 in October.

The German economy, often considered the locomotive of the European Union, is showing worrying signs of slowdown. In the third quarter of 2024, industrial production fell by 2.6%, marking one of the sharpest declines in Europe:

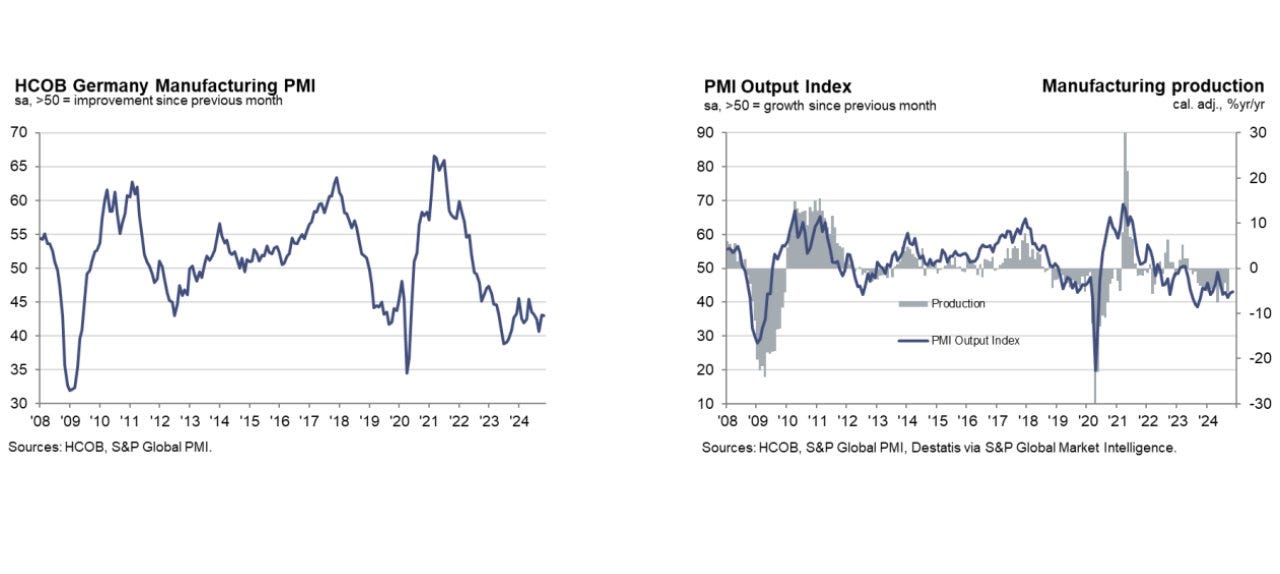

In November, Germany's final manufacturing PMI came in at 43.0, slightly below the forecast of 43.2 and unchanged from October's level. This figure, well below the 50 threshold that distinguishes growth from contraction, confirms the persistent slowdown in the German manufacturing sector:

The German industrial sector has now been in contraction for 2 years and 4 months!

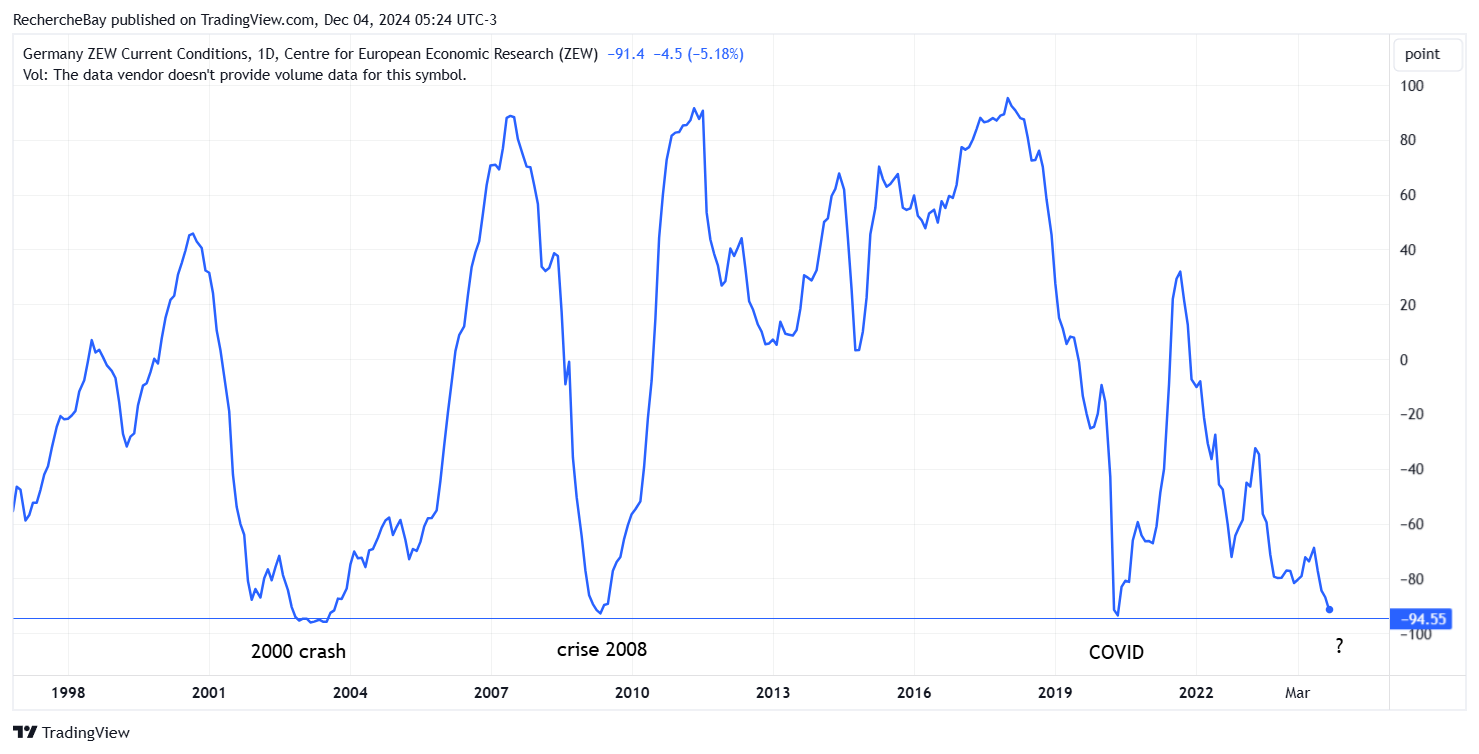

Investor outlook, as measured by the ZEW index, has fallen to its lowest level since the 2020 crisis:

(Click on image to enlarge)

ThyssenKrupp CEO warns of “massive deindustrialization”, as investments and orders plummet.

In October, orders from German machinery and equipment manufacturers resumed their downward trend, according to the VDMA association, reflecting customers' persistent reluctance to invest.

Overall, orders fell by 9% year-on-year, recording a second consecutive month of decline. This follows a slight upturn in August, which briefly interrupted a series of prolonged declines spanning more than a year.

The increase in domestic orders is the result of a particularly low basis of comparison in the previous year, while the sharp fall in foreign orders is linked to large-scale equipment projects completed a year ago. Over the less volatile period from August to October, orders fell by 3%: -7% for domestic orders and -1% for foreign orders.

For the first ten months of the year, orders show an overall decline of 8%, according to the VDMA.

Consumer confidence also plunged, fuelled by growing concerns about job losses and the risk of recession. The GfK consumer sentiment index for December fell by 4.9 points to -23.3, well below forecasts of -19. The situation was exacerbated by the collapse of the government coalition in November, following a disagreement over public borrowing, as well as by Donald Trump's victory as President of the United States, which raises fears of new tariffs on foreign imports, further complicating the outlook for German companies.

In addition, the strategic automotive sector, a pillar of the German economy, is facing a sharp rise in production costs, mainly due to soaring energy prices.

Volkswagen saw its profits plunge by 64%, while its sales in China plummeted by 12%.

Mercedes also suffered heavy losses, with profits down 54%.

These difficulties are exacerbated by Germany's energy dependence, which has become even more acute since the phasing out of Russian gas. Industrial companies, once competitive thanks to moderate energy costs, are now finding it hard to compete with their American and Asian counterparts. If these trends persist, analysts fear that Germany could officially slip into recession early next year.

For its part, France has not escaped the crisis. Growth forecasts for 2024 have been revised downwards to a modest 0.4%, well below the European average. Public debt now stands at a record 112% of GDP, while French industry continues to suffer from a structural competitiveness deficit. Production costs, already high, have risen further as a result of the energy crisis.

On the social front, the situation remains tense. The increase in the cost of living, combined with persistent inflation on basic goods, is fueling widespread discontent. Social movements are multiplying, complicating the implementation of structural reforms for the government.

It is these tensions that led to the fall of the Barnier government.

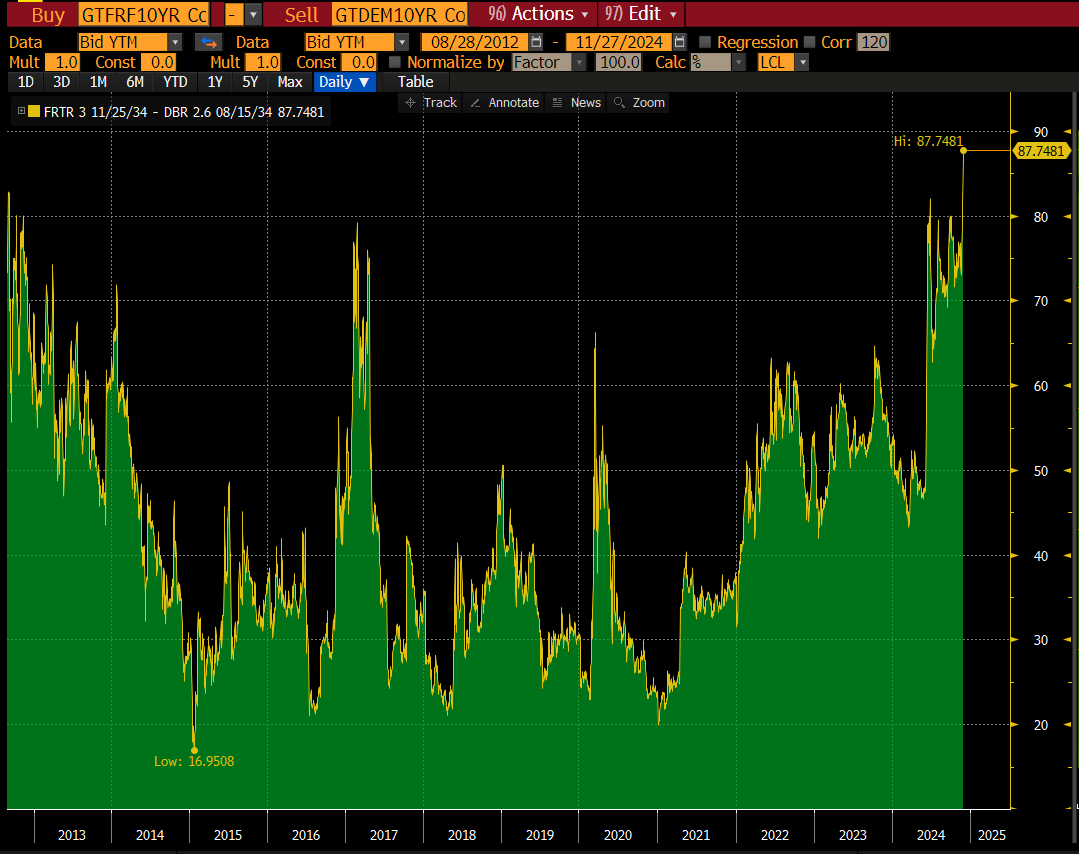

Political instability in France is putting additional pressure on the domestic bond market.

Bond investors are keeping a close eye on France, faced with government instability, a growing deficit and flagging economic indicators. The spread between French and German 10-year bond yields has reached 87 basis points, a level not seen since 2012 :

The French crisis represents an additional threat to European stability, coming at a time when the continent is in a very fragile position.

Several factors explain Europe's current fragility. The energy crisis is undoubtedly the main cause. The precipitous abandonment of Russian gas imports, combined with an accelerated transition to renewable energies, has destabilized European economies. Not only has this led to soaring energy costs, it has also undermined entire industrial sectors.

The hasty enthusiasm for renewables and the abandonment of nuclear power have weakened Germany’s industrial engine, a view that is increasingly shared within the country.

Investigative journalist Morten Freidel has published an in-depth investigation into the efforts of the German Greens to influence discussions within the IPCC (Intergovernmental Panel on Climate Change). The Greens seem particularly concerned by the IPCC reports' recognition of the role of nuclear power in combating climate change. This opposition to nuclear power seems to be a key element of their strategy, as revealed by internal documents relating to this campaign.

The Greens’ strategy has focused on manipulating debates at international climate conferences, aiming to downplay the importance of nuclear energy. An approach perceived as ideological, based on flimsy arguments, and which has led to the closure of nuclear power plants in Germany.

Further investigations are underway to determine how these Green campaigns may have been financed by gas interests, particularly from Russia. The revelations surrounding these practices could have a decisive impact on the forthcoming German elections.

The risk to the European currency is probably much higher today than it was in 2011.

The price of gold in euros is currently consolidating around €2,500, as we await the repercussions of the political crisis in France and the early elections in Germany:

(Click on image to enlarge)

More By This Author:

Trump: The American Economy On TrialThe US Structural Deficit, An Increasingly Visible Threat

French Debt Is Actually High-Risk

Disclosure: GoldBroker.com, all rights reserved.

Agreed