Equity Vietnam Outperformed In ASEAN Region

Equity Vietnam RFS Taiwan Performance Analysis

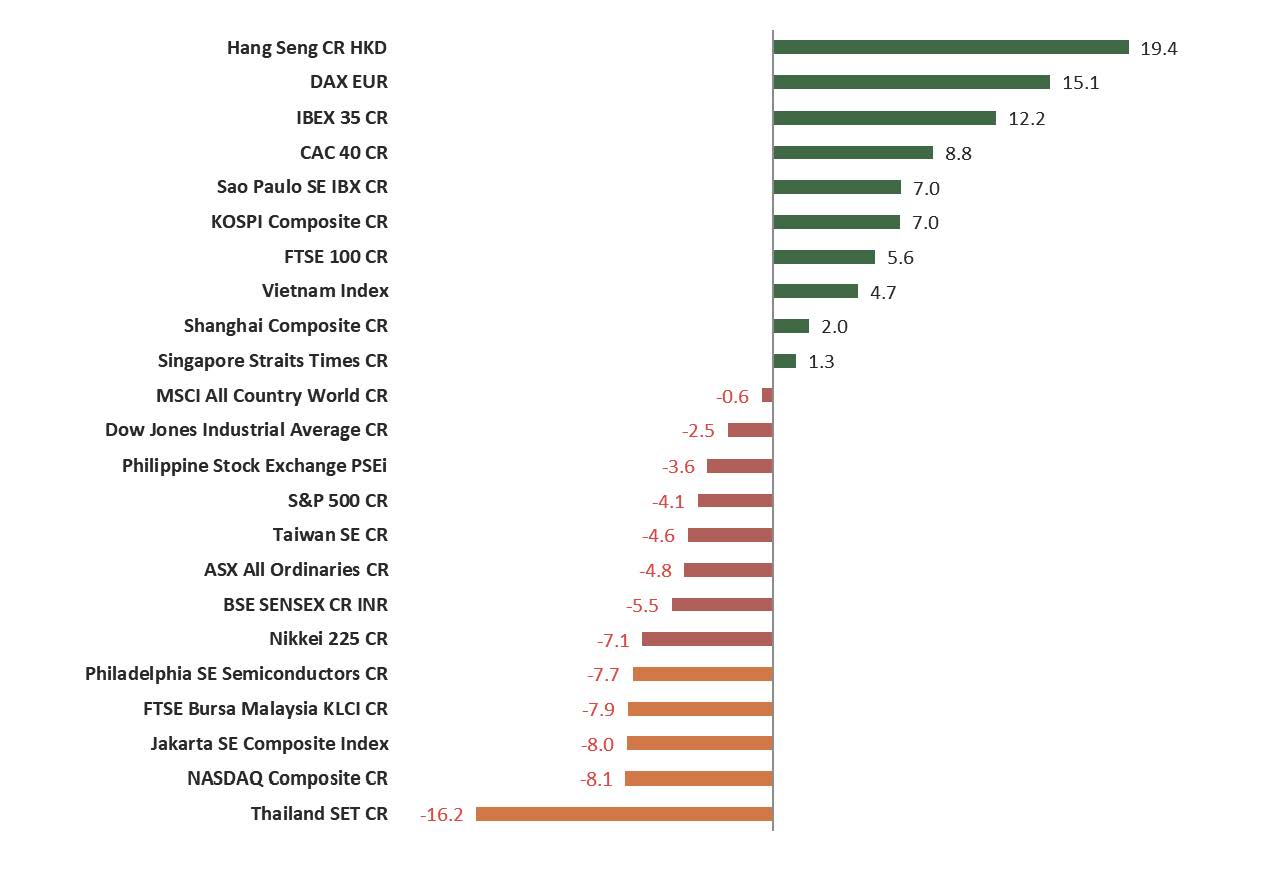

Global stock markets have been fluctuated by Trump’s tariff war. In the Southeast Asian market, Vietnam stands out with its strong economic growth, and domestic Vietnam equity funds have also benefited from it. According to LSEG Lipper’s statistics, there are a total of 4 Equity Vietnam registered for sale in Taiwan, of which 3 are actively managed funds and 1 is a passive ETF. For the year-to-date period as of March 17, 2025, Equity Vietnam posted an average performance of 2.9%, and the average performance over the past year is as high as 10.9%.

(Click on image to enlarge)

Source:LSEG Lipper, as of 2025/3/14

Vietnam Market Analysis

The geopolitical struggle after the US-China trade war has intensified, coupled with the COVID-19 pandemic causing supply chain disruptions. The “China +1” strategy has emerged as a new global economic business strategy, leading to the rise of Vietnam as a shining new star. In recent years, Vietnam’s economy has flourished, primarily due to the government’s implementation of “bamboo diplomacy,” which has upgraded its relationships with the US and Japan to comprehensive strategic partnerships while maintaining good relations with China, thus attracting a significant increase in foreign investment. According to statistics, from 2020 to 2023, foreign direct investment (FDI) flowing into Vietnam has exceeded $100 billion. Last year, Vietnam achieved a record high in attracting foreign direct investment, with registered capital surpassing $38.2 billion, ranking among the top 15 developing countries in the world for FDI inflows. The actual funds received exceeded $25.3 billion, setting a historical record and growing by 9.4% compared to the same period the previous year.

Vietnam’s economy is heavily reliant on exports. In 2024, Vietnam’s trade surplus with the United States is expected to surge by 18%, making it a likely target in the Trump tariff war, which could impact over $142 billion in exports to the U.S., equivalent to 30% of Vietnam’s annual GDP. To mitigate the threat of tariffs, the Vietnamese government has expressed its willingness to negotiate with the United States and is considering seeking a compromise by reducing import tariffs on American goods. Additionally, Vietnam is one of the countries most involved in free trade agreements (FTAs) globally. Following the EU-Vietnam Free Trade Agreement (EVFTA) and the EU-Vietnam Investment Protection Agreement (EVIPA), the Vietnamese government and parliament also hope to complete negotiations for free trade agreements with Middle Eastern countries, Switzerland, Norway, and Finland to explore important new markets.

With the significant rise of the technology industry and AI, Vietnam is rapidly emerging as an important base for global electronics manufacturing. In particular, northern Vietnam has gradually developed into a corridor for precision and high value-added industries. Companies such as Dell, Google, Apple, and Microsoft from the United States, Lenovo from Hong Kong, and Nintendo from Japan are all expanding their factories or investing in contract manufacturing capacity in Vietnam. NVIDIA will also establish AI research and development and data centers in the region, positioning it as an industrial hub in Southeast Asia.

Outlook

Due to the rise in global energy and food prices, along with the impact of the strong typhoon Molave, Vietnam’s consumer price index surged to nearly 4.5% last year. In order to boost this year’s economic growth to over 8%, officials estimate that electricity demand will significantly increase this year. Additionally, the strong dollar has been a drag on the economy. As a result, the Vietnamese National Assembly has raised this year’s inflation ceiling from the original target of below 4% to a maximum of 5%, allowing for greater flexibility in monetary and fiscal policy adjustments.

Vietnam’s exports saw a strong recovery last year, with comprehensive growth in both industrial production and the service sector. The country’s economic growth significantly accelerated, with a GDP growth rate of 7.1% for the entire year, making it the fifth largest economy in Southeast Asia. According to forecasts from several multinational organizations, Vietnam’s economic growth rate this year is expected to dominate the ASEAN region. The International Monetary Fund (IMF) released its latest forecast last October, predicting that Vietnam’s economic growth rate could reach 6.4% this year. The Asian Development Bank (ADB) provided a more optimistic estimate in December, projecting a growth rate of 6.6%. The World Bank (WB) released its latest Economic Update report this year, predicting an even more optimistic growth rate of 6.8% for Vietnam’s economy this year, with a growth rate of 6.5% expected for next year. Even in the face of the looming Trump 2.0 tariffs from the United States, the Vietnamese National Assembly has raised the economic growth target for this year to at least 8%, with hopes of achieving remarkable double-digit economic growth estimates from 2026 to 2030.

More By This Author:

Hong Kong MPF Continued Rallying For February 2025

S&P 500 Earnings Dashboard 24Q4 - Friday, March 14

Russell 2000 Earnings Dashboard 24Q4 - Thursday, March 13

Disclaimer: This article is for information purposes only and does not constitute any investment advice.

The views expressed are the views of the author, not necessarily those of Refinitiv ...

more