Hong Kong MPF Continued Rallying For February 2025

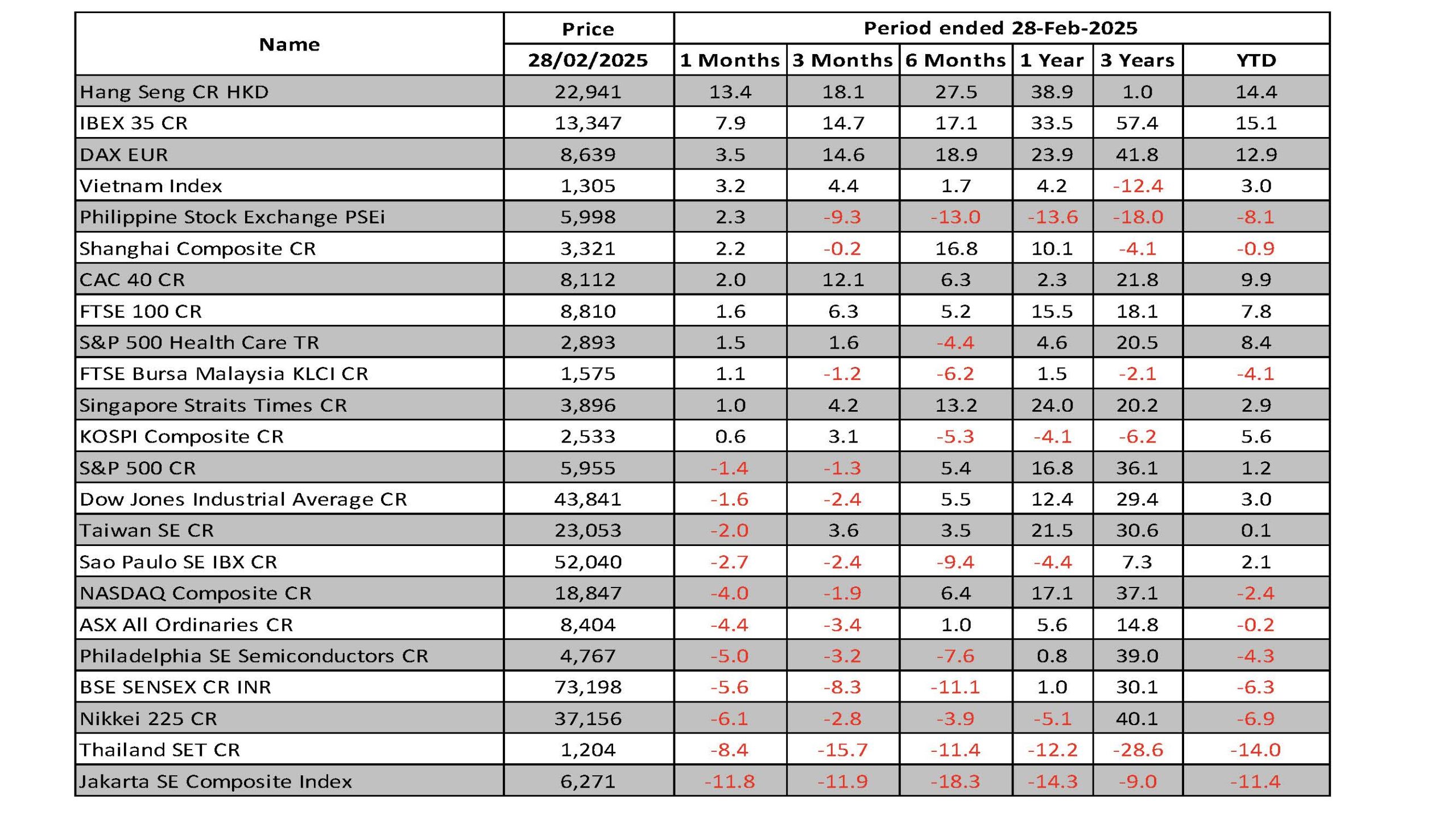

Key Benchmarks Performance

Hong Kong’s stock market is turning into one of the biggest winner of Donald Trump’s chaotic first 50 days in office. Its stock market benchmark of Hang Seng Index has surged 13.4% for February and 14.4% for the year-to-date period (as of 2025/2/28), making it one of the world’s top performer. China Shanghai Composite Index also rose 2.2% in February but posted negative return of 0.9% for the year-to-date period. US S&P 500, Dow Jones Industrial Average and NASDAQ Composite Index fell behind and posted negative return of 1.4%, 1.6% and 4.0%, separately for February. European markets, Germany’s DAX, France’s CAC 40 and UK’s FTSE 100 Index were also top performers and posted 12.9%, 9.9% and 7.8%, separately, for the year-to-date period.

(Click on image to enlarge)

Asset Types Analysis

The total 376 Hong Kong Mandatory Provident Fund (MPF) registered for sale in Hong Kong posted positive return of 2.6% on average in February of 2025(as of 2025/02/28). Equity type posted highest average gain of 4.4% while Money Market type posted slightly average return of 0.2% for February. For the year-to-date period (as of 2025/2/28), Equity type posted an average return of 7.2% while bond type posted an average negative return of 5.4%.

Hong Kong MPF Performance by LGC Analysis

There are overall 376 Hong Kong Mandatory Provident Fund (MPF) registered for sale in Hong Kong market with a total 24 Lipper Global Classifications. Among all 24 classifications, Equity Hong Kong posted 12.5% on average and took the leading positions among all MPF classifications while Equity China, Equity Greater China and Equity Europe positive return of 12.0%, 8.6% and 3.9%, respectively in February.For the year-to-date period (as of 2025/2/28), Equity China, Equity Hong Kong and Equity Greater China posted an outstanding performance and posted an average return of 41.5%, 38.4% and 28.1%, separately.

Figure1:Top/Bottom 10 Hong Kong MPF Performance by Lipper Global Classifications, February 2025

(Click on image to enlarge)

Source:LSEG Lipper, as of 2025/02/28

(Click on image to enlarge)

Source:LSEG Lipper, as of 2025/02/28

Outlook

In recent years, China has made remarkable strides in technological innovation. Emerging technologies such as supercomputing, artificial intelligence (AI) and big data have seen accelerated adoption, driving the rapid expansion of new industries and business models. DeepSeek, a Chinese AI start-up, recently captured global media attention.

International investment is focusing on China and Hong Kong. Hong Kong shares rose to a three-year peak fueled by economic stimulus and optimistic data that have catapulted tech stocks like Baidu and Alibaba to notable gains. The Hang Seng TECH Index represents the 30 largest technology companies listed in Hong Kong that have high business exposure to technology themes. The Asian giant’s capital market performance recorded its best start to a year in history despite trade tensions, and thanks to the milestone represented by the AI open-source model DeepSeek. Hong Kong’s US$6 trillion bourse stands to benefit because it’s become the preferred home for Chinese tech listings, while also being one of the world’s most liquid equities markets.

Hong Kong’s economy progressed steadily amid a complicated and changing environment in 2024. Hong Kong’s economy recorded a moderate growth of 2.5 percent in 2024. Hong Kong’s economy is expected to grow 2 to 3 percent in 2025.

More By This Author:

S&P 500 Earnings Dashboard 24Q4 - Friday, March 14

Russell 2000 Earnings Dashboard 24Q4 - Thursday, March 13

White House Leans Into An Economic Downturn

Disclaimer: This article is for information purposes only and does not constitute any investment advice.

The views expressed are the views of the author, not necessarily those of Refinitiv ...

more