Elliott Wave Technical Analysis KOSPI Composite Index

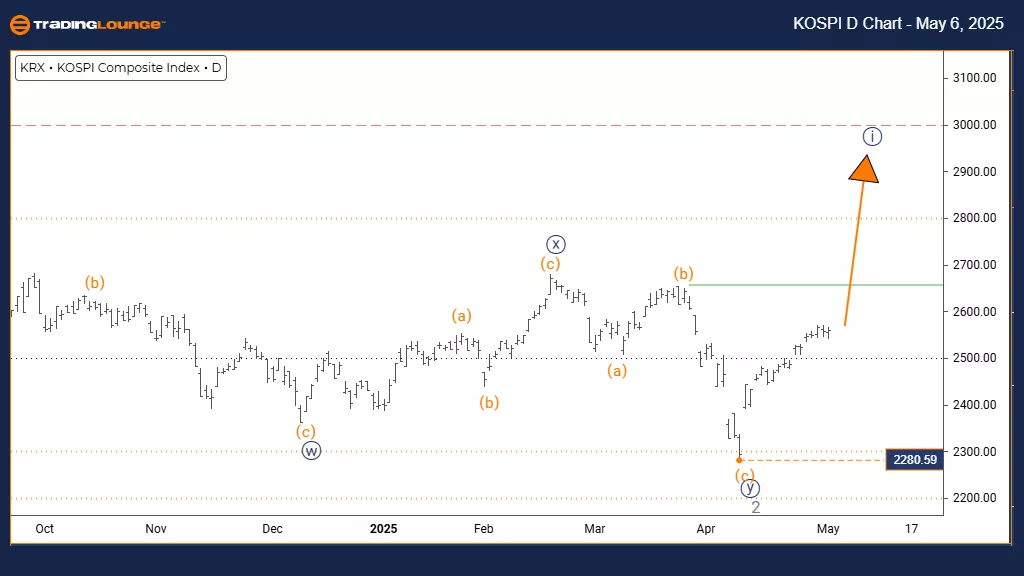

KOSPI Composite Elliott Wave Analysis Trading Lounge Day Chart

KOSPI Composite Wave Technical Analysis

FUNCTION: Trend

MODE: Impulsive

STRUCTURE: Navy blue wave 1

POSITION: Gray wave 3

DIRECTION NEXT HIGHER DEGREES: Navy blue wave 1 (started)

DETAILS: Gray wave 2 appears completed, and navy blue wave 1 of 3 is now underway.

Wave Cancel Invalidation Level: 2280.59

The KOSPI Composite daily chart highlights a bullish trend developing through an impulsive Elliott Wave structure. The index has completed its gray wave 2 correction and entered navy blue wave 1 within the larger gray wave 3 formation. This positioning signals the early stages of a new impulse wave, with potential for significant upside momentum in the upcoming sessions.

Navy blue wave 1 represents the initial stage of this new impulse move, typically characterized by gradual momentum building as the market gains directional conviction. The completion of gray wave 2's correction sets the foundation for wave 1, usually showing steady growth rather than explosive movement. The current structure suggests the upward movement will continue developing progressively before the next corrective phase.

A critical invalidation level to monitor is 2280.59. A breach below this level would invalidate the bullish scenario, requiring reassessment of the wave count. This support level protects the low of wave 2.

The daily timeframe offers essential context on the emerging structure. Traders should watch for traditional wave characteristics like increasing volume and steady price progression, understanding that wave 1 often lacks the strength seen in wave 3.

The next anticipated development will be navy blue wave 2 following the completion of wave 1. This corrective wave should present a pullback opportunity before a stronger wave 3 emerges. Price action and momentum indicators will be key to confirming the evolving structure.

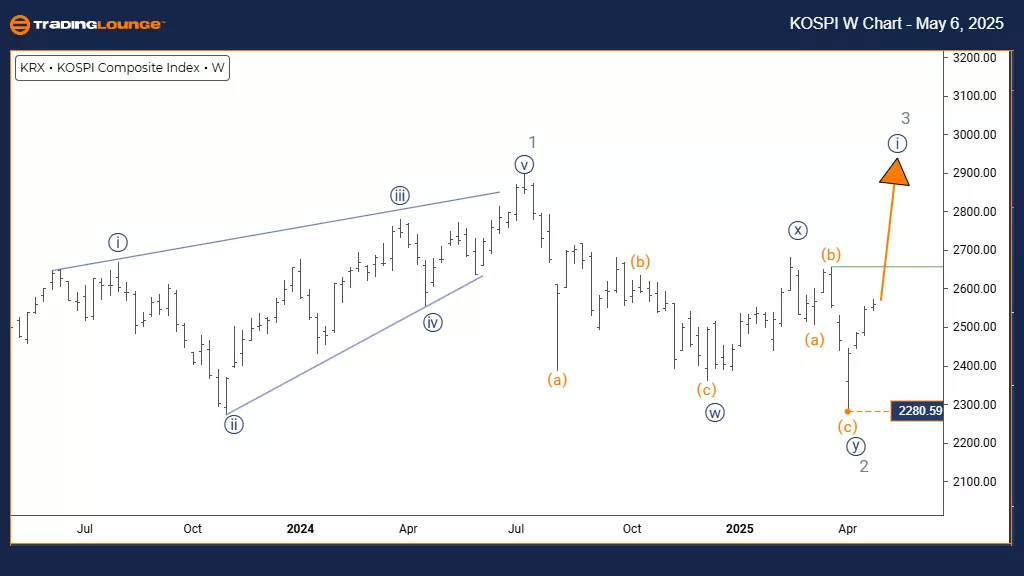

KOSPI Composite Elliott Wave Analysis Trading Lounge Weekly Chart

KOSPI Composite Wave Technical Analysis

FUNCTION: Trend

MODE: Impulsive

STRUCTURE: Navy blue wave 1

POSITION: Gray wave 3

DIRECTION NEXT HIGHER DEGREES: Navy blue wave 1 (started)

DETAILS: Gray wave 2 appears completed, and navy blue wave 1 of 3 is now underway.

Wave Cancel Invalidation Level: 2280.59

The KOSPI Composite weekly chart reveals a bullish trend advancing through an impulsive Elliott Wave structure. After completing gray wave 2 correction, the index has moved into navy blue wave 1 within the larger gray wave 3 formation. This early-stage positioning of a new impulse wave suggests strong upside potential over the coming weeks and months.

Navy blue wave 1 is the foundational stage of this new trend, usually characterized by building momentum as the market establishes direction. The gray wave 2 correction’s completion sets the stage for progressive gains. Although wave 1 often progresses steadily, it lays the groundwork for a more powerful wave 3 later.

Key support stands at 2280.59. If the price breaks below this level, the bullish interpretation would be invalidated, necessitating an updated analysis.

The weekly perspective strengthens the view of new upward momentum building. Traders should observe for signs like increasing volume and consistent price action, bearing in mind that wave 1 typically lacks the aggressive speed found in wave 3.

Once navy blue wave 1 completes, a corrective navy blue wave 2 should follow, offering a retracement opportunity before a more forceful wave 3 surge. Close attention to price behavior and momentum indicators will help confirm the structure’s progression.

Technical Analyst: Malik Awais

More By This Author:

Elliott Wave Technical Analysis: NEO Crypto Price News For Tuesday, May 6

Unlocking ASX Trading Success: Insurance Australia Group Limited - Monday, May 5

Natural Gas - Elliott Wave Technical Analysis

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more