Elliott Wave Technical Analysis: Car Group Limited - Wednesday, April 9

ASX: CAR GROUP LIMITED – CAR Elliott Wave Technical Analysis

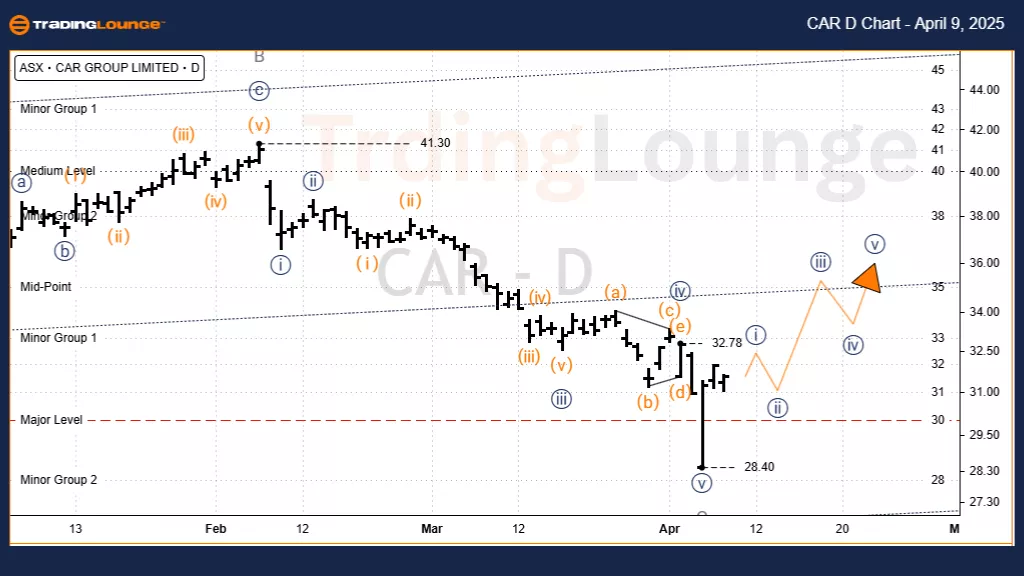

TradingLounge (1D Chart)

Greetings,

This Elliott Wave update focuses on the Australian Stock Exchange (ASX) listing: CAR GROUP LIMITED – CAR. Our latest analysis indicates that CAR may have completed a corrective wave (4) in orange, forming a Zigzag structure. This signals a potentially bullish phase worth watching. This short analysis outlines a projected trend and crucial invalidation points for this scenario.

1D Chart (Semilog Scale) Analysis

- Function: Major Trend (Intermediate Degree, Orange)

- Mode: Motive

- Structure: Impulse

- Position: Wave (5) – Orange

Details:

Wave (4) – orange began forming after the peak near 42.71 and likely ended at the 28.40 low, completing a Zigzag correction labeled A, B, C – grey. The sub-wave C – grey wave I also displayed five sub-waves, suggesting it has concluded. This increases the probability that wave (5) – orange is now unfolding. Furthermore, a decisive bounce above 32.78 strengthens the bullish outlook.

-

Invalidation Point: 28.40 (A drop below this level invalidates the current wave outlook.)

ASX: CAR GROUP LIMITED – CAR Elliott Wave Technical Analysis

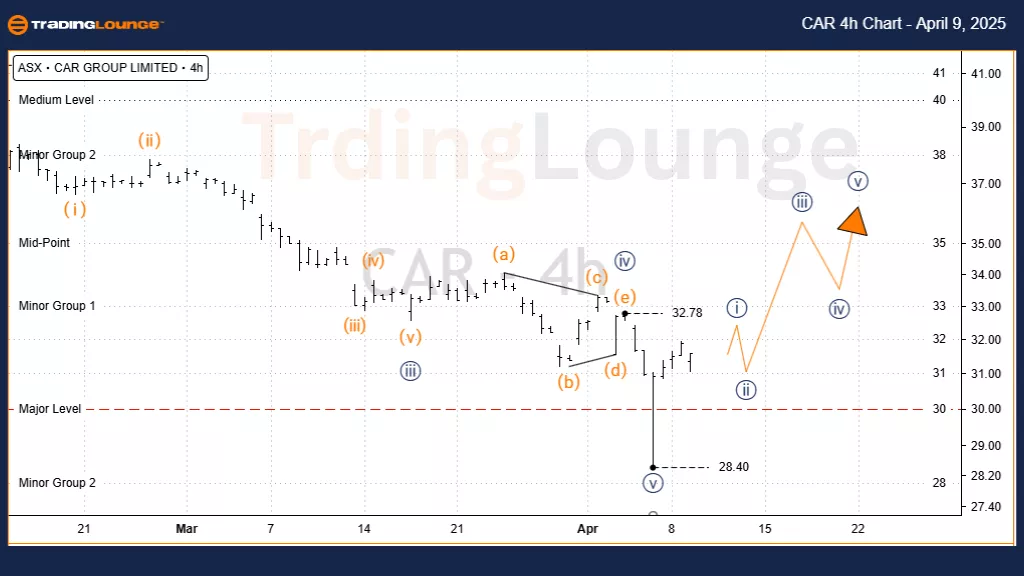

4-Hour Chart Analysis

- Function: Major Trend (Minor Degree, Grey)

- Mode: Motive

- Structure: Impulse

- Position: Wave ((i)) – Navy of Wave (5) – Orange

Details:

Following the low at 28.40, wave (5) – orange appears to be unfolding upward. Wave ((i)) – navy is nearing completion. A subsequent corrective move in wave ((ii)) – navy is anticipated, which could present a long trading opportunity, aiming for the development of wave ((iii)) – navy. The continued strength above 32.78 reinforces the bullish perspective.

-

Invalidation Point: 28.40 (The bullish scenario is void if price falls below this level.)

Conclusion:

This analysis provides insights into the mid-term and short-term trends for ASX: CAR GROUP LIMITED – CAR. With outlined price targets and invalidation levels, readers can approach this setup with clarity and confidence. The goal is to offer a structured, professional, and objective overview to support strategic trading decisions.

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation)

More By This Author:

Elliott Wave Analysis: Netflix Inc. - Tuesday, April 8

Elliott Wave Technical Analysis: British Pound/U.S. Dollar - Tuesday, April 8

Elliott Wave Technical Analysis: AAVE Crypto Price News For Tuesday, April 8

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more