ECB Cuts Asset Purchase Program To 30 Billion Euro

The European Central Bank reduced its bond-buying program to 69 percent in January, the first full month since the apex bank announced its balance sheet normalization.

The central bank had announced in October it will reduce its asset-buying program to 30 billion euros per month in January 2018 but that the bank will continue to buy sizeable quantities of corporate bonds, hence, the reason corporate-sector bonds rose to 19 percent.

Asset purchase program is scheduled to end in September, depending on economic numbers in 2018. However, the region’s economy is growing at the fastest pace in a decade and the week inflation rate has started picking up despite rising foreign exchange rate. Still, Mario Draghi said the European Central Bank still can’t claim success yet.

“While our confidence that inflation will converge toward our aim of below, but close to, 2 percent has strengthened, we cannot yet declare victory on this front,” the ECB president said in his opening statement at the European Parliament in Strasbourg on Monday. “Monetary policy will evolve in a fully data-dependent and time-consistent manner.”

Draghi reiterated that monetary policy is still needed to build underlying price pressures and for inflation to converge towards the central bank’s 2 percent target. Meaning, the central bank may not be raising rate soon, especially with Euro rising to more than three years high in recent months.

“The euro-area economy is expanding robustly, with stronger growth rates than previously expected and significantly above potential,” Draghi said. “While we can be more confident about the path of inflation, patience and persistence with regard to monetary policy is still warranted for underlying inflation pressures to build up and inflation to converge durably toward our objective.”

The central bank one concern now is the rising foreign exchange rate, the central bank said it needs monitoring because of its impact on the inflation rate.

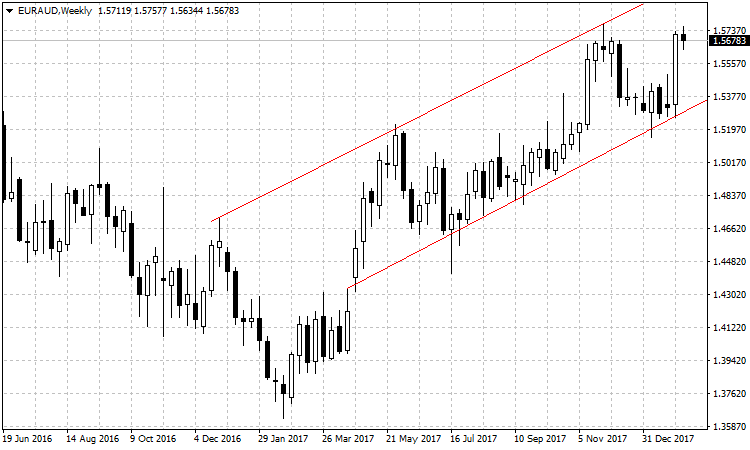

(Click on image to enlarge)

The Euro remained fairly stable against emerging currency trading at 1.5679 against the Aussie dollar and 1.7044 against the New Zealand dollar.

This is very interesting; it's great to see European economy and the Euro stabilizing, but I would also like to see how individual countries are doing economically, and whether or not the Euro's stabilization is due to a few key players.