Czech National Bank Review: A Softer 25bp Cut With Tighter Monetary Policy Ahead

Image Source: Pexels

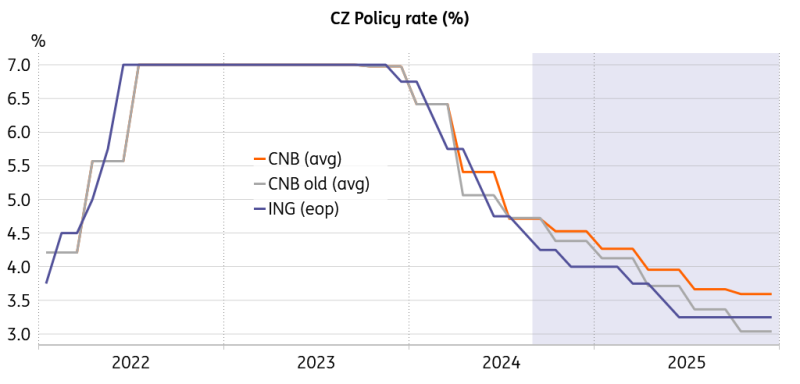

The CNB policymakers decided to moderate the pace of rate reduction to 25bp as anticipated, with the policy rate at 4.5% since early August. At the same time, the whole rate curve shifted upward, especially toward the longer end of the projection horizon, while economic rebound expectations remain upbeat for the coming year.

Fewer rate cuts in the pipeline with upbeat growth and inflation close to target

The first cut by only 25bp in August, the new Summer Forecast, and the CNB communication indicate that a softer approach will be the new normal from August onward. The future rates path is well above the previous projection, suggesting only one more cut till the end of this year with a terminal rate of 4.5%. The following year would also see fewer rate reductions, ending with the CNB policy rate at 3.6%, which is considerably above the previous forecast of 3%. The Board Members indicated that they see the long-term neutral rate in the range of 3% to 3.5% despite being rather reluctant to address the concept in more detail. Looking at the decomposition of the upward rates revision, the main driving forces are higher interest rates abroad and expert judgment.

Policy rate path has been revised upward

Source: CNB, ING, Macrobond

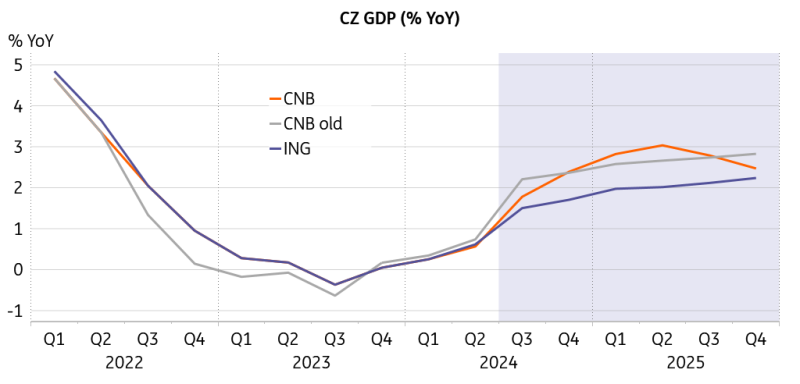

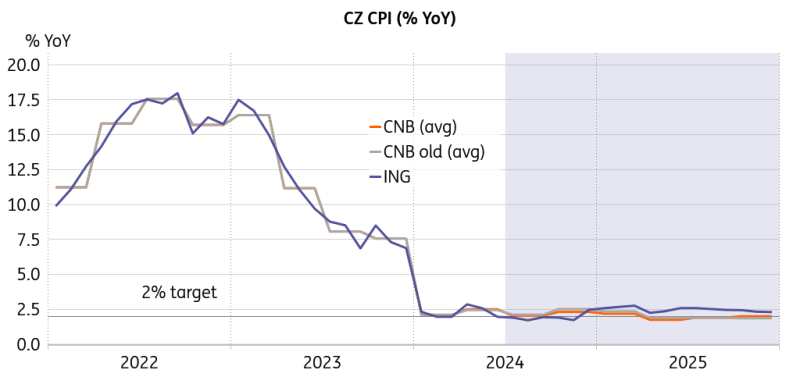

That said, the economic rebound is expected to continue at a marginally lower rate of 1.2% this year and accelerate to a robust 2.8% in the next, despite the elevated restrictiveness of the monetary policy stance. With inflation close to target over the forecast horizon with a minor downward revision, real interest rates should remain above 2% until mid-next year, representing rather challenging conditions for economic activity even if the equilibrium real rate is seen at the 1.5% upper bound.

The expected economic rebound is buoyant

Source: CNB, ING, Macrobond

Clearly, the monetary conditions may be observed as much broader, considering the weaker exchange rate trajectory, which may lend some support to exports and import prices. Still, the 2.8% expansion in the next year seems slightly optimistic, given the current disappointment in second-quarter GDP, weakness in hard indicators such as industrial output and retail sales, and deteriorating consumer and business confidence. Our GDP forecast remains rather conservative also on the back of the tepid performance of the main Czech trading partners, with risks to the outlook mounting.

Inflation remains close to the target

Source: CNB, ING, Macrobond

Lower equilibrium values in the G3+ forecasting model

The CNB has introduced crucial changes to the equilibrium values of key variables. These changes are currently based on expert judgment but will be fully incorporated into the G3+ in the upcoming Autumn Forecast. That said, recalibration of a large-scale DSGE model that the CNB Staff uses as the core projection model is an immense task, so we hope all will go well for the sake of consistency of future projections.

Potential growth and other key equilibria have been lowered

Source: CNB

The equilibrium potential growth of the Czech economy has been lowered by 0.5 percentage points to 2.5%, and so have the long-term productivity gains. A milder steady-state appreciation of the real exchange rate is foreseen in the future, reflecting the slowdown in convergence of the Czech economy toward more advanced eurozone neighbours, which also implies a weaker average wage growth. We see the reduction in potential output as a step in the right direction, as it has likely deteriorated since the onset of the pandemic and during the last two years of economic stagnation. This brings the CNB potential output closer to our estimate of just above 2%.

Storytelling and the way forward

We see the recent evolution of the Czech economic story as follows. All seemed like an onset of a fully-fledged cyclical recovery until May, with consumers taking the lead and the manufacturing sector joining a bit later. This would put the positive feedback loops in action, implying two or three years of economic expansion taking the lead, with inflation in the upper segment of the CNB tolerance band and interest rates at 3.5% mid-next year. Right now, the story looks more like a lukewarm recovery with mounting risks for the second half of the year, inflation just above or close to the target, and the policy rate at 3.25% in mid-next year, which still is our central scenario.

However, given the disappointing hard data and sentiment in Czechia and abroad, we might be shifting toward an uglier tale with the weak German economy, little or no growth in Czechia, inflation below target, and rates around 3% mid-next year to provide some support to the not-so-convincing economic activity. It seems that the CNB is reluctant to compensate for the structural weaknesses of the economy with low rates, as the low real rates of the previous decade have been repeatedly criticized. Also, inflation below the target is not seen as an issue for some time in the future to offset the high and destructive price increases of the previous years.

Everybody knows the reasons for the Czech economic malaise are of a structural nature. However, tepid growth and inflation below target can change minds. We see the economic rebound coming in more gradually, with a need for a less restrictive monetary policy setup. Our forecast remains unchanged, with the policy rate likely declining to 4% at the end of this year at the pace of 25bp rate reductions. After a short break around the year-end due to waiting for the pronounced price changes in January, we expect the interest rate will gradually decrease to 3.25% by mid-next year and stay there until December. Should the recovery prove robust in the second half, we will revise the rates forecast to get closer to CNB expectations.

Our market view

The CNB delivered a strong hawkish report and surprised all expectations with an upward revision to the rates forecast. However, the current rally in global markets and the CNB's extreme scenario of high rates for a longer period of time convinced markets to rather ignore the central bank's new forecast. Market pricing of the key rate has thus settled at 3.60% for the end of this year and 2.90% for the end of next year. This is higher than our economists expect and significantly higher than the CNB's new forecast with 4.50% for the end of this year and 3.60% for the end of next year.

The short end of the IRS curve seems too hot for us, but in the current environment there is no point in going against it, and at the same time cracks in the economic recovery in the Czech Republic and globally with headline inflation teetering on target markets may have reasons to leave this pricing in place longer. However, in this context we see more room for the long-end of the curve to go down further. The 5y5y already fallen to 3.36%, but an overly hawkish CNB and a weakening economic outlook should naturally lead to a flattening curve, following the Polish case.

EUR/CZK reacted to the CNB's decision with a quick move down and, as we expected, the hawkish approach of the central bank triggered a CZK rally. Still the interest rate differential is the main driver here and the current multi-week highs point to 25.20-25.25 EUR/CZK as the landing zone. Potentially we see room for more CZK rally but first we will need to see some repricing up in the front of the curve to add more fuel. The weakening economy will of course be an issue but we already know from previous years that the CZK is watching the CNB and rates more and that could drive EUR/CZK lower this time too.

More By This Author:

Mounting US Job Fears To Push The Fed Into ActionThe Commodities Feed: US Macro Weighs On The Complex

Rates Spark: Bank Of England First Cut Is A Reality

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more