Currency Speculators Raise British Pound Bullish Bets For 6th Time In 7 Weeks

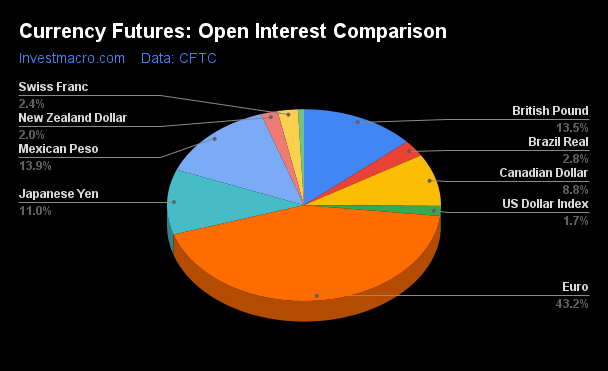

Here are the latest charts and statistics for the Commitment of Traders (COT) data published by the Commodities Futures Trading Commission (CFTC).

The latest COT data is updated through Tuesday May 16th and shows a quick view of how large market participants (for-profit speculators and commercial traders) were positioned in the futures markets. All currency positions are in direct relation to the US dollar where, for example, a bet for the euro is a bet that the euro will rise versus the dollar while a bet against the euro will be a bet that the euro will decline versus the dollar.

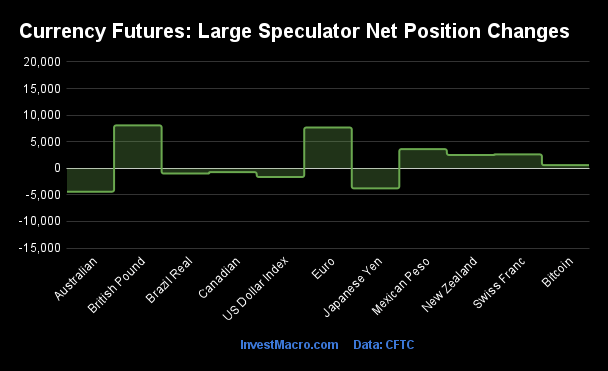

Weekly Speculator Changes led by British Pound & EuroFX

The COT currency market speculator bets were higher this week as six out of the eleven currency markets we cover had higher positioning while the other five markets had lower speculator contracts.

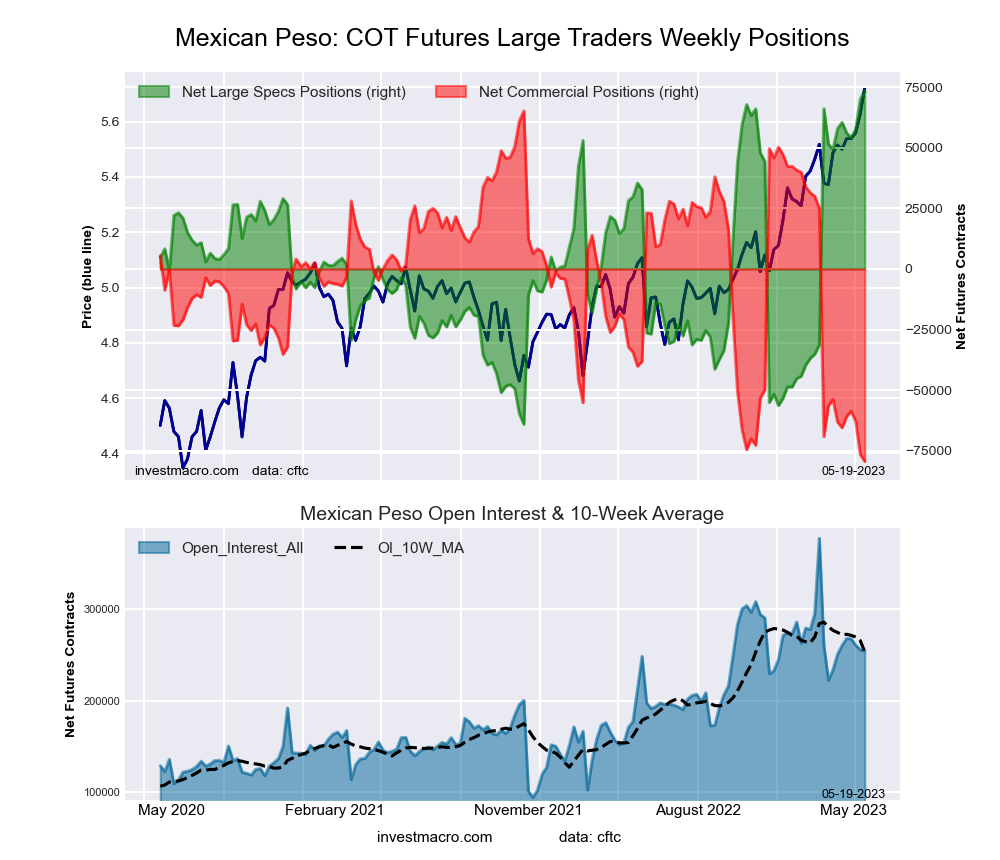

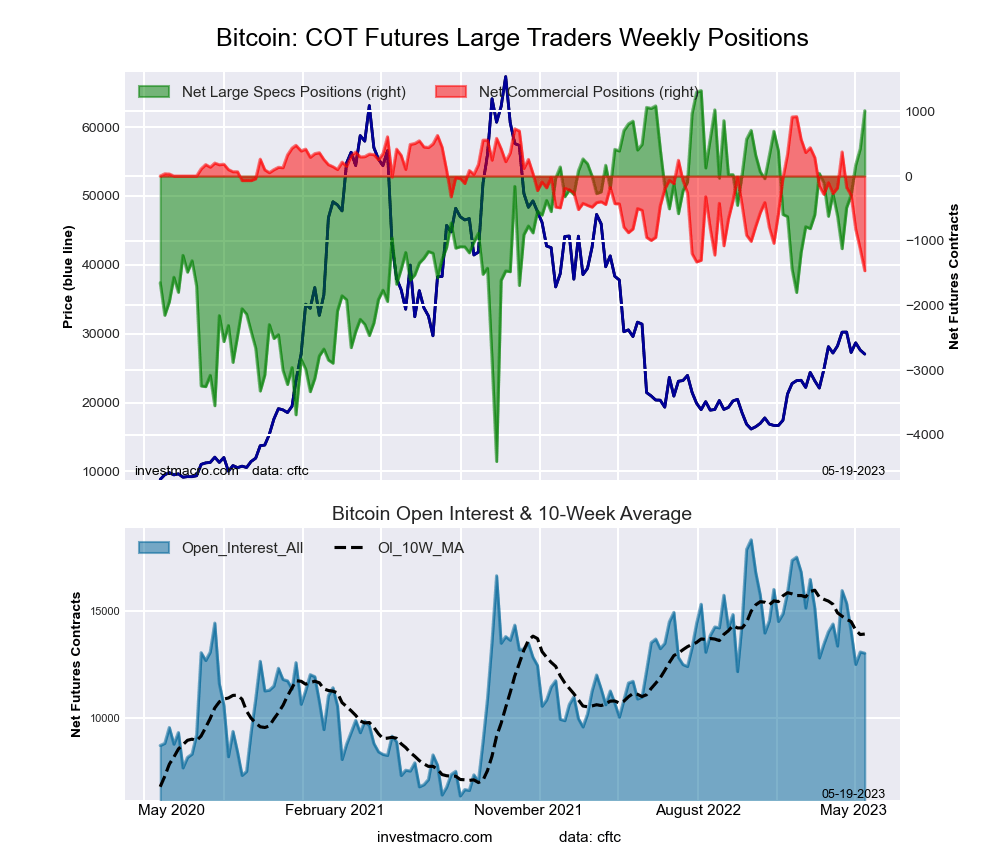

Leading the gains for the currency markets was the British Pound (8,065 contracts) with the EuroFX (7,667 contracts), Mexican Peso (3,603 contracts), Swiss Franc (2,608 contracts), New Zealand Dollar (2,506 contracts) and Bitcoin (588 contracts) also showing positive weeks.

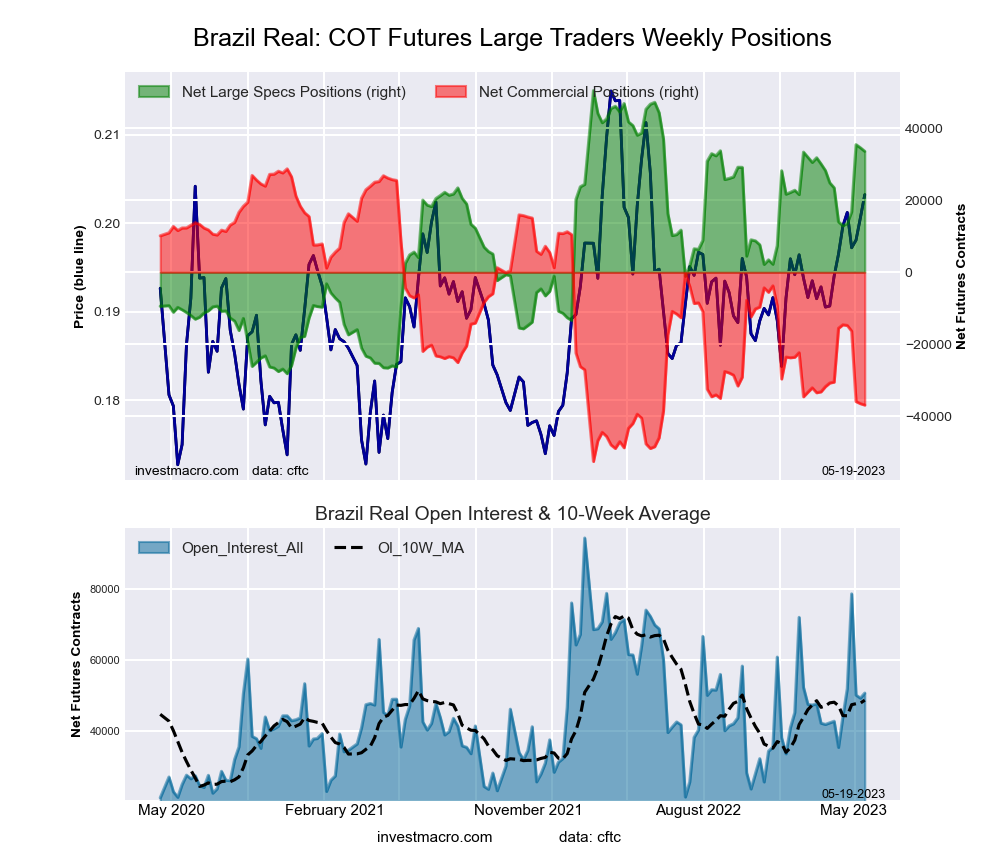

The currencies seeing declines in speculator bets on the week were the Australian Dollar (-4,401 contracts), the Japanese Yen (-3,776 contracts), the US Dollar Index (-1,642 contracts), Canadian Dollar (-727 contracts) and the Brazilian Real (-988 contracts) also registering lower bets on the week.

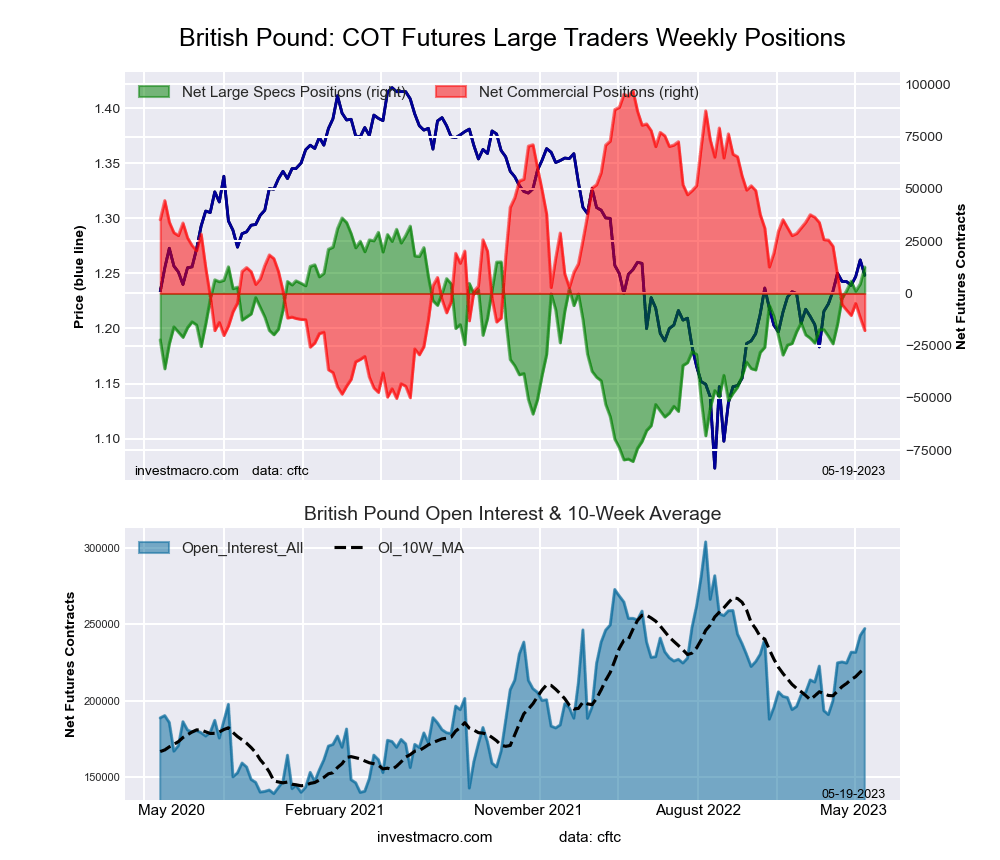

Speculators raise British Pound bullish bets for 6th time in 7 weeks

Highlighting the COT currency’s data this week is the rising bullishness of the speculator’s positioning in the British pound sterling. Large speculative pound Sterling positions gained this week for a second consecutive week and for the sixth time in the past seven weeks.

Sterling weekly positions have now increased by a total of +36,677 contracts over the past seven-week period. This bullish turn in bets has taken the overall net speculator position from a total of -24,084 contracts on March 28th to a total of +12,593 contracts this week, the best level since November of 2021. The sterling position has been in a bullish level for five straight weeks after a streak of sixty straight weeks in bearish territory through April 11th.

The sterling’s front-month future’s price has been on the uptrend since bottoming in September with a low at the 1.0392 exchange rate. This week’s closing price of 1.2457 is approximately 20 percent higher than that September low.

Helping boost the sterling in recent months is the rising interest rate as the Bank of England increased it’s Bank Rate to 4.5 percent at the May 11th meeting. The inflation rate in the UK currently is right around 10 percent (with a target of 2 percent) and investor’s are expecting more rate rises to come, according to ING.

|

May-16-2023

|

OI

|

OI-Index

|

Spec-Net

|

Spec-Index

|

Com-Net

|

COM-Index

|

Smalls-Net

|

Smalls-Index

|

|---|---|---|---|---|---|---|---|---|

| EUR | 789,930 | 88 | 187,089 | 90 | -238,333 | 10 | 51,244 | 61 |

| MXN | 254,037 | 57 | 73,635 | 100 | -79,465 | 0 | 5,830 | 92 |

| GBP | 247,165 | 66 | 12,593 | 80 | -17,729 | 22 | 5,136 | 68 |

| JPY | 200,515 | 47 | -64,791 | 29 | 76,137 | 73 | -11,346 | 30 |

| AUD | 167,020 | 63 | -53,594 | 35 | 61,902 | 65 | -8,308 | 32 |

| CAD | 161,195 | 38 | -42,990 | 14 | 44,533 | 86 | -1,543 | 19 |

| BRL | 50,633 | 40 | 33,606 | 79 | -36,899 | 19 | 3,293 | 70 |

| CHF | 43,681 | 48 | -1,859 | 50 | 2,838 | 50 | -979 | 54 |

| NZD | 36,187 | 24 | -2,075 | 48 | 1,943 | 51 | 132 | 52 |

| USD Index | 30,880 | 25 | 9,514 | 41 | -12,357 | 56 | 2,843 | 48 |

| RUB | 20,930 | 4 | 7,543 | 31 | -7,150 | 69 | -393 | 24 |

| Bitcoin | 13,043 | 56 | 1,011 | 95 | -1,463 | 0 | 452 | 23 |

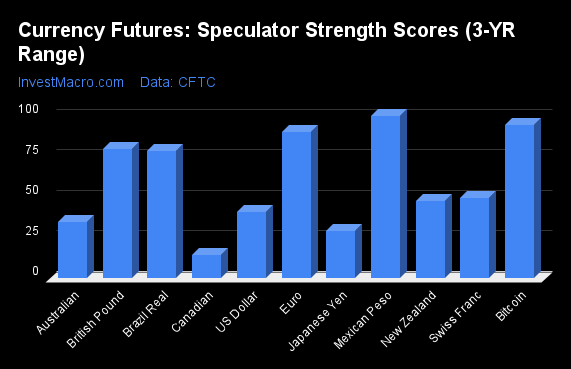

Strength Scores led by Mexican Peso & Bitcoin

COT Strength Scores (a normalized measure of Speculator positions over a 3-Year range, from 0 to 100 where above 80 is Extreme-Bullish and below 20 is Extreme-Bearish) showed that the Mexican Peso (100 percent) and the Bitcoin (95 percent) lead the currency markets this week. The EuroFX (90 percent), British Pound (80 percent) and the Brazilian Real (79 percent) come in as the next highest in the weekly strength scores.

On the downside, the Canadian Dollar (14 percent) comes in at the lowest strength levels currently and is in Extreme-Bearish territory (below 20 percent). The next lowest strength scores are the Japanese Yen (29 percent) and the Australian Dollar (35 percent).

Strength Statistics:

US Dollar Index (40.8 percent) vs US Dollar Index previous week (43.5 percent)

EuroFX (90.5 percent) vs EuroFX previous week (87.5 percent)

British Pound Sterling (79.8 percent) vs British Pound Sterling previous week (72.9 percent)

Japanese Yen (29.0 percent) vs Japanese Yen previous week (31.3 percent)

Swiss Franc (49.7 percent) vs Swiss Franc previous week (42.8 percent)

Canadian Dollar (14.5 percent) vs Canadian Dollar previous week (15.1 percent)

Australian Dollar (35.1 percent) vs Australian Dollar previous week (39.2 percent)

New Zealand Dollar (48.0 percent) vs New Zealand Dollar previous week (41.2 percent)

Mexican Peso (100.0 percent) vs Mexican Peso previous week (97.4 percent)

Brazilian Real (78.5 percent) vs Brazilian Real previous week (79.8 percent)

Bitcoin (94.6 percent) vs Bitcoin previous week (84.3 percent)

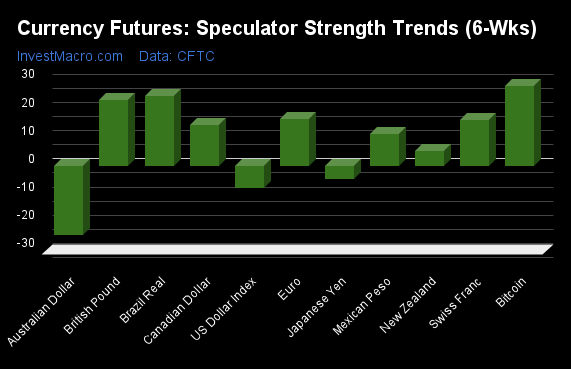

Bitcoin & Brazilian Real top the 6-Week Strength Trends

COT Strength Score Trends (or move index, calculates the 6-week changes in strength scores) showed that the Bitcoin (28 percent) and the Brazilian Real (25 percent) lead the past six weeks trends for the currencies. The British Pound (24 percent), the EuroFX (17 percent) and the Swiss Franc (16 percent) are the next highest positive movers in the latest trends data.

The Australian Dollar (-24 percent) leads the downside trend scores currently with the US Dollar Index (-8 percent) and Japanese Yen (-5 percent) following next with lower trend scores.

Strength Trend Statistics:

US Dollar Index (-7.7 percent) vs US Dollar Index previous week (-2.6 percent)

EuroFX (16.8 percent) vs EuroFX previous week (13.3 percent)

British Pound Sterling (23.5 percent) vs British Pound Sterling previous week (24.6 percent)

Japanese Yen (-4.8 percent) vs Japanese Yen previous week (-4.3 percent)

Swiss Franc (16.2 percent) vs Swiss Franc previous week (4.2 percent)

Canadian Dollar (14.5 percent) vs Canadian Dollar previous week (13.6 percent)

Australian Dollar (-24.4 percent) vs Australian Dollar previous week (-12.8 percent)

New Zealand Dollar (5.3 percent) vs New Zealand Dollar previous week (5.5 percent)

Mexican Peso (11.4 percent) vs Mexican Peso previous week (15.1 percent)

Brazilian Real (24.9 percent) vs Brazilian Real previous week (14.1 percent)

Bitcoin (28.4 percent) vs Bitcoin previous week (12.2 percent)

Individual COT Forex Markets:

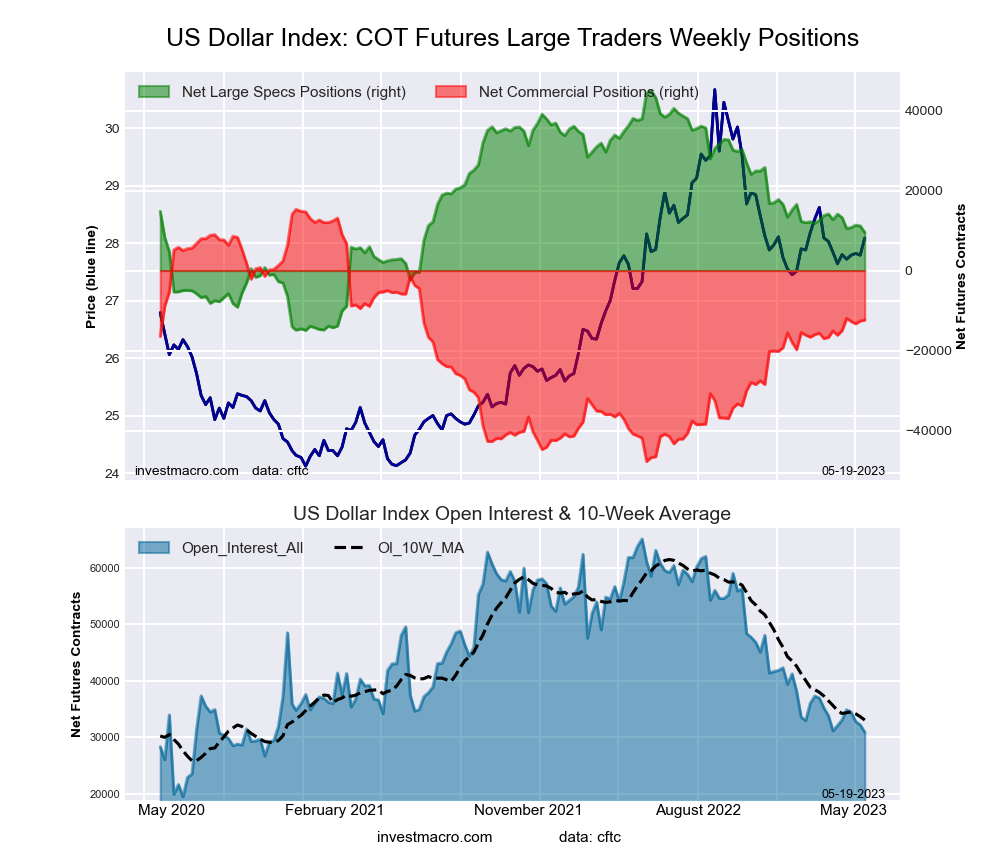

US Dollar Index Futures:

The US Dollar Index large speculator standing this week reached a net position of 9,514 contracts in the data reported through Tuesday. This was a weekly reduction of -1,642 contracts from the previous week which had a total of 11,156 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish with a score of 40.8 percent. The commercials are Bullish with a score of 56.1 percent and the small traders (not shown in chart) are Bearish with a score of 47.6 percent.

| US DOLLAR INDEX Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 66.9 | 9.1 | 18.3 |

| – Percent of Open Interest Shorts: | 36.1 | 49.1 | 9.1 |

| – Net Position: | 9,514 | -12,357 | 2,843 |

| – Gross Longs: | 20,669 | 2,817 | 5,644 |

| – Gross Shorts: | 11,155 | 15,174 | 2,801 |

| – Long to Short Ratio: | 1.9 to 1 | 0.2 to 1 | 2.0 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 40.8 | 56.1 | 47.6 |

| – Strength Index Reading (3 Year Range): | Bearish | Bullish | Bearish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -7.7 | 6.0 | 8.7 |

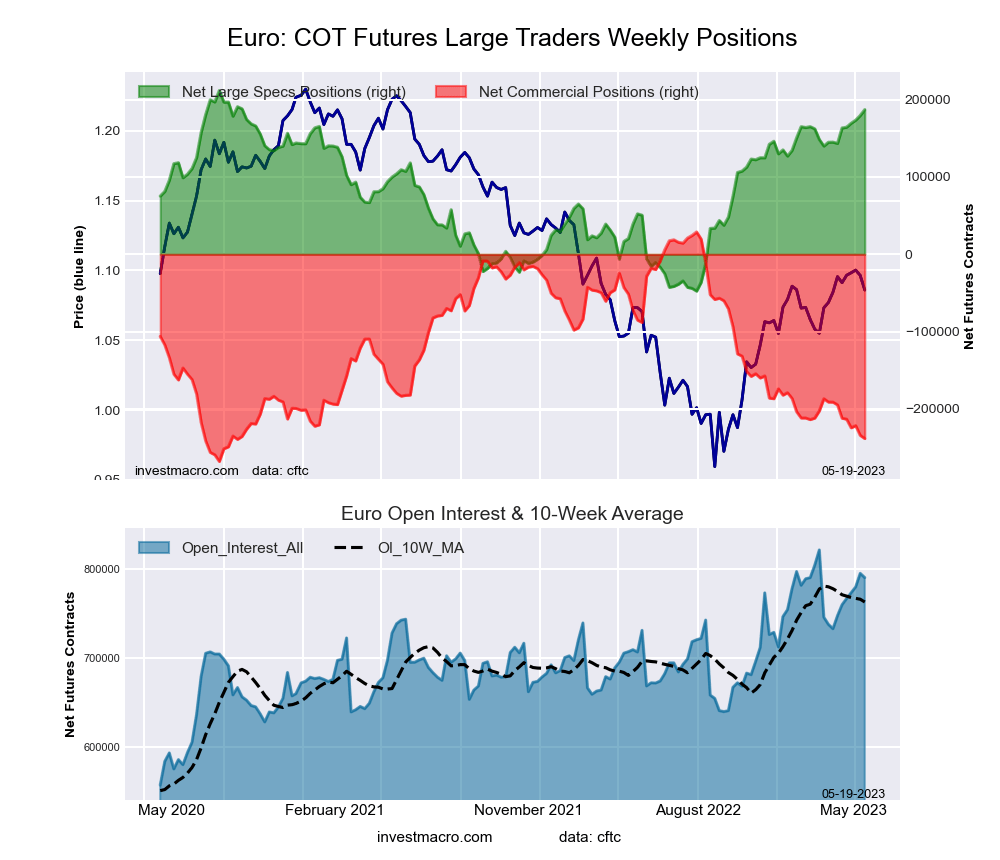

Euro Currency Futures:

The Euro Currency large speculator standing this week reached a net position of 187,089 contracts in the data reported through Tuesday. This was a weekly advance of 7,667 contracts from the previous week which had a total of 179,422 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish-Extreme with a score of 90.5 percent. The commercials are Bearish-Extreme with a score of 10.0 percent and the small traders (not shown in chart) are Bullish with a score of 60.7 percent.

| EURO Currency Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 32.8 | 52.7 | 11.8 |

| – Percent of Open Interest Shorts: | 9.1 | 82.9 | 5.3 |

| – Net Position: | 187,089 | -238,333 | 51,244 |

| – Gross Longs: | 258,736 | 416,383 | 93,212 |

| – Gross Shorts: | 71,647 | 654,716 | 41,968 |

| – Long to Short Ratio: | 3.6 to 1 | 0.6 to 1 | 2.2 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 90.5 | 10.0 | 60.7 |

| – Strength Index Reading (3 Year Range): | Bullish-Extreme | Bearish-Extreme | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 16.8 | -14.7 | -0.2 |

British Pound Sterling Futures:

The British Pound Sterling large speculator standing this week reached a net position of 12,593 contracts in the data reported through Tuesday. This was a weekly gain of 8,065 contracts from the previous week which had a total of 4,528 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 79.8 percent. The commercials are Bearish with a score of 22.0 percent and the small traders (not shown in chart) are Bullish with a score of 68.1 percent.

| BRITISH POUND Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 31.3 | 50.8 | 12.5 |

| – Percent of Open Interest Shorts: | 26.2 | 58.0 | 10.4 |

| – Net Position: | 12,593 | -17,729 | 5,136 |

| – Gross Longs: | 77,388 | 125,675 | 30,873 |

| – Gross Shorts: | 64,795 | 143,404 | 25,737 |

| – Long to Short Ratio: | 1.2 to 1 | 0.9 to 1 | 1.2 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 79.8 | 22.0 | 68.1 |

| – Strength Index Reading (3 Year Range): | Bullish | Bearish | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 23.5 | -18.1 | -1.5 |

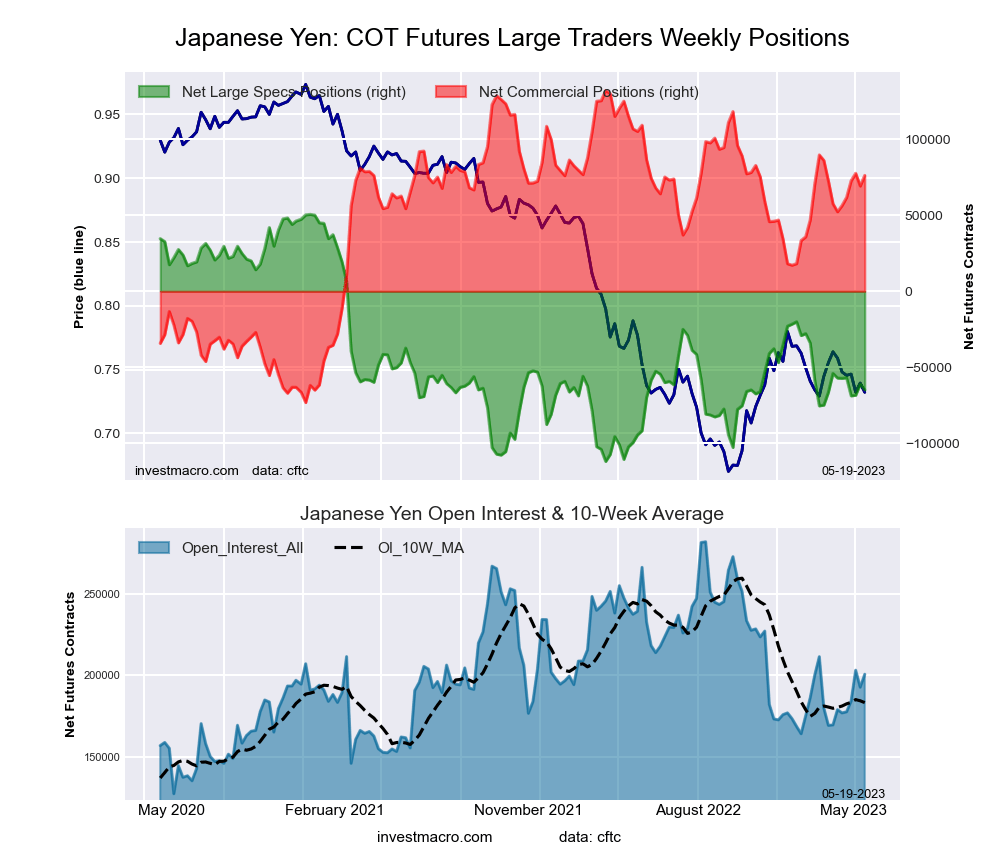

Japanese Yen Futures:

The Japanese Yen large speculator standing this week reached a net position of -64,791 contracts in the data reported through Tuesday. This was a weekly decline of -3,776 contracts from the previous week which had a total of -61,015 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish with a score of 29.0 percent. The commercials are Bullish with a score of 72.8 percent and the small traders (not shown in chart) are Bearish with a score of 30.4 percent.

| JAPANESE YEN Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 14.7 | 71.0 | 13.3 |

| – Percent of Open Interest Shorts: | 47.0 | 33.0 | 18.9 |

| – Net Position: | -64,791 | 76,137 | -11,346 |

| – Gross Longs: | 29,494 | 142,392 | 26,570 |

| – Gross Shorts: | 94,285 | 66,255 | 37,916 |

| – Long to Short Ratio: | 0.3 to 1 | 2.1 to 1 | 0.7 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 29.0 | 72.8 | 30.4 |

| – Strength Index Reading (3 Year Range): | Bearish | Bullish | Bearish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -4.8 | 11.6 | -32.7 |

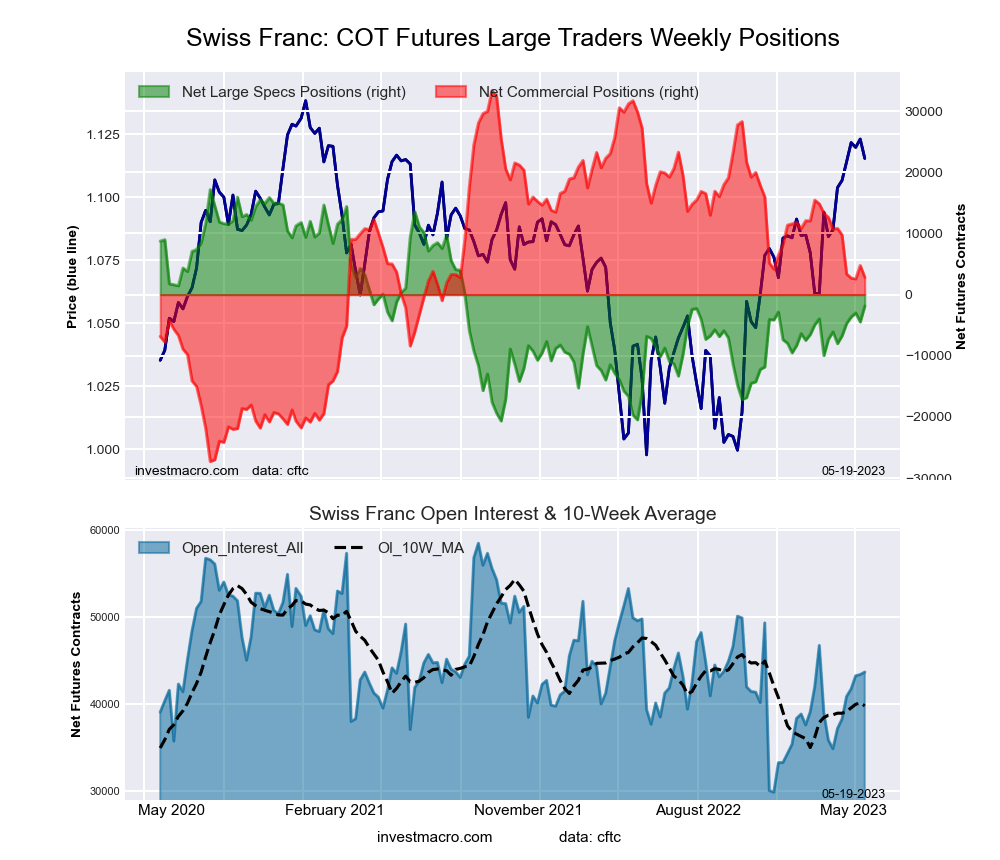

Swiss Franc Futures:

The Swiss Franc large speculator standing this week reached a net position of -1,859 contracts in the data reported through Tuesday. This was a weekly advance of 2,608 contracts from the previous week which had a total of -4,467 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish with a score of 49.7 percent. The commercials are Bearish with a score of 49.7 percent and the small traders (not shown in chart) are Bullish with a score of 54.2 percent.

| SWISS FRANC Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 19.6 | 42.4 | 33.4 |

| – Percent of Open Interest Shorts: | 23.9 | 35.9 | 35.7 |

| – Net Position: | -1,859 | 2,838 | -979 |

| – Gross Longs: | 8,561 | 18,524 | 14,600 |

| – Gross Shorts: | 10,420 | 15,686 | 15,579 |

| – Long to Short Ratio: | 0.8 to 1 | 1.2 to 1 | 0.9 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 49.7 | 49.7 | 54.2 |

| – Strength Index Reading (3 Year Range): | Bearish | Bearish | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 16.2 | -13.2 | 6.2 |

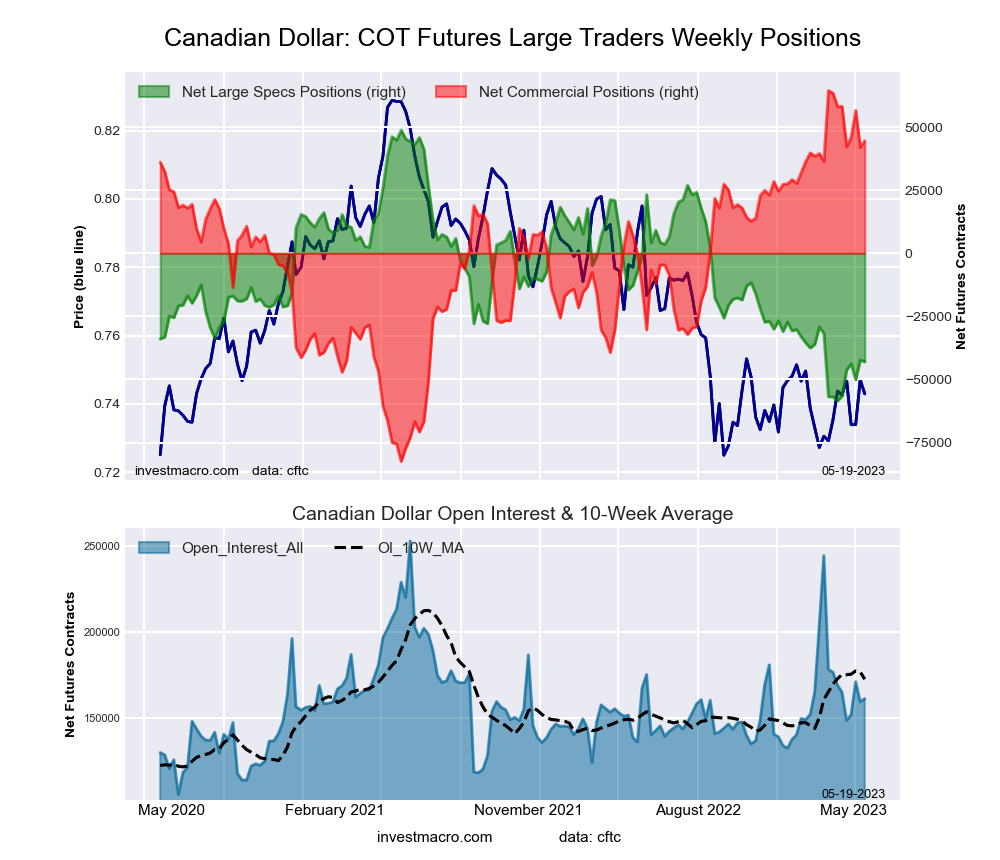

Canadian Dollar Futures:

The Canadian Dollar large speculator standing this week reached a net position of -42,990 contracts in the data reported through Tuesday. This was a weekly decrease of -727 contracts from the previous week which had a total of -42,263 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish-Extreme with a score of 14.5 percent. The commercials are Bullish-Extreme with a score of 86.4 percent and the small traders (not shown in chart) are Bearish-Extreme with a score of 19.4 percent.

| CANADIAN DOLLAR Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 17.7 | 60.9 | 19.1 |

| – Percent of Open Interest Shorts: | 44.4 | 33.2 | 20.0 |

| – Net Position: | -42,990 | 44,533 | -1,543 |

| – Gross Longs: | 28,514 | 98,089 | 30,767 |

| – Gross Shorts: | 71,504 | 53,556 | 32,310 |

| – Long to Short Ratio: | 0.4 to 1 | 1.8 to 1 | 1.0 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 14.5 | 86.4 | 19.4 |

| – Strength Index Reading (3 Year Range): | Bearish-Extreme | Bullish-Extreme | Bearish-Extreme |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 14.5 | -9.3 | -4.2 |

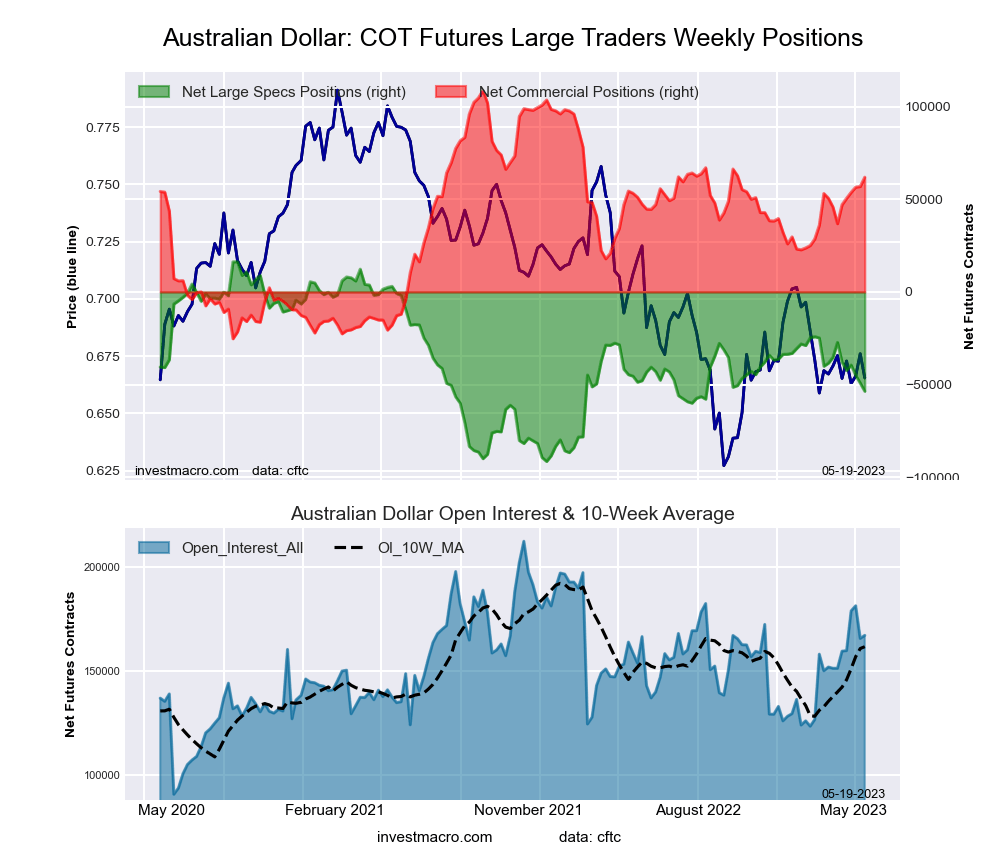

Australian Dollar Futures:

The Australian Dollar large speculator standing this week reached a net position of -53,594 contracts in the data reported through Tuesday. This was a weekly decrease of -4,401 contracts from the previous week which had a total of -49,193 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish with a score of 35.1 percent. The commercials are Bullish with a score of 65.1 percent and the small traders (not shown in chart) are Bearish with a score of 32.2 percent.

| AUSTRALIAN DOLLAR Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 26.3 | 58.7 | 11.8 |

| – Percent of Open Interest Shorts: | 58.4 | 21.7 | 16.8 |

| – Net Position: | -53,594 | 61,902 | -8,308 |

| – Gross Longs: | 43,903 | 98,069 | 19,676 |

| – Gross Shorts: | 97,497 | 36,167 | 27,984 |

| – Long to Short Ratio: | 0.5 to 1 | 2.7 to 1 | 0.7 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 35.1 | 65.1 | 32.2 |

| – Strength Index Reading (3 Year Range): | Bearish | Bullish | Bearish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -24.4 | 18.7 | 3.2 |

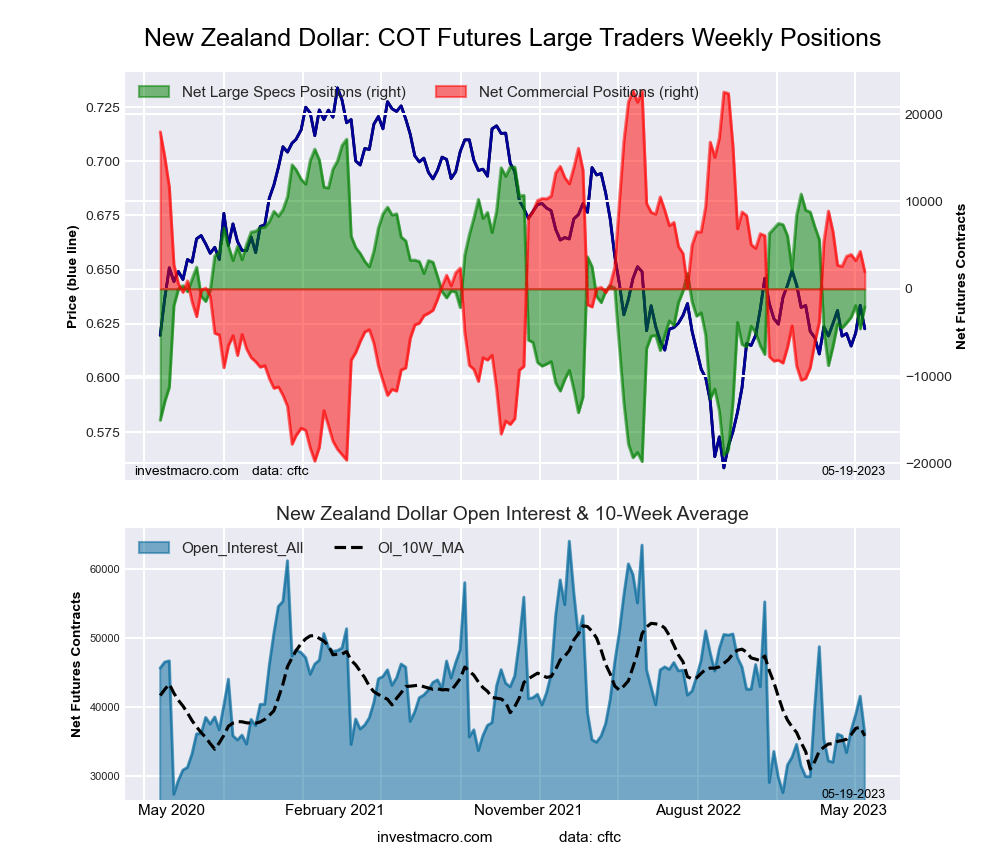

New Zealand Dollar Futures:

The New Zealand Dollar large speculator standing this week reached a net position of -2,075 contracts in the data reported through Tuesday. This was a weekly increase of 2,506 contracts from the previous week which had a total of -4,581 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish with a score of 48.0 percent. The commercials are Bullish with a score of 51.1 percent and the small traders (not shown in chart) are Bullish with a score of 51.5 percent.

| NEW ZEALAND DOLLAR Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 40.4 | 49.2 | 10.2 |

| – Percent of Open Interest Shorts: | 46.1 | 43.8 | 9.8 |

| – Net Position: | -2,075 | 1,943 | 132 |

| – Gross Longs: | 14,610 | 17,789 | 3,695 |

| – Gross Shorts: | 16,685 | 15,846 | 3,563 |

| – Long to Short Ratio: | 0.9 to 1 | 1.1 to 1 | 1.0 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 48.0 | 51.1 | 51.5 |

| – Strength Index Reading (3 Year Range): | Bearish | Bullish | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 5.3 | -1.8 | -14.3 |

Mexican Peso Futures:

The Mexican Peso large speculator standing this week reached a net position of 73,635 contracts in the data reported through Tuesday. This was a weekly boost of 3,603 contracts from the previous week which had a total of 70,032 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish-Extreme with a score of 100.0 percent. The commercials are Bearish-Extreme with a score of 0.0 percent and the small traders (not shown in chart) are Bullish-Extreme with a score of 91.9 percent.

| MEXICAN PESO Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 52.5 | 43.8 | 3.5 |

| – Percent of Open Interest Shorts: | 23.5 | 75.0 | 1.2 |

| – Net Position: | 73,635 | -79,465 | 5,830 |

| – Gross Longs: | 133,268 | 111,178 | 8,968 |

| – Gross Shorts: | 59,633 | 190,643 | 3,138 |

| – Long to Short Ratio: | 2.2 to 1 | 0.6 to 1 | 2.9 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 100.0 | 0.0 | 91.9 |

| – Strength Index Reading (3 Year Range): | Bullish-Extreme | Bearish-Extreme | Bullish-Extreme |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 11.4 | -11.3 | 3.3 |

Brazilian Real Futures:

The Brazilian Real large speculator standing this week reached a net position of 33,606 contracts in the data reported through Tuesday. This was a weekly decline of -988 contracts from the previous week which had a total of 34,594 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 78.5 percent. The commercials are Bearish-Extreme with a score of 19.3 percent and the small traders (not shown in chart) are Bullish with a score of 70.2 percent.

| BRAZIL REAL Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 76.4 | 14.7 | 8.9 |

| – Percent of Open Interest Shorts: | 10.0 | 87.6 | 2.4 |

| – Net Position: | 33,606 | -36,899 | 3,293 |

| – Gross Longs: | 38,661 | 7,439 | 4,485 |

| – Gross Shorts: | 5,055 | 44,338 | 1,192 |

| – Long to Short Ratio: | 7.6 to 1 | 0.2 to 1 | 3.8 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 78.5 | 19.3 | 70.2 |

| – Strength Index Reading (3 Year Range): | Bullish | Bearish-Extreme | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 24.9 | -26.2 | 13.8 |

Bitcoin Futures:

The Bitcoin large speculator standing this week reached a net position of 1,011 contracts in the data reported through Tuesday. This was a weekly increase of 588 contracts from the previous week which had a total of 423 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish-Extreme with a score of 94.6 percent. The commercials are Bearish-Extreme with a score of 0.0 percent and the small traders (not shown in chart) are Bearish with a score of 23.2 percent.

| BITCOIN Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 77.1 | 1.2 | 10.2 |

| – Percent of Open Interest Shorts: | 69.3 | 12.5 | 6.8 |

| – Net Position: | 1,011 | -1,463 | 452 |

| – Gross Longs: | 10,055 | 163 | 1,334 |

| – Gross Shorts: | 9,044 | 1,626 | 882 |

| – Long to Short Ratio: | 1.1 to 1 | 0.1 to 1 | 1.5 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 94.6 | 0.0 | 23.2 |

| – Strength Index Reading (3 Year Range): | Bullish-Extreme | Bearish-Extreme | Bearish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 28.4 | -53.7 | -7.9 |

*COT Report: The COT data, released weekly to the public each Friday, is updated through the most recent Tuesday (data is 3 days old) and shows a quick view of how large speculators or non-commercials (for-profit traders) were positioned in the futures markets.

The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators) as well as their open interest (contracts open in the market at time of reporting). See CFTC criteria here.

More By This Author:

COT Speculator Extremes: Peso, 2-Year, 5-Year & SP500 Lead Weekly Bullish & Bearish Positions

Currency Speculators Push Mexican Peso Positions To 165-Week High As Peso Cruises

Bonds Speculators Drop Their 2-Year & 5-Year Bets To Record Lows

Disclosure: Foreign Currency trading and trading on margin carries a high level of risk and can result in loss of part or all of your investment.Due to the level of risk and market volatility, ...

more