China’s Loan Growth Beats Consensus But Results Are Unbalanced

Leading members of the People's Bank of China, including Governor, Yi Gang (waving)

Historic jump in loan growth

New yuan loans grew by CNY 4.9 trillion in January 2023, mostly from corporate loans. Loan growth is usually strong in the first quarter of the year. But this time, the jump was significant, at 23% year-on-year. This could suggest that the economic recovery in 2023 has the potential to exceed the pre-pandemic level.

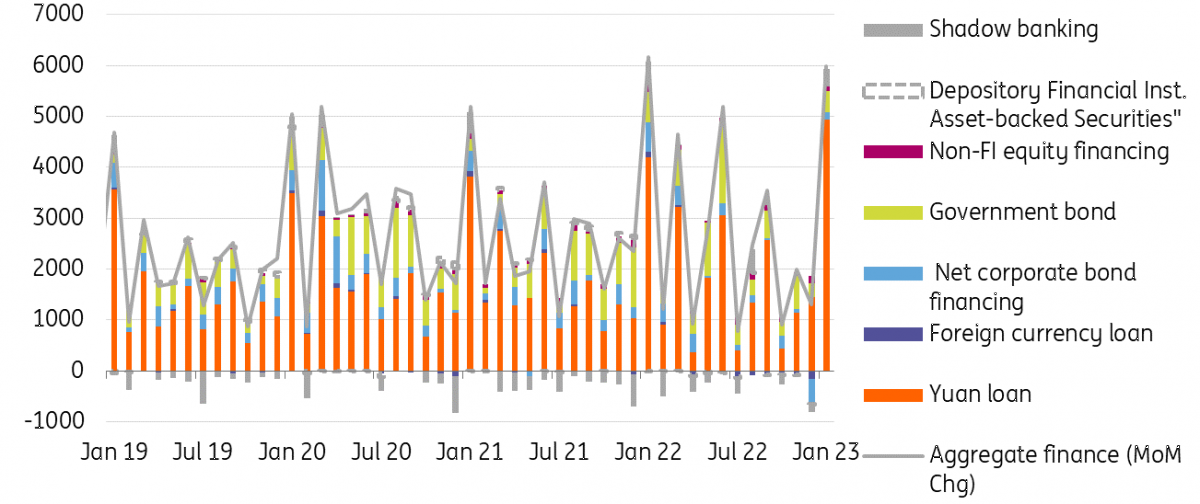

Not every sub-sector of credit creation was as strong in January on a yearly basis. Aggregate finance, which measures overall credit in China including the new yuan loans we mentioned, shadow banking, new bond issuance and IPOs, increased by CNY 5.98 trillion in January, less than the CNY 6.175 seen in the same month last year. The year-on-year fall came from smaller corporate bond and government bond issuance, trust loans and IPOs. This shows that bank loans were the main channel and perhaps provided a cheaper way of raising funds than in the credit market compared to last year.

Having said that, the chart shows us that on a monthly basis, there was slightly more credit growth in bond issuance and the stock market.

Monthly change in aggregate finance

(Click on image to enlarge)

Source: CEIC, ING

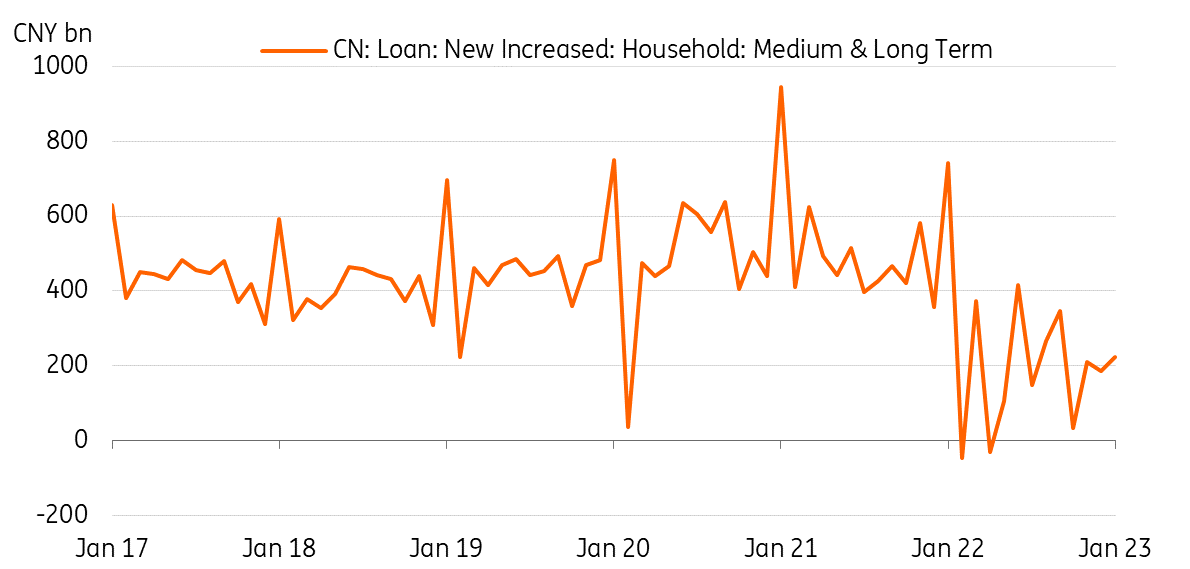

Loan data shows that residential mortgages need more time to recover

Medium- and long-term household loans are a proxy of residential mortgages in China. The chart shows us that the increase in loans was still small compared to the period before the slump in the residential market in early 2022. As the job market is still uncertain at the beginning of an economic recovery, potential buyers, even with the necessary down payments, may choose to wait until they feel their jobs are more secure.

Sluggish mortgages signal that the residential property market is taking time to recover

(Click on image to enlarge)

Source: CEIC, ING

We should continue to see strong loan growth in 1Q23

As the People's Bank of China continues to inject liquidity into the money market to stabilise interest rates, we believe loan demand remained strong in February. And in March, around the time of the "Two Sessions" government meetings, we should see more local government special bond issuance for infrastructure spending.

As such, credit growth should be very strong in the first quarter.

More By This Author:

Italian Industrial Production Rebounded In December, Beating Expectations

FX Daily: The Waiting Game Is On

Riksbank Hikes By 50bp Amid Concerns About Weak Krona

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more