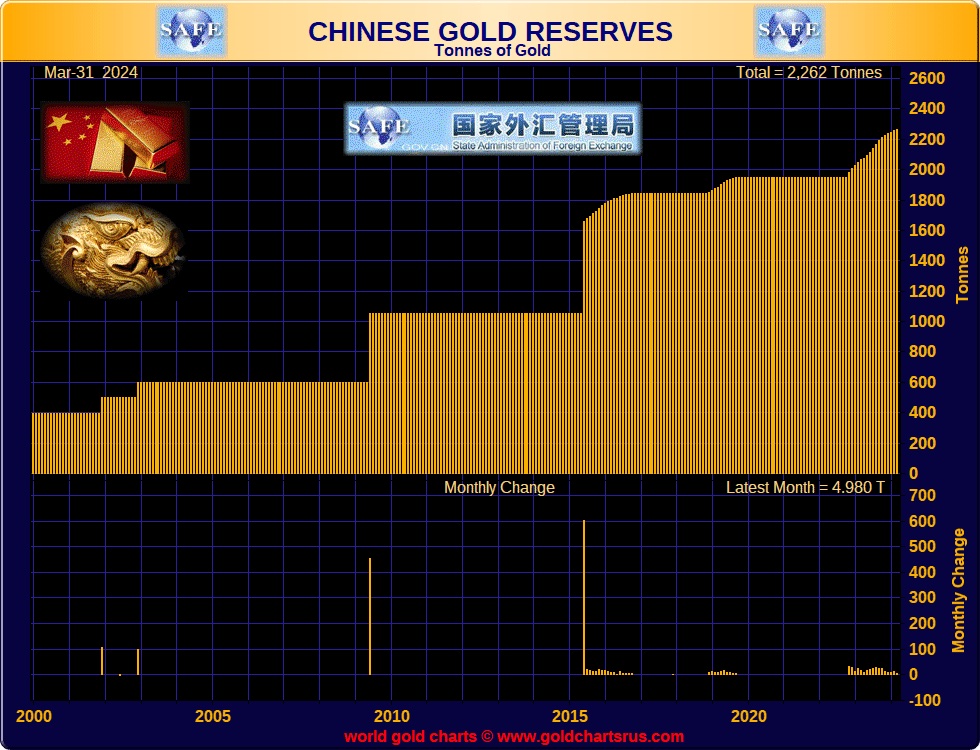

China's Central Bank Purchases Gold For 17th Consecutive Month

China’s central bank purchased gold for its reserves for a 17th straight month in March, extending a buying spree that has helped the price of the precious metal surge to a record.

Last month, the addition of around 5 tonnes boosted the People's Bank of China's (PBoC) gold reserves by 0.2% to 2,262 tonnes (72.74 million troy ounces), according to official data. However, this is the smallest increase since November 2022.

In the first three months of 2024, China accumulated a total of 27 tonnes of gold.

According to the World Gold Council, global central banks continued to increase their gold reserves in February, marking a ninth consecutive month of growth. However, February's figure shows a 58% drop on the previous month, partly explained by higher volume of sales.

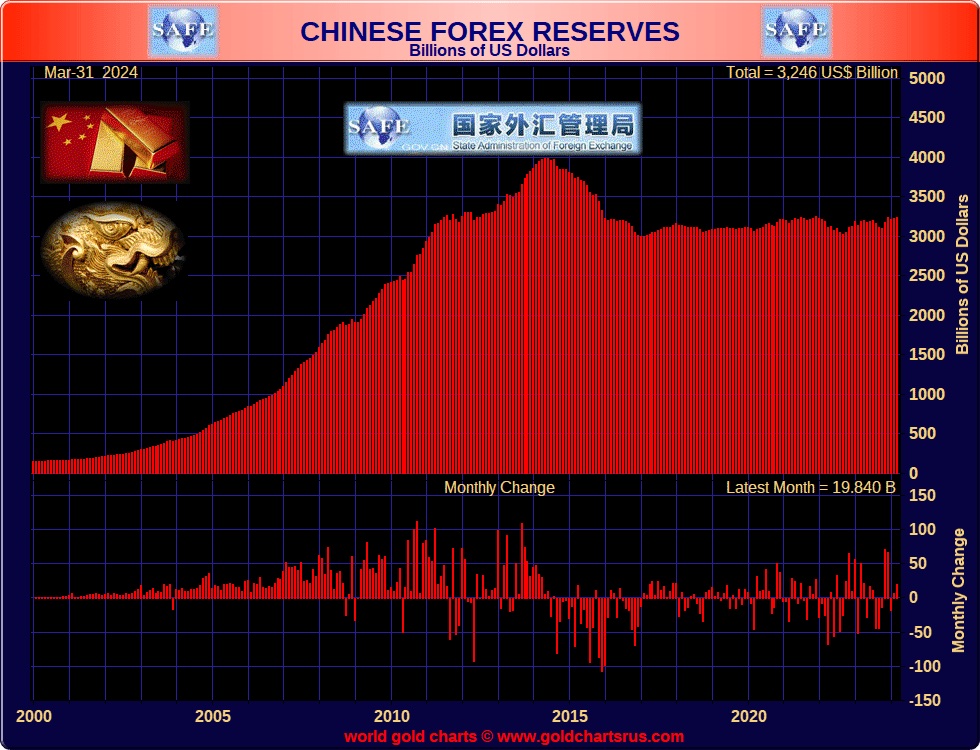

China’s official reserve assets in March rose to the highest since November 2015. The country’s foreign exchange reserves rose to $3.2457 trillion, the highest since December 2021, as the central bank aims to maintain stable holdings to fend off risks. This represents an increase of 0.6% on February and 1.9% on the previous year.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

More By This Author:

U.S. Monetary And Fiscal Policy Driving Precious Metals Higher

Silver Makes A Big Move, As Gold Vs. U.S. Debt And Money Supply Breakout

Inflation Set To Remain Persistently High In Europe

Disclosure: GoldBroker.com, all rights reserved.