China Stocks: Why The Party Is Just Starting

Image: Bigstock

When I think of the Chinese market, I think of legendary investor George Soros’ quote:

“When I see a bubble forming, I rush in to buy, adding fuel to the fire."

Another one that comes to mind is Stan Druckenmiller's liquidity quote:

“Earnings don't move the overall market; it's the Federal Reserve Board... focus on the central banks, and focus on the movement of liquidity... most people in the market are looking for earnings and conventional measures. It's liquidity that moves markets.”

This chart of China’s money supply says it all.

Image Source: Zacks Investment Research

As billionaire and investing legend David Tepper explained in a recent interview, “When China wants to boost their stock market, the government will stop at nothing.” By the way, according to his last 13F disclosure, Tepper has more than 20% of his massive portfolio ($6.73 billion) allocated to Chinese equities.

David Tepper’s Massive China Bet

David Tepper’s latest 13F disclosure shows the following bets:

- Alibaba (BABA - Free Report): 15.54% allocation, added 18.43%

- PDD Holdings (PDD - Free Report): 8.04% allocation, added 1.04%

- JD.com (JD - Free Report): 5.61% allocation, added 43.37%

- iShares China Large-Cap ETF (FXI - Free Report): 3.13% allocation, added 13.75%

- KraneShares Trust (KWEB - Free Report): 2.07% allocation, added 21.53%

- Baidu (BIDU - Free Report): 1.99% allocation, added 7.22%

It’s worth paying attention to Tepper’s portfolio because not only does he have a massive one, he bets heavily, maintains the conviction to stick with those bets, and, most importantly, has the conviction to be proven correct.

In a recent interview, CNBC’s Becky Quick asked how David Tepper is hedging and why he is going over his typical investment limit into Chinese stocks. Tepper’s answer shined a light onto just how bullish and confident he is on Chinese equities, as he said he is “buying everything” (in reference to China). When asked about hedges he said, “I don’t care.”

China Share Buybacks Reach All-Time Highs

Share buybacks are one of the more bullish indicators for a stock. Apple (AAPL - Free Report), the biggest buyer of its own stock, has proved this over the years with its staggering share price appreciation. In 2024, Chinese companies bought back a record number of shares.

Fresh Breakouts Emerge in China

While stocks like Alibaba have already appreciated dramatically, fresh breakouts have started to emerge in stocks like JD.com. After a nasty correction that started in October, the stock began to emerge from a weekly bull flag.

Image Source: TradingView

As the Wall Street adage goes, “The longer the base, the higher in space.”

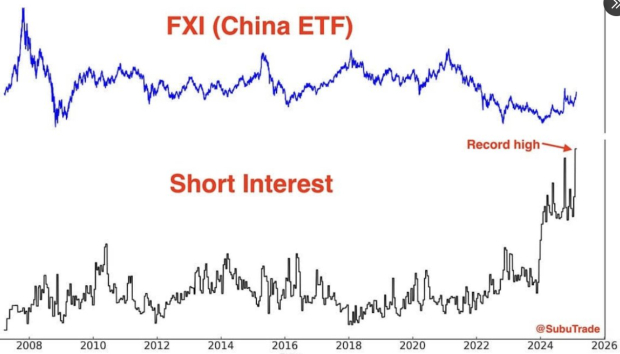

Record Short Interest Adds Fuel to the Fire

The best cocktail for a vertical move is the combination of a technical breakout coupled with heavy short interest. Short interest in China recently notched fresh all-time highs.

Image Source: @SubuTrade

Bottom Line

An expanding balance sheet, record share buybacks, and historically high short interest all suggest that the Chinese stock market is just getting started.

More By This Author:

Investing In The Future: 3 Disruptive AI Robotics Stocks

Bull Of The Day: Bill Holdings

5 Metrics To Watch As Stocks Make 2025 Debut

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more