Bull Of The Day: Bill Holdings

Bill Holdings Company Overview

Zacks Rank #1 (Strong Buy) stock Bill Holdings (BILL) is a cloud-based software firm that leverages AI to help customers automate and streamline back-office financial operations for small and medium-sized businesses (SMBs). The California-based company’s vast umbrella of products includes software-as-as-service solutions for accounts payable, accounts receivable, supply management, and client management.

BILL Bolsters Offering through M&A

Bill Holdings is growing organically and through acquisition. In 2022, Bill Acquired Finmark, “a leading financial planning software provider that simplifies financial planning and cash flow insights for SMBs.” Bill also made strategic acquisitions in Divvy (spend & expense software) and Invoice2go.

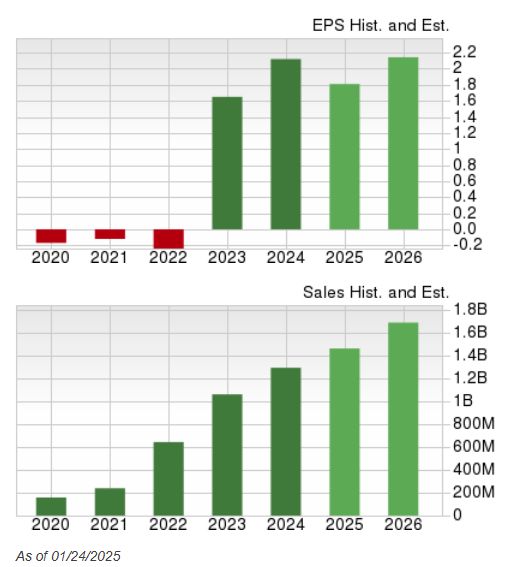

Robust Sales & Earnings Growth History

BILL’s niche market, a vast array of products, and aggressive acquisition strategy are working. The company has achieved double-digit top-and-bottom-line growth for five consecutive quarters.

Image Source: Zacks Investment Research

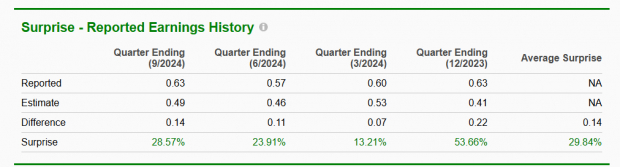

In addition, BILL tends to smash Wall Street EPS expectations. The company has delivered positive earnings surprises in past four quarters, with an average EPS surprise of 29.84% (versus Zacks Consensus Estimates).

Image Source: Zacks Investment Research

DeepSeek Rattles US Equity Markets, but is it Bullish for Software?

“DeepSeek,” an open-source Chinese AI model, is the buzzword currently among Wall Street circles. According to DeepSeek, its “DeepSeek-R1” model can outperform the most popular large language models (LLMs), such as Meta Platform’s (META) “Llama” and OpenAI and Microsoft’s (MSFT) ChatGPT. In addition, DeepSeek claims that its large language model was could be trained with a fraction of the expensive Nvidia (NVDA) GPUs used in other LLMs, sending shockwaves through Wall Street.

Though investors are still analyzing the fallout from DeepSeek and waiting for the smoke to clear, many wonder if AI will be commoditized. Software companies that leverage AI, like Bill Holdings, should benefit dramatically if this is the case. Currently, the software group ranks an impressive 47 out of the 250 industries tracked by Zacks (top 19%). Meanwhile, software stocks such as Twilio (TWLO) and Snowflake (SNOW) exhibited standout relative strength during Monday’s equity bloodbath – a bullish sign.

Bullish Chart Pattern

In addition to robust relative strength, BILL shares are breaking out of a bull flag pattern after finding support at the rising 50-day moving average.

Image Source: Zacks Investment Research

Bottom Line

Software is a rare bright spot in an otherwise weak tech sector. As a result, stocks like BILL Holdings may benefit as money flows out of chip stocks.

More By This Author:

5 Metrics To Watch As Stocks Make 2025 DebutExpectations For Stock Market 2025: Read The 'January Barometer'

Bull Of The Day: GameStop

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more