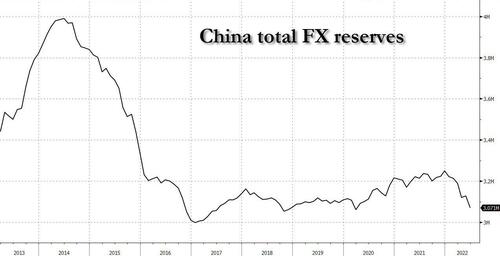

China FX Reserves Unexpectedly Plunge $56 BN To 2-Year Low, Hint At Significant Bitcoin Upside

Back in May, we warned readers to "Prepare For More Chinese Capital Controls As Exodus Worsens" and said that total capital outflows "may surge to about $300b this year from $129b in 2021, IIF said in a report last week. While that figure is well below $725b, IIF’s estimate for 2016, Beijing’s options for combating it are much narrower this time around."

Two months later, we are well on our way there, because as China revealed overnight, the country's foreign exchange reserves plunged far more than expected in June as the dollar climbed against other major currencies, fueled by aggressive U.S. interest rate hikes, and as the yuan tumbled.

The country’s foreign exchange reserves – the world’s largest – fell $56.5 billion to $3.071 trillion last month, compared with $3.111 trillion in consensus expectations.

After plunging by $56 billion in June, just shy of the massive $68 billion in April when the yuan cratered lower and sparked speculation of another yuan devaluation, and the second biggest drop since 2016...

... for the first half of 2022, China’s foreign exchange reserves fell $178.9 billion, data from the central bank showed, inching towards a closely watched threshold of $3 trillion. Reserves have not fallen below that level since early 2017.

The State Administration of Foreign Exchange (SAFE) said in a statement that the 1.8% drop in June reserves mainly reflected valuation effects, as the dollar rose and global asset prices fell sharply amid worries over inflation and the growth outlook. Which, of course, is what China is expected to say: the last thing Beijing would admit is that it has a capital flight problem on its hands as that goes to the biggest weakness in China's closed financial system: the fact that the financial firewall is actually quite porous. And the last time China saw such aggressive capital flight preceded a historic crunch in China's economy, one which Beijing can't afford to repeat in its much-weakened state today.

“At present, global economic growth has slowed, inflation remains high, international financial market volatility has increased, and the external environment has become more complex and severe,” SAFE said, but added that China’s resilient economic fundamentals and long-term growth potential will help to keep the country’s foreign exchange reserves largely steady.

Ken Cheung, chief Asian FX strategist at Mizuho Bank, said whether forex reserves would fall below $3 trillion would depend on the dollar’s movements. “It really depends on whether the dollar could strengthen further,” Cheung said, estimating that valuation effects should account for $31.4 billion of the drop in June reserves. Even if accurate, that means that there was still roughly $30 billion in capital outflows, a massive number for an economy that prides itself on being "closed" in times of stress.

Meanwhile, using third-party IIF data, we already know that foreign investors continued to cut holdings in Chinese bonds in June but added positions in equities, bucking the trend in other emerging markets, as investors bet on a modest rebound in China's stock market.

As Reuters notes, China’s economy has started to show signs of recovery from a sharp COVID-induced slump in spring, but concerns over capital outflow risks are likely to linger as its supportive monetary policy continues to diverge from major central banks in the rest of the world, which are hiking interest rates to tackle inflation.

The yuan fell 0.4% against the dollar in June, while the dollar rose 2.9% in June against a basket of other major currencies.

Separately, China held 62.64 million fine troy ounces of gold at the end of June, unchanged from end-May, but this number is irrelevant as what Beijing is unofficially doing with gold is a closely guarded secret and the country only gives an official update once every decade or so. The value of China’s gold reserves fell to $113.82 billion at the end of June from $115.18 billion in end-May.

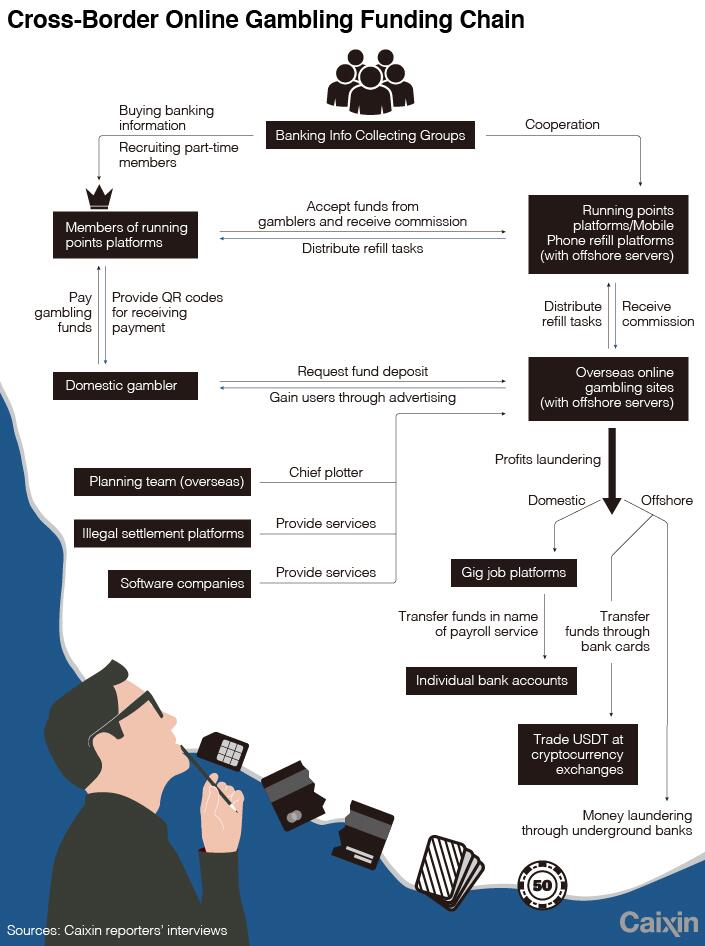

The biggest winner here may be crypto, because the last time we saw a big pick up in capital flight out of China in 2015 and 2015, we saw the first bitcoin supercycle which pushed it from the low triple digits to over $20,000 by December 2017. Will the current capital flight episode from China mark the bottom of the crypto winter and the start of the next cryptosupercycle? For the answer, keep a close eye on the price of tether...

(Click on image to enlarge)

... which as we have discussed previously, is the preferred crypto-linked pathway for illicit capital flight out of China, which eventually translates into (much) higher bitcoin prices.

More By This Author:

WTI Drops After Huge Surprise Crude Build, Crack Spread Soars On Product Draws

Initial & Continuing Jobless Claims Accelerate As Layoffs Soar

WTI Extends Losses After Unexpected Crude Build

Disclosure: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more

Propping up the ruble.