WTI Drops After Huge Surprise Crude Build, Crack Spread Soars On Product Draws

Oil prices are soaring this morning, with WTI rebounding dramatically back above $100 on the heels of demand stress (China reopening) and supply fears (Texas power outage rumors constricting production/refinery capacity and a possible blockage of Kazakhstan's exports).

WTI is back at $104 after dipping to $96.50 last night after API reported a surprise crude build and follows comments from Goldman that the sell-off was overdone...

"We view this move as driven by growing recession fears in the face of low trading liquidity, with technicals exacerbating the selloff," the bank's analysts, including Damien Courvalin, the head of energy research, wrote in a note on Wednesday.

"The declines in prices and refining margins since mid-June are now equivalent to the oil market pricing in an 1.1% downward revision to 2H22-2023 global GDP (gross domestic product) growth expectations."

So will the official data confirm the API build... and/or any signs of demand destruction?

API

- Crude +3.825mm (-1.1mm exp)

- Cushing +459k

- Gasoline -1.814mm

- Distillates -635k

DOE

- Crude +8.23mm (-1.1mm exp)

- Cushing +69k

- Gasoline -2.49mm

- Distillates -1.266mm

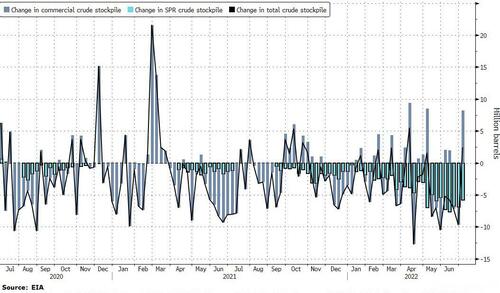

The official DOE data confirmed and exceeded API's surprise crude build data, but also showed draws on the product side...

Source: Bloomberg

Notably, there was another major SPR draw last week (-5.8mm) which likely offsets some of the anxiety over the huge crude build...

Source: Bloomberg

US Crude production remained flat at 12.1mm b/d - the highest since April 2020...

Source: Bloomberg

Refinery Capacity is still running near record-high levels, although it did drop modestly last week after a string of problems on the West Coast weighed on runs

Source: Bloomberg

WTI was hovering around $104 ahead of the official data and tumbled back to $103 on the big build...

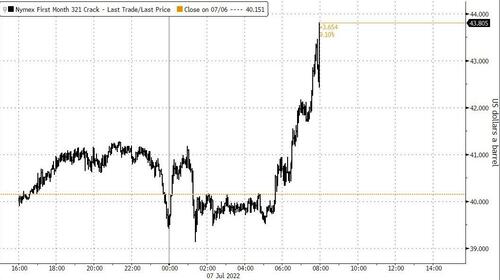

The crack spread is blowing out again (driven by the crude build and product draws)...

Circling back to the start, the Goldman analysts said the selloff had overshot as "demand destruction through high prices is the only solver left as still declining inventories approach critically low levels."

“While the odds of a recession are indeed rising, it’s premature for the oil market to be succumbing to such concerns,” Goldman Sachs & Co. analysts including Damien Courvalin said in a note.

“The global economy is still growing, with the rise in oil demand this year set to significantly outperform GDP growth.”

In China, there are signs of rising demand as the world’s biggest importer emerges from virus lockdowns. Overall consumption of gasoline and diesel last month was at almost 90% of June 2019 levels, according to people with knowledge of the energy industry.

The good news for Americans is that pump prices have fallen for 23 straight days (the longest losing streak since April 2020)...

But the bad news for President Biden is that's not helping his ratings.

More By This Author:

Initial & Continuing Jobless Claims Accelerate As Layoffs Soar

WTI Extends Losses After Unexpected Crude Build

FOMC Minutes Show "More Restrictive" Fed Worried About 'Entrenched' Inflation

Disclosure: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more