WTI Extends Losses After Unexpected Crude Build

Oil prices continued to slide on apparent recession fears today with Brent joining WTI below $100, with low liquidity exacerbating the moves.

"We view this move as driven by growing recession fears in the face of low trading liquidity, with technicals exacerbating the selloff," the bank's analysts, including Damien Courvalin, the head of energy research, wrote in a note on Wednesday.

"The declines in prices and refining margins since mid-June are now equivalent to the oil market pricing in an 1.1% downward revision to 2H22-2023 global GDP (gross domestic product) growth expectations."

Citi's Ed Morse said “Almost everybody has reduced their expectations of demand for the year."

Talk of demand destruction continues but the rubber meets the road when inventory and supply data hits.

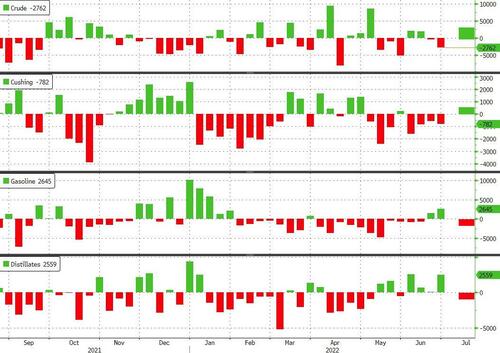

API

- Crude +3.825mm (-1.1mm exp)

- Cushing +459k

- Gasoline -1.814mm

- Distillates -635k

US Crude stockpiles unexpectedly rose last week, according to API...

Source: Bloomberg

WTI was hovering around $98.60 ahead of the API data and dipped modestly on the print

Circling back to the start, the Goldman analysts said the selloff had overshot as "demand destruction through high prices is the only solver left as still declining inventories approach critically low levels."

“While the odds of a recession are indeed rising, it’s premature for the oil market to be succumbing to such concerns,” Goldman Sachs & Co. analysts including Damien Courvalin said in a note.

“The global economy is still growing, with the rise in oil demand this year set to significantly outperform GDP growth.”

In China, there are signs of rising demand as the world’s biggest importer emerges from virus lockdowns. Overall consumption of gasoline and diesel last month was at almost 90% of June 2019 levels, according to people with knowledge of the energy industry.

More By This Author:

FOMC Minutes Show "More Restrictive" Fed Worried About 'Entrenched' Inflation

US, G7 Discuss "Capping" Russian Oil Price At $40-60, A Move Which Could Send Oil Soaring Up To $380

US Services Surveys Signal "Bout Of Stagflation" Ahead, Employment Contracts Most Since COVID Collapse

Disclosure: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more