Canadian Banks Are Stumbling In A Weakened Economy

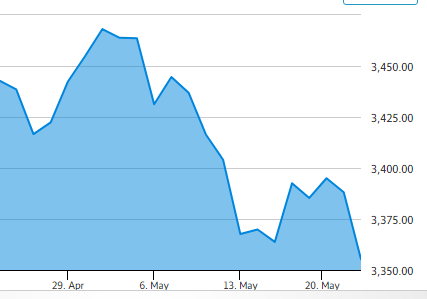

It is often thought that as the Canadian banks fare, so does the Canadian economy. This reference is very apt given the banking results for the first half of the year. An earlier blog brought attention to the decline in the expansion of bank credit and its implications for a slow down in the Canadian economy[1]. Now, that the Canadian banks are starting to report results for their second quarter and, more significantly, their anticipated outlook for the balance of the year, clearly the banks are no longer the darling of the investment community. About a month ago, the TSX/bank index started a steady decline as investors sensed that the banks were experiencing very uneven performances among their different banking activities.

(Click on image to enlarge)

First out of the starting gate was the CIBC and the bank clearly stumbled at the bell. The CIBC posted a 2.4 % earnings decline in its domestic consumer-banking division, its core business. As Canada’s largest mortgage originator, the fall in domestic mortgages and net interest income and a commensurate increase in loan losses provisions hit the bottom line. Mortgage loan growth has declined for two consequent quarters. Although the bank countered with earnings gains in the capital markets, wealth management, and its U.S. commercial banking, the overall results domestically were poor. Its stock sold off quickly and essentially wiped out the dividend income for the past 12 months.

CIBC officials claimed that they were essentially got off guard, saying that the retrenchment in domestic mortgages and personal lending was more severe than they forecasted. Furthermore, the bank gave a rather sobering outlook when it stated that earnings per share this year to be “relatively flat” given “market conditions”. It can be argued, however, that the CIBC made a strategic error in closing down its mortgage lending window sometime in 2018, fearing a major downturn in the Canadian housing market. That downturn has not taken place--- at worse housing prices in the Toronto area, for example, have dropped just 5-7% and evidence is now building that prices have rebounded this spring and the housing market remains in tight supply with ample demand.

Today, RBC Royal Bank, Canada’s largest bank, reported earnings that were better than its CIBC competitor, but not in line with RBC’s strong performance in the past. Annual profit growth was mere 2%, just in line with inflation, so real profits are stagnant. As in the case of the CIBC, RBC upped its loan loss provisions, anticipating further weakness going forward. Also, today, TD Canada Trust released earnings report which came in at 9% year over year. However, that stronger performance can be traced directly to its 29% profit growth in its American banking business. Whereas, in Canada growth was far more muted as profits in domestic banking inched up a mere 1%.

With just three more of the major banks yet to report we are unlikely to see much change in the pattern already established by the CIBC, RBC, and TD. That pattern is one of slow growth in the core business of mortgages and personal lending, buttressed by increased provisions for loan losses in anticipation of further weakness on the home front. As of the time of writing, the TSX/bank index continues to slide, as investors re-assess their commitment to investing in the banking sector.

How's that socialism working out for you?

Oh yeah, you've got "free" healthcare that takes six months to deliver what you can get in the US the next day.

Brilliant.

I currently live overseas and have experienced this first hand. We truly are spolied with our healthcare in the US. If I need to see a specialist, I can wait months for an appointment now :(