Canada And Recession

Notice that I don’t say in or out of recession. Nonetheless, with slow growth (and per capita growth negative), there’s plenty of discussion (e.g., here today). And Trump’s threats of tariffs — even if they don’t come through — could impart enough uncertainty to throw the country into recession.

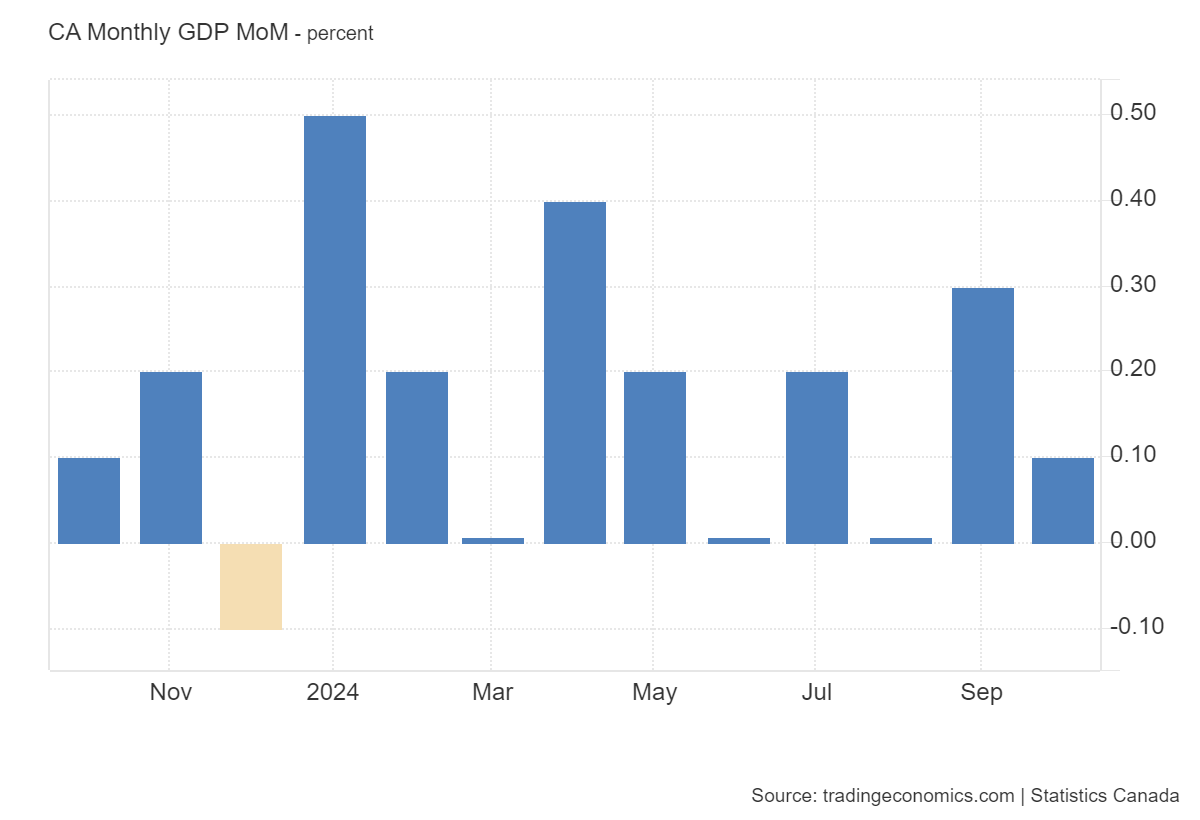

Q3 q/q growth was 1.5% (annualized). Here’s m/m GDP growth through October:

(Click on image to enlarge)

It’s still positive, but there have been months of near zero growth, and all these measures are subject to revision.

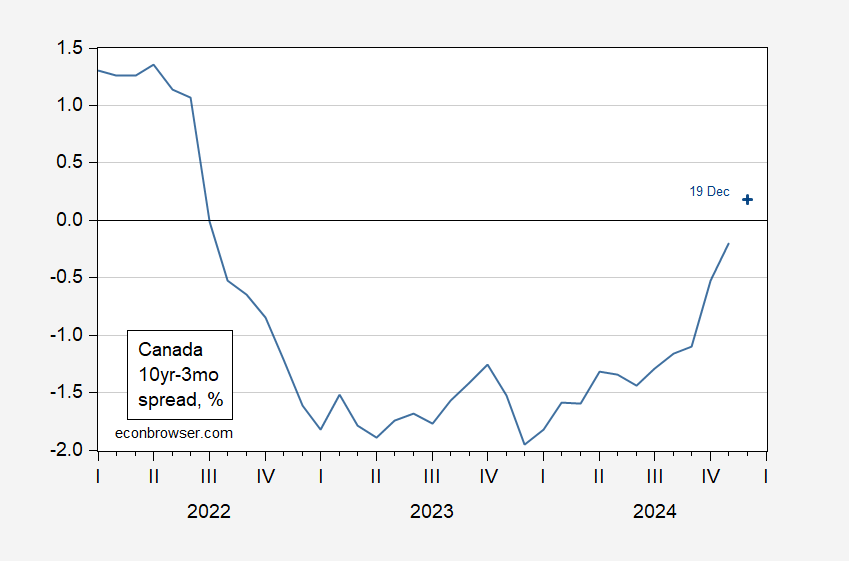

Why the concerns about recession? As noted in Chinn and Ferrara (2024), the term spread plus financial conditions index and foreign term spread has a pretty good track record of predicting recessions as identified by ECRI; over a sample starting in 1971, the term spread alone has a pseudo-R2 of 0.36. (The arbiter of recessions in Canada, the Business Cycle Council at the C.D Howe Institute has a slightly different identification of peak and trough for the last cycle, so our results would not necessarily translate.) The 10yr-3mo spread over the past two years looks like the following:

(Click on image to enlarge)

Figure 1: Canadian 10yr-3mo spread, % (blue). December value is 19 December. Source: OECD and Reuters.

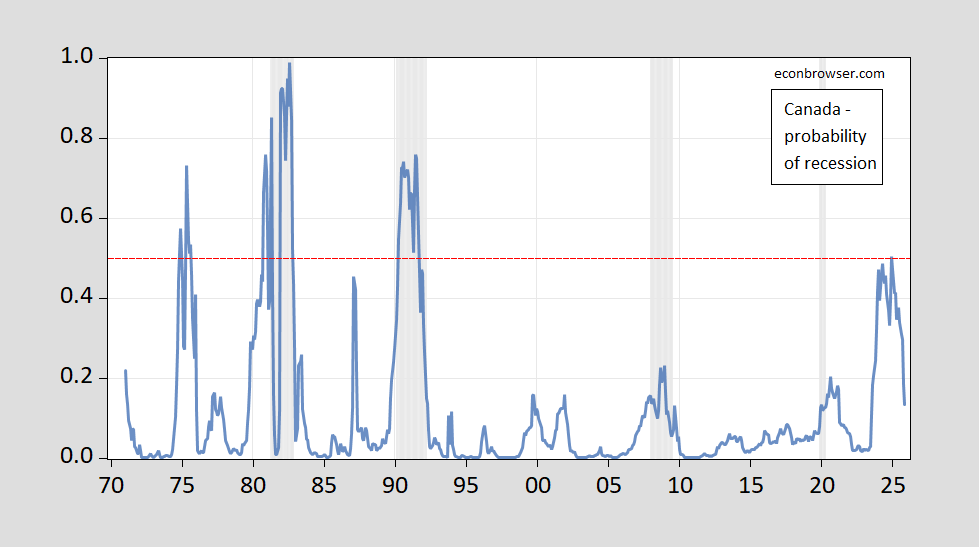

Using the ECRI dates, and assuming no recession had occurred by December 2022, I obtain the following estimates for the term spread (only) model, estimated for interest rates 1971M01 to 2021M12.

(Click on image to enlarge)

Figure 2: Probability of Canadian recession 12 months ahead using 10yr-3mo term spread. ECRI defined peak-to-trough recession dates shaded gray. Red dashed line at 50%. Source: ECRI, author’s calculations.

Based on the spread 12 months ago, the probability of being in a (ECRI-defined) recession in December is 50%.

If I were to do a conditional forecast, incorporating additional information about the likelihood of Trump tariffs on(will he or won’t he), my estimates of what happens in January 2025 onward would certainly deviate from a spread-alone indicator.

More By This Author:

Business Cycle Indicators As Of Mid-December

How Competitive Is China?

If You Thought Construction Costs Were High, Wait For Mass Deportation