Bank Of Canada Preview: At The Top With Only Downside To Come

Tiff Macklem, governor of the Bank of Canada

No change as Bank of Canada confirms we are at the peak

All 22 banks surveyed by Bloomberg expect the Bank of Canada (BoC) to leave policy interest rates unchanged next week. This shouldn’t come as a surprise given that at the January 25 BoC policy meeting, the governing council stated that it expects to “hold the policy rate at its current level while it assesses the impact of the cumulative interest rate increases” at upcoming meetings.

The data since then has shown inflation undershooting expectations despite remaining well above the 2% target and GDP growth stalling at 0%, significantly below the 1.6% annualised rate expected. However, the economy continues to create jobs in significant numbers with January’s 150,000 increase in employment meaning that there are now 806,000 more Canadians in work than before the pandemic struck in 2020.

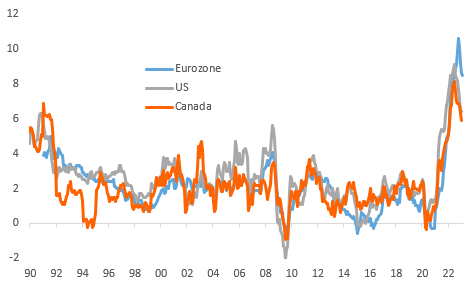

Inflation rates (YoY%)

Source: Macrobond, ING

Canada much more exposed to higher interest rates than the US

The weak growth and disinflation story should trump the jobs data especially given that monetary policy operates with long and varied lags and labour market data tends to be the most lagging of all the lagging indicators. The Bank of Canada has implemented 425bp of hikes over the course of just eight meetings, including a 100bp move in July, while Canada is much more exposed to interest rates rate hikes via a higher prevalence of variable rate borrowing and high debt levels versus the US. For example, in the US the 30Y fixed rate mortgage is the most common borrowing method while in Canada it is five years or less before they face a change in interest rate.

In fact, Canadian household liabilities are equivalent to more than 180% of disposable income versus 103% in the US. Canada is therefore more exposed to the risk of a housing market correction, especially when we consider that house prices in several cities are ten times greater than average household incomes, whereas in the US it is typically five to six times income.

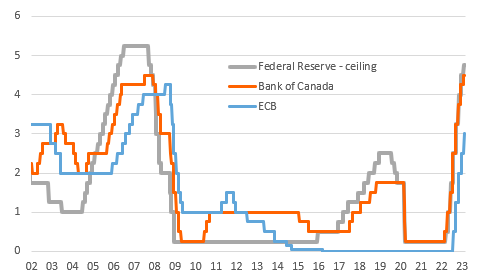

Central Bank policy rates (%)

Source: Macrobond, ING

Cuts could be on the agenda before year-end

Consequently, we are concerned that the Canadian economy is likely to be more impacted by the interest rate hikes already enacted than most other major economies. We look for the economy to continue to slow and in fact contract later this year, which will help to dampen price pressures. As a result, we see a strong chance that the BoC will end up reversing course and cutting interest rates later in the year.

FX: BoC pause means less upside and downside risks for CAD

From a market perspective, the fact that the BoC has paused (and mostly likely peaked) naturally has negative implications for the Canadian dollar: a wider USD-CAD rate differential reduces USD/CAD downside potential. However, there are some silver linings. Remember that Canada has a rather vulnerable property market, which is experiencing a deep correction as mortgage rates spiked. This is also the case in another country, Sweden, where the central bank is still hiking rates quite aggressively. The difference is that the BoC dovish pivot should now prevent the build-up of that housing-related risk premium in the currency market that the Riksbank tightening is instead risking to cause. In other words, the BoC pause means both fewer upside and downside risks for the loonie.

At the March meeting, markets will monitor whether the BoC will continue to leave the door open for more tightening if necessary. There are very few reasons for Governor Tiff Macklem to close that door at this stage, and the 25bp of additional tightening (a spill-over from the Fed's pricing) currently embedded in the CAD OIS curve are not something the BoC should be uncomfortable with. A largely unchanged message by the BoC in March may ultimately have limited implications for CAD.

We continue to expect a move below 1.3000 in USD/CAD by year-end, but that should mostly be the result of US dollar weakness and a generalised improvement in risk sentiment. CAD remains less attractive than the other dollar bloc currencies (AUD, NZD), which can benefit from more domestic tightening and exposure to the benign Chinese growth story.

More By This Author:

Asia Week Ahead: Reserve Bank Of Australia Meeting Plus Regional Inflation DataKey Events In EMEA For The Week Of March 6

Key Events In Developed Markets Next Week

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more