Key Events In EMEA For The Week Of March 6

Image Source: Pixabay

We expect the National Bank of Poland to keep rates unchanged next week and believe rate cuts are unlikely this year. For Hungary, we see core inflation continuing its slow-paced ascent, while the trade balance should finally switch back into surplus after being in deficit for 18 months.

Poland: NBP expected to keep rates unchanged

Poland's central bank is widely expected to keep interest rates unchanged next week. Although recent CPI readings have been lower than expected, the pace of disinflation is highly uncertain and price growth may turn out to be persistently high (especially core inflation) as seen in the recent data from core markets. At the same time, the NBP will present new forecasts which may show a lower path of inflation due to a more favorable starting point and lower energy price index. Still, in our view, the persistence of core inflation will leave no room for interest rate cuts this year.

Czech Republic: Headline inflation expected to slightly exceed central bank forecast

Czech headline inflation likely moderated slightly in February. Core inflation likely declined further but should still remain above 10% year-on-year. Weekly surveys suggest food prices remained more or less flat compared to January, while fuel prices started to pick up again. In our view, headline inflation in February slightly exceeded the central bank’s estimate at 16.5% YoY. Still, the Bank's board is unlikely to be swayed by such a move given its firm stance on holding rates steady.

Hungary: Headline inflation to show minor deceleration, while the core should continue to climb

Next week will also serve up some hard evidence on how the Hungarian economy has started this year. We expect some minor improvement in retail sales activity in year-on-year terms due to base effects in January 2023. On a monthly basis, we still see a retreat in the volume of turnover. The main cause behind this weakening remains negative real wage growth. If we believe in survey indicators (which we take with a pinch of salt), we should see yet another monthly-based increase in the volume of industrial production in January. This will translate into a significant improvement compared to a year ago due to the calendar effect. We see the budget balance posting a monthly deficit roughly in line with historic standards in February. The real fireworks of the week will arrive with the February inflation print, where we see the headline reading showing a minor deceleration, while core inflation should continue its (now slow-paced) climb. The reason for the opposite direction of travel is that energy and fuel prices, which are not part of the core basket, will drag down the headline figure. At the end of the week, we foresee yet more good news: with dropping energy prices, lowering energy demand, and improving export activity, we see the monthly trade balance switching back into surplus after being in deficit for 18 months.

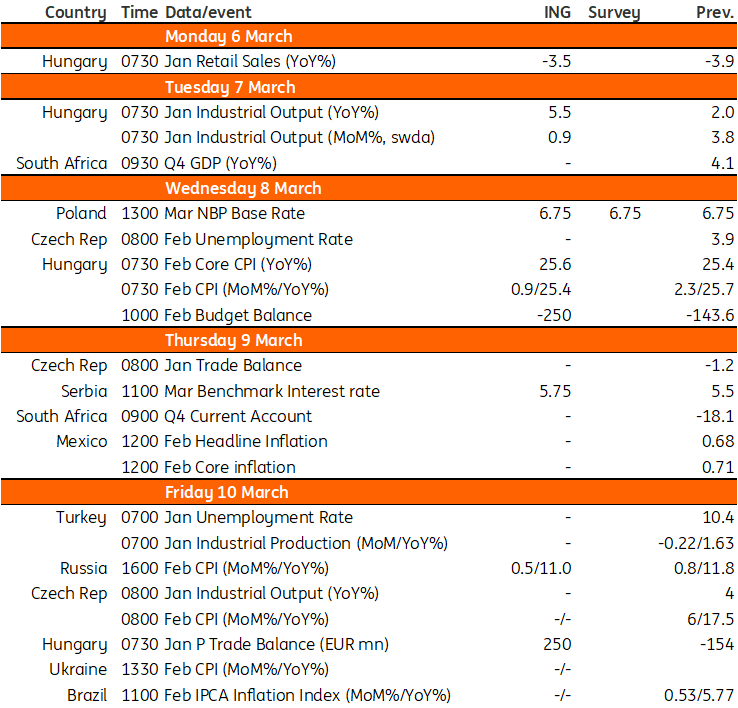

Key events in EMEA next week

Image Source: Refinitiv, ING

More By This Author:

Italian GDP Contraction Driven By Consumption And Inventories

FX Daily: The ISM Litmus Test

Rates Spark: Inflation Breakevens Continue To Add Pressure

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more