Key Events In Developed Markets Next Week - Friday, March 3

With inflation data undershooting expectations, and GDP growth stalling, we have much more confidence that the Bank of Canada will leave rates unchanged next week. For the UK, the economy is likely to register an overall first-quarter GDP decline, and we expect a technical recession in the first half of this year.

Source: Shutterstock

US: Job growth set to moderate after debatable January employment surge

Financial markets are fully buying into the Federal Reserve’s higher-for-longer narrative on interest rates with the US 2Y Treasury yield fast approaching 5% and the 10Y breaking above 4%. Strong activity at the start of the year and a surprise jump in core inflation now means that 25bp rate hikes at the March, May and June FOMC meetings are the minimum expectations from the Federal Reserve. In fact, markets are pricing a 25% chance that the Fed moves by 50bp at the March FOMC meeting. There are two events to watch next week that will have an important bearing on the near-term outlook for monetary policy.

Firstly, Federal Reserve Chair Jerome Powell will be appearing before Congress to present the central bank’s Semi-Annual Monetary Policy Report. His testimony will be closely followed for hints as to whether he thinks there should be a re-acceleration in the Fed’s policy tightening or whether having hiked rates so far and so fast that the more modest 25bp incremental moves remain the most sensible course of action to take. He will be appearing before the Senate on Tuesday and the House of Representatives on Wednesday.

After that, all eyes will be on the February jobs report after the blowout 517,000 jump in January payrolls caught everyone by surprise. It was 200,000 higher than even the most optimistic forecasts out there and didn’t tally with any of the business surveys such as the ISMs, the ADP jobs report or numbers from the National Federation of Independent Businesses. On a non-seasonally adjusted basis, payrolls actually fell 2.5mn, which wasn’t far away from the 2.6mn drop in 2021 and 2.8mn drop in 2022. It is therefore likely that labor hoarding in the form of reduced seasonal layoffs post the holiday season was responsible for the strength while 'generous' seasonal adjustment factors appear to have provided an additional boost to generate the seasonally adjusted 517,000 gain. Significantly, the fact that full-time employment has flat-lined since March 2022, meaning all the job creation has been in part-time positions, was largely overlooked.

We have pencilled in a 200,000 jobs gain for February but we have next to no confidence. Any random guess between -500k and +500k would be just as valid as our own guestimate. Business surveys of employment remain soft and job loss announcements are up 440% year-on-year and there is a high chance of revisions to January’s 517,000 jump. Given that pretty much anything could happen in this report, the likelihood of significant market volatility in the hours and potentially days around the jobs report is high.

Canada: Bank of Canada to keep rates on hold

We have much more confidence that the Bank of Canada will leave policy rates unchanged next week. At the 25 January BoC policy meeting, the governing council stated that it expects to “hold the policy rate at its current level while it assesses the impact of the cumulative interest rate increases” at upcoming meetings. The data since then has shown inflation undershooting expectations and GDP growth stalling, yet the economy continuing to create jobs. We will get an update on Canadian jobs at the end of the week and we wouldn’t be surprised to see a correction lower given the volatility in the series. Read our full preview here.

UK: GDP still set for first quarter decline, despite likely January rebound

UK economic output fell sharply in December, and probably only partially rebounded in January. Admittedly, these monthly GDP figures have been hard to read, owing to distortions surrounding both the Queen’s funeral last September and then the World Cup (which threw around consumer services activity). That December plunge, however, means that the economy is likely to register an overall first-quarter GDP decline (our current forecast is for a 0.2% fall). The underlying trend in the economy appears to be one of very gradual contraction, thanks in part to an ongoing downtrend in retail spending. We’re expecting a technical recession in the UK in the first half of this year, albeit one that’s not much to write home about. The fall in wholesale gas prices should help consumer bills fall by the summer, which should limit further damage to consumer spending.

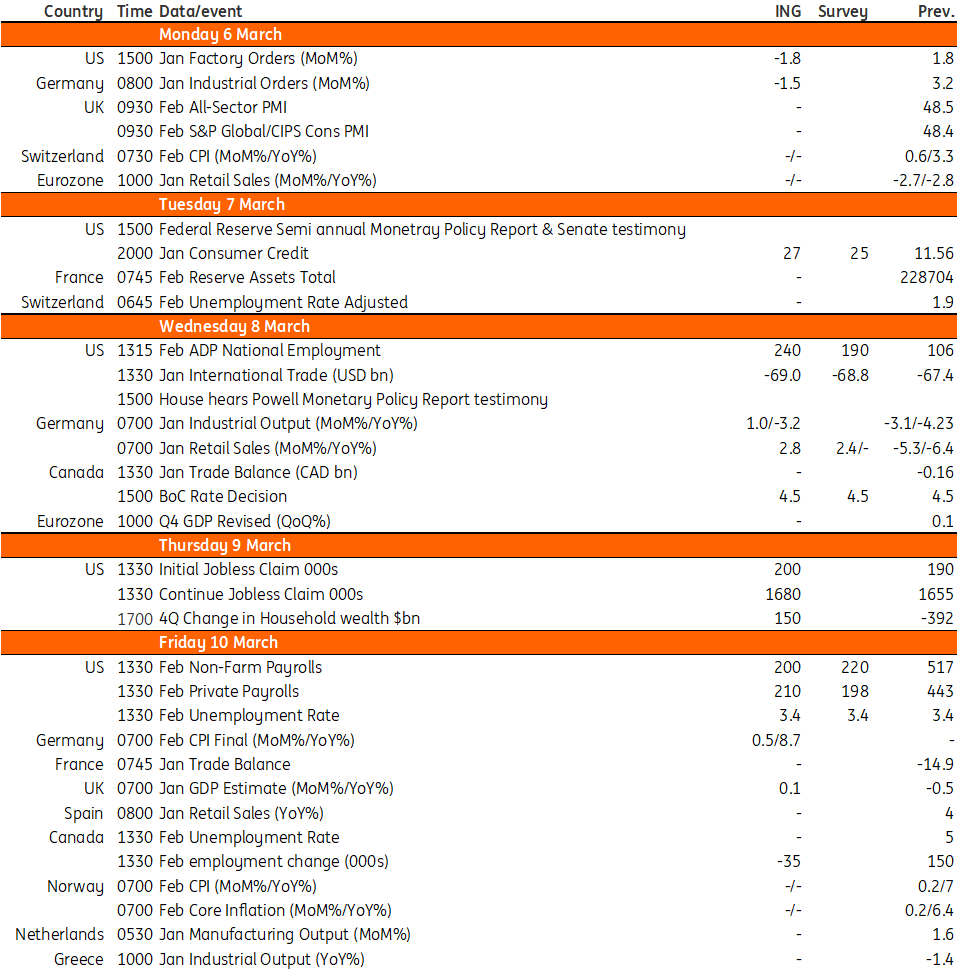

Key events in developed markets next week

(Click on image to enlarge)

Source: Refinitiv, ING

More By This Author:

Japan: Inflation May Have Peaked In January

Italian GDP Contraction Driven By Consumption And Inventories

FX Daily: The ISM Litmus Test

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more