Bank Of Canada Likely To Hike Again To Ensure Inflation Returns Sustainably To Target

Persistent inflation and resilient demand led the BoC to restart rate hikes in June after a five-month pause. The bar to justifying renewed policy tightening was always high and it seems unlikely that the BoC will revert to pausing again just yet. Some CAD strength could emerge, although primarily against other procyclical currencies.

Bank of Canada building in Ottawa

We expect another hike by the BoC next week

Having hiked interest rates to 4.5% in January the Bank of Canada had been on hold but, after a five-month hiatus, decided to tighten monetary policy further and raised rates by 25bp in early June. Policymakers argued that demand had proven to be more resilient than expected and inflation more persistent, and left the door ajar to further policy tightening at subsequent meetings.

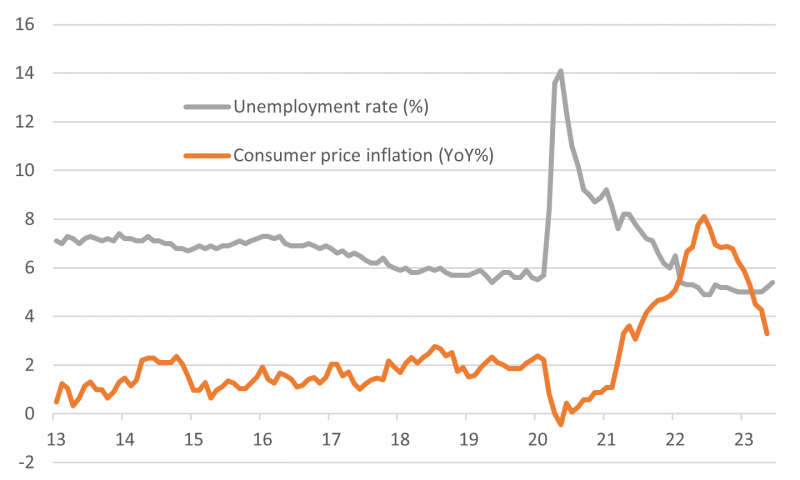

Last month, the BoC suggested that it would continue to evaluate inflation, wage and demand dynamics to determine its next steps. Since that meeting, the data has been mixed. Inflation slowed to 3.4% year-on-year from 4.4%, which was in line with expectations, but the core rate undershot, coming in at 3.9% versus 4.3% previously. GDP was flat in April, but the flash estimate for May was better at +0.4% month-on-month. Then, the labour market data showed the economy adding 60,000 jobs in June, three times the 20,000 consensus expectation, but unemployment rose to 5.4% having been stable at 5% in the first four months of the year. Wage growth slowed to 3.9% from 5.1%, which is a very encouraging outcome.

Unemployment and inflation in Canada

ING, Refinitiv

Given this backdrop, it isn’t surprising to see a split view on whether the BoC will hike again on 12 July. Eight out of 21 banks surveyed by Bloomberg expect interest rates to remain at 4.75%, with 13 expecting a 25bp hike to 5%. We are among the latter grouping. To restart hiking after a five-month break suggests the BoC feels it hasn’t done enough to be certain that inflation will return sustainably to the 2% target. To us, this means the odds certainly favour at least one additional move and we see little reason for them to wait – hence our call for a 25bp hike on 12 July. Nonetheless, the encouraging inflation and wage story should bring into doubt the need for aggressive additional hikes thereafter.

CAD can bounce back against other pro-cyclicals

The loonie has followed the US dollar’s soft momentum over the past week and lost ground against most G10 peers. Since markets aren’t fully pricing in a July BoC hike (implied probability around 70% as of Friday), we could see a week of restrengthening for CAD, especially since the BoC may not have much interest in attaching a very dovish tone to a hike, and may well keep the door open for more tightening ahead.

USD/CAD has been hovering around 1.32/1.33 recently, and the growing correlation between CAD and USD means that it will be up to monetary policy divergence to drive a bigger move in any direction in the near term. USD’s recent softness looks hardly sustainable in an environment of higher US yields and hawkish Fed communication, so we do not see major downside potential for USD/CAD just yet. We favour, instead, some outperformance of the loonie against other high-beta commodity currencies (such as the Australian and New Zealand dollars) should our view for a BoC hike prove correct.

More By This Author:

US Jobs Show Signs Of Slowdown, But It Won’t Deter The Fed

Hungarian Inflation Falls On Food Deflation

FX Daily: Dollar Late To The Party

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more