Australian Dollar Edges Higher As Export Prices Rise In Q4

Image Source: Unsplash

- The Australian Dollar appreciates following the release of the Export Price Index on Thursday.

- Australian Bureau of Statistics showed export prices rose by 3.6% QoQ in Q4 2024, reversing a 4.3% decline in Q3.

- The Fed held its overnight borrowing rate steady in the 4.25%-4.50% range at its January meeting on Wednesday.

The Australian Dollar (AUD) breaks its three-day losing streak against the US Dollar (USD) after the release of the Export Price Index on Thursday. Data from the Australian Bureau of Statistics showed export prices rose by 3.6% quarter-over-quarter in Q4 2024, reversing a 4.3% decline in Q3 and marking the first increase since Q4 2023.

Australia’s Import Price Index rose by 0.2% QoQ in Q4 2024, rebounding from a 1.4% drop in Q3 and surpassing market expectations of a 1.5% decline. The increase was primarily driven by surging Gold prices, which hit an all-time high in October as investors sought safe-haven assets amid ongoing economic uncertainty.

The AUD/USD pair weakened as the US Dollar (USD) gained broadly. The US Federal Reserve (Fed) kept interest rates unchanged on Wednesday, as expected, but provided little indication of potential rate cuts this year, reinforcing USD strength.

Easing inflationary pressures toward the end of 2024 have fueled speculation that the Reserve Bank of Australia (RBA) could consider a rate cut in February. The RBA has maintained the Official Cash Rate (OCR) at 4.35% since November 2023, emphasizing that inflation must “sustainably” return to its 2%-3% target range before any policy easing.

Australian Dollar gains ground despite Fed’s cautious tone

- The US Dollar Index (DXY), which measures the US Dollar’s value against six major currencies, remains steady around 108.00 at the time of writing.

- US Federal Reserve held its overnight borrowing rate steady in the 4.25%-4.50% range at its January meeting on Wednesday, as widely expected. This decision followed three consecutive rate cuts since September 2024, totaling a full percentage point.

- The US Dollar strengthened after the Fed adopted a cautious tone. During the press conference, Fed Chair Jerome Powell emphasized that the central bank would need to see “real progress on inflation or some weakness in the labor market” before considering any further adjustments to monetary policy.

- Scott Bessent, the Treasury Secretary under Trump, stated that he aims to introduce new universal tariffs on US imports, starting at 2.5%. These tariffs could rise to as much as 20%, reflecting Trump’s aggressive stance on trade policies, consistent with his campaign rhetoric last year.

- Speaking with reporters aboard Air Force One early Tuesday, US President Donald Trump stated that he “wants tariffs ‘much bigger’ than 2.5%,” as Treasury Secretary Scott Bessent proposed. However, Trump has not yet decided on the specific tariff levels.

- Australia’s CPI rose by 0.2% quarter-on-quarter in the fourth quarter of 2024, matching the growth seen in the previous quarter but falling short of the market expectation of 0.3%. On an annual basis, CPI inflation eased to 2.4% in Q4 from 2.8% in Q3, also below the consensus forecast of 2.5%.

- Australia’s Monthly CPI for December 2024 increased by 2.5% year-over-year, in line with forecasts and up from November’s 2.3%. This marked the highest reading since August but remained within the Reserve Bank of Australia’s (RBA) target range of 2% to 3% for the fourth consecutive month. The RBA’s Trimmed Mean CPI rose by 3.2% YoY, the slowest pace in three years, slightly under the expected 3.3% but still above the central bank’s target range.

- Australian Treasurer Jim Chalmers stated on Wednesday that "the worst of the inflation challenge is well and truly behind us." Chalmers further emphasized that "the soft landing we have been planning and preparing for is looking more and more likely," according to Reuters.

- The AUD also faced challenges amid increased risk aversion due to tariff threats made by US President Donald Trump. President Trump announced plans on Monday evening to impose tariffs on imports of computer chips, pharmaceuticals, steel, aluminum, and copper. The goal is to shift production to the United States (US) and bolster domestic manufacturing.

Technical Analysis: Australian Dollar remains below 0.6250 and ascending channel

The AUD/USD pair trades near 0.6230 on Thursday, remaining slightly below the ascending channel on the daily chart, signaling a shift toward a bearish bias. Additionally, the 14-day Relative Strength Index (RSI) remains below the 50 level, reinforcing the bearish sentiment in the market.

A decisive break below the key support zone at the lower boundary of the ascending channel has further strengthened the bearish outlook. This could push the AUD/USD pair toward the 0.6131 level, its lowest since April 2020, recorded on January 13.

On the upside, immediate resistance lies at the nine-day Exponential Moving Average (EMA) at 0.6252, followed by the channel’s lower boundary at 0.6280. A rebound above this level and a return into the ascending channel could shift the bias back to bullish, with the pair potentially targeting the upper boundary near 0.6380.

AUD/USD: Daily Chart

Australian Dollar PRICE Today

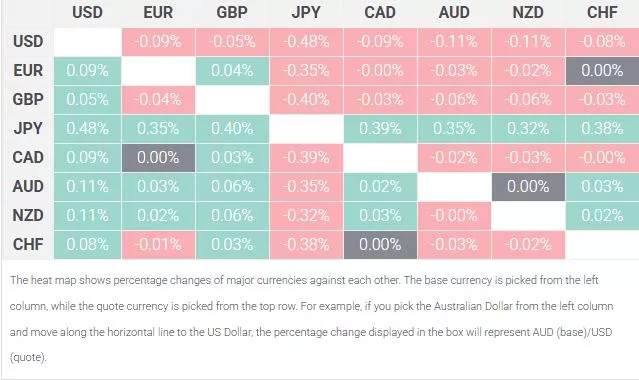

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the strongest against the US Dollar.

More By This Author:

GBP/JPY Remains Below 193.50 Due To Hawkish Mood Surrounding BoJ’s Policy OutlookUSD/CAD Price Forecast: Maintains Position Around 1.4400 Near A Crucial Support Zone

Australian Dollar Loses Ground Following CPI Data

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not ...

more