Asia Week Ahead: RBA Meeting And A Flurry Of Regional Growth And Inflation Reports

The Reserve Bank of Australia will likely hike rates next week, while third-quarter GDP reports could show economies slowing across the region.

Reserve Bank of Australia likely to hike rates

Inflation has been drifting higher over the last two months, and although this is partly due to less favorable base effects, the monthly run rates for August and September were close to 0.6% month-on-month. This is far higher than what is consistent with a return to the Reserve Bank of Australia’s target inflation range of 2-3%.

Given the RBA’s latest indication of a low tolerance for inflation remaining above target together with still tight labor markets, it looks like the new Governor, Michele Bullock, has few credible options except to tighten rates again at the upcoming meeting. A 25bp hike will take the cash rate to 4.35%.

China’s trade data and inflation number to show weakness in the economy

As hinted by the PMI released earlier this week, China’s exports are likely to remain on a declining trajectory. That should see the export growth rate coming in at about -3.7% year-on-year, with weak external demand being the main contributor. Imports are now contracting at a slower pace as household spending stabilizes slowly amid the fragile economic outlook.

Chinese inflation should come in slightly above the zero level on the assumption of a 0.1% MoM increase and rise to 0.2% YoY. Weak demand will keep inflation subdued. But we should see inflation creep slowly up to around 1% during 2024.

Taiwan’s export to strengthen amidst higher semiconductor demand

Korea’s trade data last week provides some clues to the Taiwan export outlook this week, and the global pickup in demand for high-end semiconductors will probably be a major factor lifting Taiwan’s chip-heavy export figures, with US demand remaining solid.

We are expecting Taiwan’s export growth to remain positive for a second consecutive month at 2.6% YoY. For imports, the YoY number – while increasing on a month-on-month basis due to base effects – is likely to edge lower to -15.5%.

Indonesian GDP release

Indonesia’s growth is likely to accelerate in the third quarter this year, and third-quarter GDP will likely settle at 5.2% YoY. An increase in consumption is likely to be the source of growth as the country’s inflation slid back within Bank Indonesia's inflation target band.

Philippine GDP and inflation numbers

The Philippine Statistic Authority will be releasing third-quarter GDP for the Philippines and October's inflation number next week. October inflation will likely slow to 5.4% YoY from 6.1% previously. Meanwhile, GDP growth could slow to 4.2% YoY from 4.3% in the second quarter. The Bangko Sentral ng Pilipinas (BSP) will likely take both data points into consideration ahead of their policy meeting on 16 November.

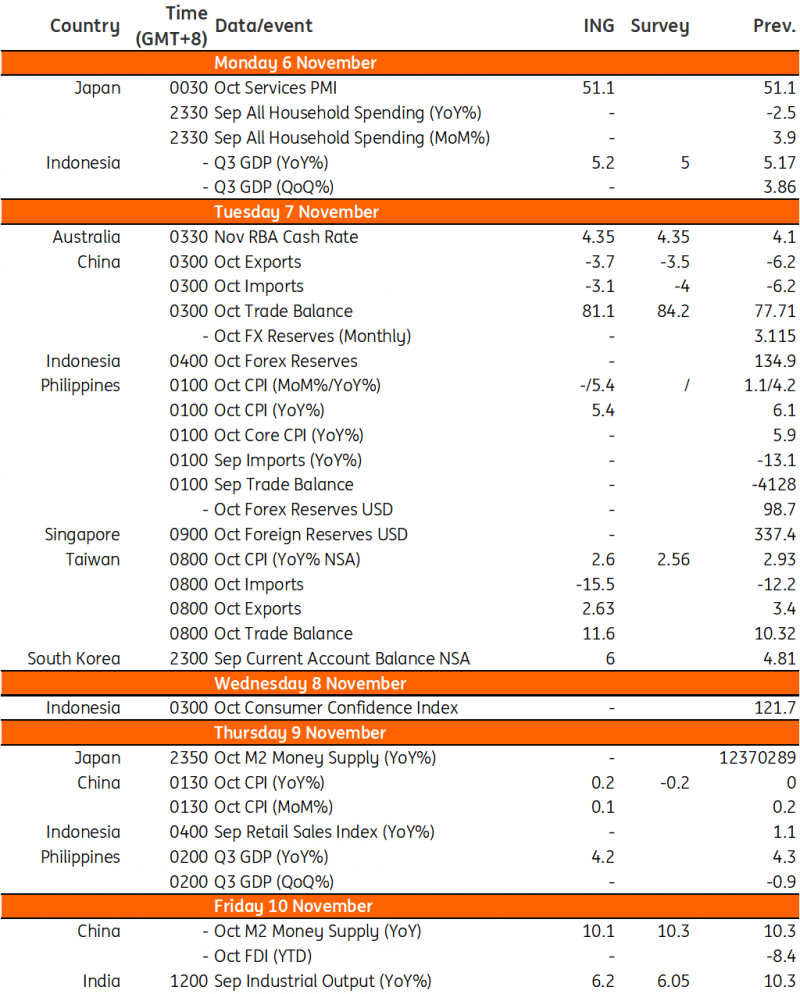

Key events in Asia next week

Refinitiv, ING

More By This Author:

Bank Of England Keeps Policy Steady But Pushes Back Against Rate Cut Expectations

The Commodities Feed: Positive Economic Sentiment Helps To Boost Prices

Rates Spark: Supply Relief, Weaker Data And The Fed Proceeding Carefully

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more