Asia Week Ahead: BoJ Meeting Plus Retail Sales From China

Image Source: Pixabay

The Bank of Japan meets next week but don’t expect any changes. China has a raft of data but we’ll be particularly focused on retail sales.

BoJ policy meeting but don’t expect any changes at this meeting

We have changed our view on the Bank of Japan’s policy in the near term based on Governor Kazuo Ueda’s recent dovish comments. We expect the BoJ to keep all its current policy settings unchanged at its policy meeting next week. Likewise, a potential tweak in BoJ’s yield curve control policy is not likely to happen this month. However, should inflation remain at current levels in the second half of the year, we could still see a possible adjustment in the YCC policy over the next few months.

Retail sales in China to be in focus

China will release the usual raft of data on economic activity for May. This will include industrial production, fixed asset investment, construction, and retail sales. Of these, most attention will probably be on the retail sales number, as consumer spending is what is keeping the economy afloat while production and construction both struggle amidst a tough global trade environment.

But the news on retail sales will probably not be very encouraging. We anticipate a 13.8% year-on-year increase in retail sales, which only looks this strong due to a very weak base comparison period, and is equivalent to around a 1% month-on-month decrease in sales adjusted for seasonality. Residential construction is likely to remain depressed, as is production.

Unemployment could edge higher in Australia

The Australian labor market data for May may show a further increase in the unemployment rate from 3.7% to 3.8%, though this remains very low by historical standards and won’t provide the Reserve Bank of Australia with too much comfort. Employment growth may register a small increase, with last month’s fall in full-time employment and rise in part-time employment likely to swap signs this month.

The Australian labor market may not be powering ahead as it recently did, but it hasn’t yet delivered a clear sign of weakening either, and we aren’t expecting the picture to change this month.

Inflation is comfortably within target in India

CPI data for May will show inflation remaining comfortably within the Reserve Bank of India's 2-6% target range. We are expecting inflation to come in at 4.3% YoY after a 0.5% MoM increase. Helpful base effects are keeping inflation within the target range for now, but we need to see the MoM trend move below 0.5% in the coming months to keep it there.

Indonesia’s trade balance to remain in a healthy surplus

Indonesia reports trade numbers next week. We expect both exports and imports to remain in contraction although the drop off may be less pronounced than the previous month. Imports are likely to dip roughly 12.2% YoY while exports may fall by 2.1% YoY, resulting in a sizable trade surplus of $4.7bn. A trade surplus of this magnitude should help keep the current account balance in surplus and could act as one counterbalance to investment-related outflows, which would help provide some support to the rupiah.

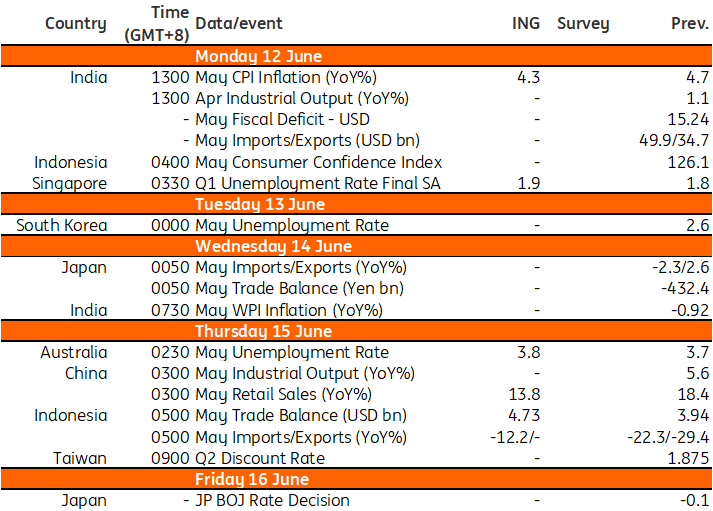

Key events in Asia next week

Image Source: Refinitiv, ING

More By This Author:

FX Daily: Late Cycle Dollar Strength Meets The Carry Trade

Bank Of Canada Surprises With A Hike And Hints At More To Come

Australia: GDP Slows Further

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more