And Then There Were Three: India Is Latest Central Bank To Pause Rate Hikes

First, it was the Bank of Canada which in January announced it would pause its rate hike campaign; then earlier this week the RBA became the second bank to join the bandwagon when it put its year-long hiking campaign on pause after leaving the cash rate unchanged at 3.6% at April's Board meeting, marking the first pause since the RBA starting raising rates in May 2022, and disappointing a majority of economists who expected at least a 25bps hike.

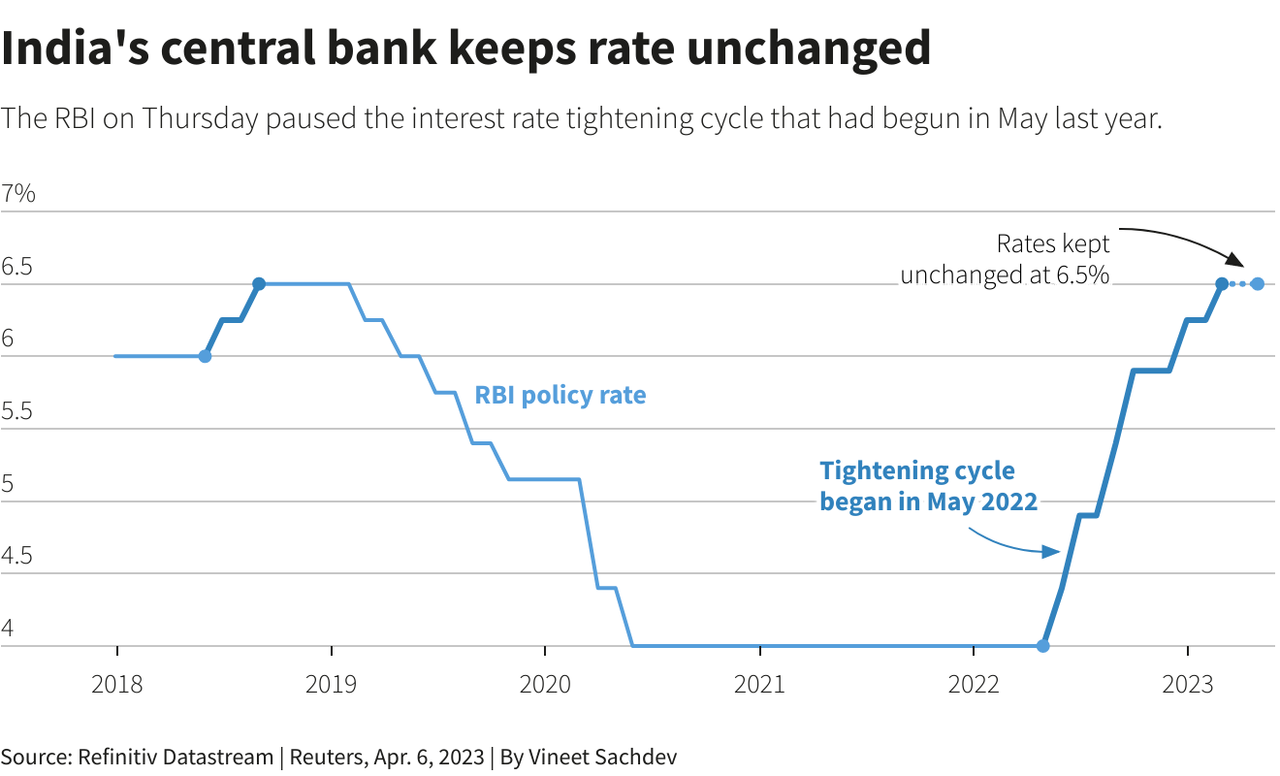

So fast forward to today, when the Reserve Bank of India became the third (but certainly not last) central bank to surprise markets by pausing its tightening campaign when it held its key repo rate steady on Thursday (consensus was for another 25bps) after six consecutive hikes, saying it was closely monitoring the impact of recent global financial turbulence on the economy and wants to see the impact of the 250 basis points of hikes it has delivered so far.

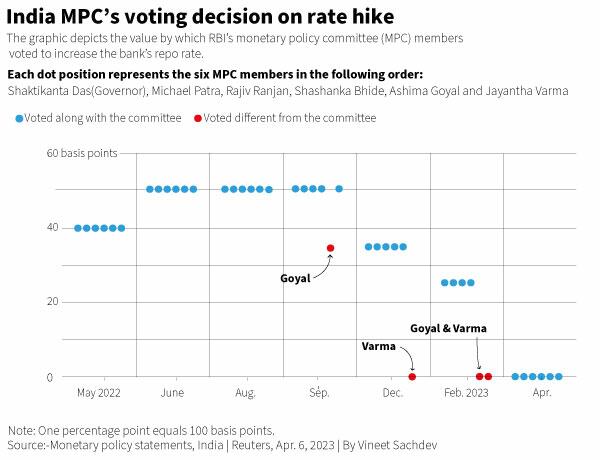

The monetary policy committee (MPC), comprising three members from the central bank and three external members, retained the key lending rate or the repo rate at 6.50%.

(Click on image to enlarge)

The decision to hold interest rates steady was unanimous in contrast to the last decision when four members had voted for a hike in rates. Five of the six committee voted in favour of continuing with the stance of "withdrawal of accommodation", while one member dissented.

The central bank said the policy stance remains focused on "withdrawal of accommodation" with central bank governor Das emphasizing today’s decision was “a pause, not a pivot” and signalling it could consider further rate hikes if necessary, but economists now expect the central bank to remain on hold.

"We have to be extremely prudent in our actions," Das said in his statement.

"With unyielding core inflation, we remain firm and resolute in our pursuit of price stability which is the best guarantee for sustainable growth," said the committee in its statement. "The impact of our actions over the past 12 months is still playing out and would increasingly weigh on the future inflation trajectory."

While the central bank has taken the decision to pause rate hikes in light of global macroeconomic and financial conditions, "our job is not yet finished and the war against inflation has to continue" Das said, reiterating the resolve to bring inflation back within the central bank's target band of 2%-6%, which is rather wide.

India's retail inflation rose 6.44% year-on-year in February, easing from 6.52% in January but has remained above the central bank's mandated target range for 10 out of the last 12 readings. The central bank sees inflation at 5.2% in 2023-24, and GDP growth is seen at 6.5% in the financial year beginning April 1.

Predictably, government bond yields fell sharply after the surprise RBI decision. The 10-year benchmark 7.26% 2032 bond yield dropped to 7.1469%, the lowest level since Sept. 15 immediately after the policy announcement, against 7.2857% before the decision. The yield was at 7.21% as of 1.20 p.m. IST. The rupee initially pared its gains on the rate pause, before recovering as Das stressed the RBI will continue to fight inflation

Financial stability concerns appear to have prompted the pause in rate hikes, said Aditi Nayar, chief economist at rating agency ICRA, adding that another hike was possible if inflation does not fall.

"Retaining the stance at removal-of-accommodation also signals a continued focus on steadily guiding inflation down towards the 4% target," said Saugata Bhattacharya, chief economist at Axis Bank.

"We expect the RBI to maintain an extended pause and evaluate the lagged impact of previous rate hikes and global uncertainties on growth-inflation dynamics," said Upasna Bhardwaj, chief economist at Kotak Mahindra Bank.

The hiking cycle could resume if the data warrants it, said Shilan Shah, deputy chief emerging markets economist at Capital Economics. "But given the subdued growth outlook and the likelihood that inflation falls back to within the RBI’s target range before long, our view is that the tightening cycle is at an end."

Barclays does not expect any further rate hikes in the cycle. "We think only a material upside surprise keeping CPI inflation above 6% for a long period would warrant another rate action by the MPC," said Rahul Bajoria, chief India economist at Barclays.

With an increasing number of central banks pushing the pause button, the question is which of the big three - the Federal Reserve, the Bank of England and the European Central Bank - will be the next to capitulate on tightening and pull an Arthur Burns, a pivot which will not only send risk assets higher but also unleash an inflationary shock wave around the globe that forces central banks to hike much higher during the next inflationary surge.

More By This Author:

Jobless Claims Explode Higher After BLS 'Revisions'; Tech Layoffs On '2001' Pace

Recession Signals Flash At California Warehouse Hub Facing Slowdown

Labor Market Finally Cracks: Job Openings, Hires Crash To Lowest Since May 2021, Miss Every Estimate

Disclosure: Copyright ©2009-2023 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more