Recession Signals Flash At California Warehouse Hub Facing Slowdown

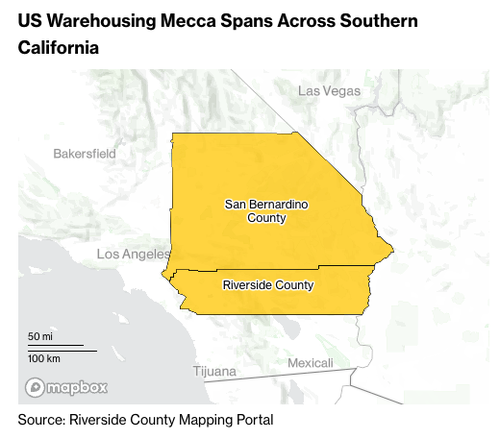

The Inland Empire in Southern California is home to 4,000 warehouses that occupy 1 billion square feet, with ownership of some of these warehouses by mega-corporations like Amazon, Walmart, and others. These massive warehouses receive imported goods from Asia via Los Angeles and Long Beach ports and store them before distributing them through a complex logistical network to fulfill the nation's growing obsession with ordering goods online.

Similar to using container rates and port activity to assess economic activity, observing warehouse activity throughout the 27,000-square-mile region of the Inland Empire spanning from east Los Angeles to the Nevada and Arizona borders is also indicative of economic trends.

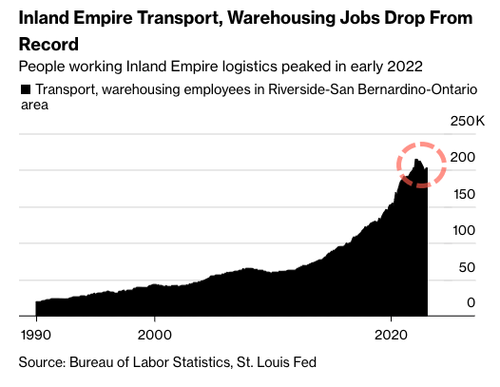

Bloomberg reports the massive influx of cargo that flowed from Los Angeles and Long Beach ports through the warehouses during Covid has plunged to a three-year low. Also, the number of jobs has peaked, which means either employers are laying off because of shipment declines or due to automation - perhaps it's both.

Transport and warehouse jobs in the Inland Empire peaked last April at around 215k. As of February, the total number of jobs is about 202k.

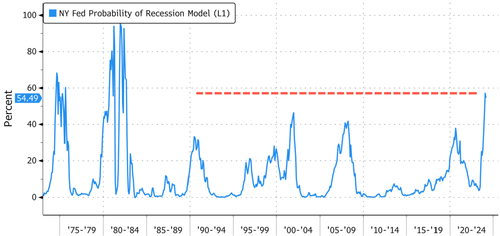

In what could be an ominous sign of the regional banking crisis, combined with an aggressive Federal Reserve raising interest rates to sky-high levels to cool down the hottest inflation prints in decades, numerous prominent folks in the financial industry are forecasting a recession.

Last week, 'Bond King' Jeff Gundlach warned of an imminent recession - within the next few months - as the yield curve suddenly steepens...

"The economic headwinds are building, we've been talking about this for a while, and I think the recession is here in a few months," Gundlach said Monday during an interview with CNBC.

"All we really need is the unemployment rate to go higher."

We shared a recent note with professional subs from Scott Feiler, Goldman Sachs' consumer retail trader, who "is quickly turning negative on the consumer sector."

The downturn in warehouse activity, declining port activity, and sliding container rates are alarming indicators of increasing recession threat, given that consumers make up a significant portion, around 70%, of GDP.

More By This Author:

Labor Market Finally Cracks: Job Openings, Hires Crash To Lowest Since May 2021, Miss Every EstimateUS Factory Orders Tumbled In February As ISM Signals Collapse To Come

These Were The Best And Worst Performing Assets In March And Q1

Disclosure: Copyright ©2009-2023 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more