Labor Market Finally Cracks: Job Openings, Hires Crash To Lowest Since May 2021, Miss Every Estimate

For months we have been warning that at a time when the US economy is careening into a hard landing recession, the manipulated, seasonally-adjusted, and politically goalseeked job openings data released as part of the DOL's JOLTS report is sheer rubbish (see "US Job Openings Far Lower Than Reported By Department Of Labor"; "Handle The JOLTS Data With Care", "Just Make it Up: Job Openings Unexpectedly Soar As Labor Department Now Guessing What The Number Is"). Today, the BLS finally got the memo.

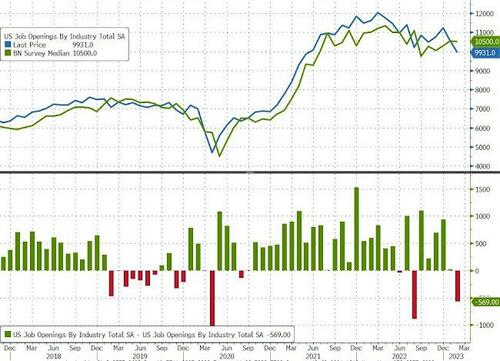

With consensus already expecting a sizable drop in February job openings from 10.824 million to 10.5 million, what the BLS reported instead was a doozy: in February there were just 9.931 million job openings, the first sub-10 million print since May 2021. Worse, had the BLS not drastically slashed the January number, the drop would have been almost 1 million job openings; instead the Jan job openings was cut to 10.563 million from 10.824 million originally reported. This means that the 2-month drop in job openings was 1.3 million, the second highest on record, surpassed just by the economic shutdown during the covid crash.

After five consecutive beats of expectations, and an unprecedented 27 beats in the past 29 months, February is when the BLS' "seasonally-adjusted" BS finally came crashing down, and not only was the February print below all sellside estimates, but it was the 3rd biggest miss of expectations on record!

According to the BLS, the largest decreases in job openings were in professional and business services (-278,000); health care and social assistance (-150,000); and transportation, warehousing, and utilities (-145,000). The number of job openings increased in construction (+129,000) and in arts, entertainment, and recreation (+38,000).

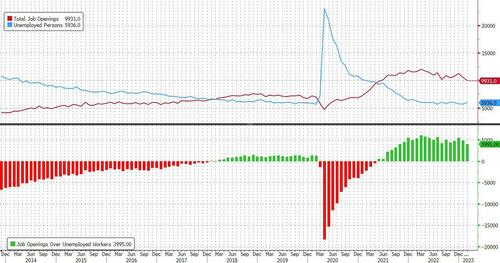

The long overdue plunge in job openings means that there are now just 3.995 million more jobs than unemployed workers, down sharply from last month's 5.13 million preadjustment, which has now been adjusted to 4.869 million.

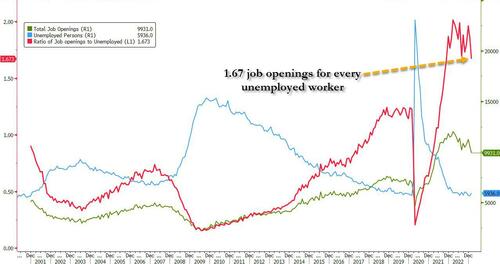

Said otherwise, there were just 1.67 job openings for every unemployed worker, down from 1.86 last month. Needless to say, this number still has a ways to drop to revert to its precovid levels around around 1.20, but the trend is now clearly lower.

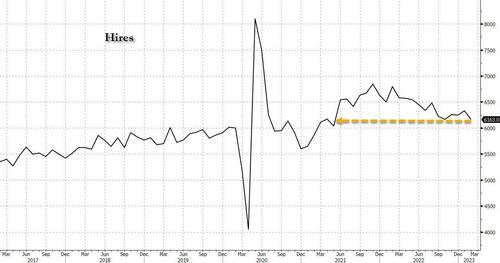

It wasn't just job openings that tumbled: there was more bad news in the number of hires, which also plunged, dropping by 164K in February to 6.163 million, the lowest since May 2021. The hires number tumbled even though Biden did everything in his power to keep it high: the only place hires increased notably was in federal government (+8,000).

In an interesting tangent, the BLS reported that in February, small establishments (those with 1 to 9 employees) saw little change in their job openings rate, hires rate, and total separations rate; but the layoffs and discharges rate decreased. Establishments with more than 5,000 employees saw little change in their hires rate and total separations rate while the job openings rate decreased.

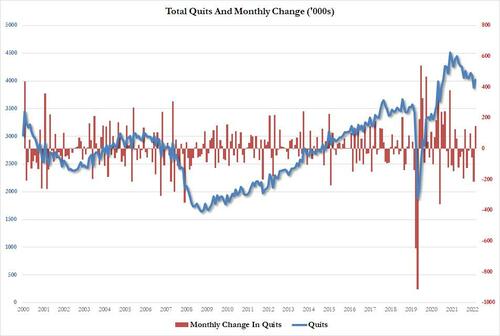

There was a modest silver lining in the number of quits, or the "take this job and shove it" indicator as it reflects confidence in finding a better paying job elsewhere, which after dropping for 2 straight months, rose by 146K to 4.024 million from 3.878 million.

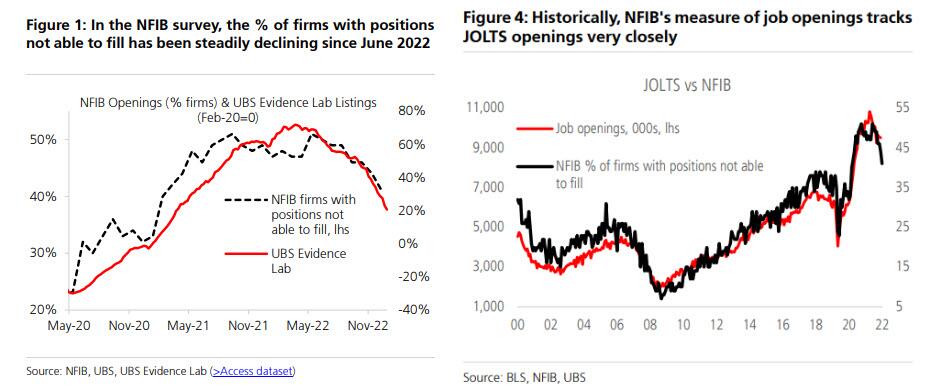

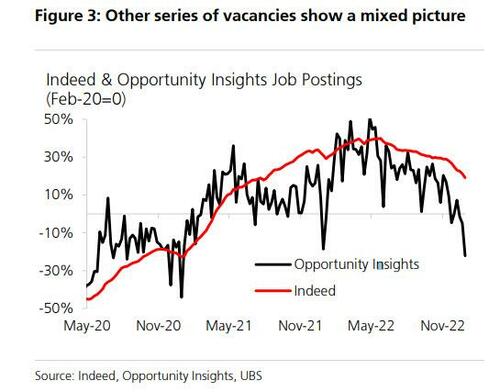

So what to make of this ugly data which as not only UBS, but also the NFIB...

(Click on image to enlarge)

... Opportunity Insights...

... and even Goldman (see "Goldman Expects Nearly 1 Million Drop In Tomorrow's Job Openings")...

(Click on image to enlarge)

... have been warning is long overdue?

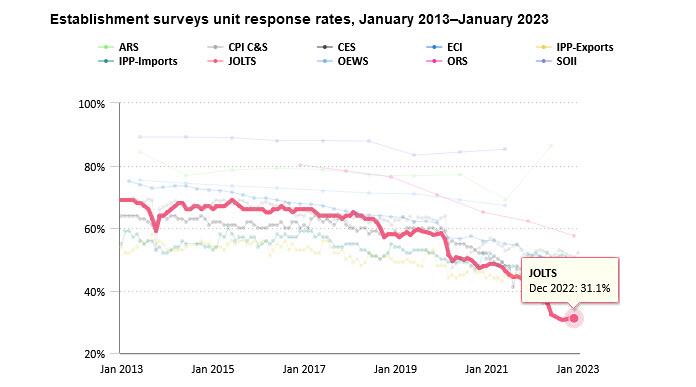

The answer is simple: while the drop was substantial, the real number of job openings remains still far lower since half of it - or some 70% to be specific - is guesswork. As the BLS itself admits, while the response rate to most of its various labor (and other) surveys has collapsed in recent years, nothing is as bad as the JOLTS report where the actual response rate has tumbled to a record low 31%

In other words, more than two thirds, or 70% of the final number of job openings, is estimated!

And at a time when it is critical for Biden to still maintain the illusion that at least the labor market remains strong when everything else in Biden's economy is crashing and burning, we'll let readers decide if the admin's Labor Department is plugging the estimate gap with numbers that are stronger or weaker.

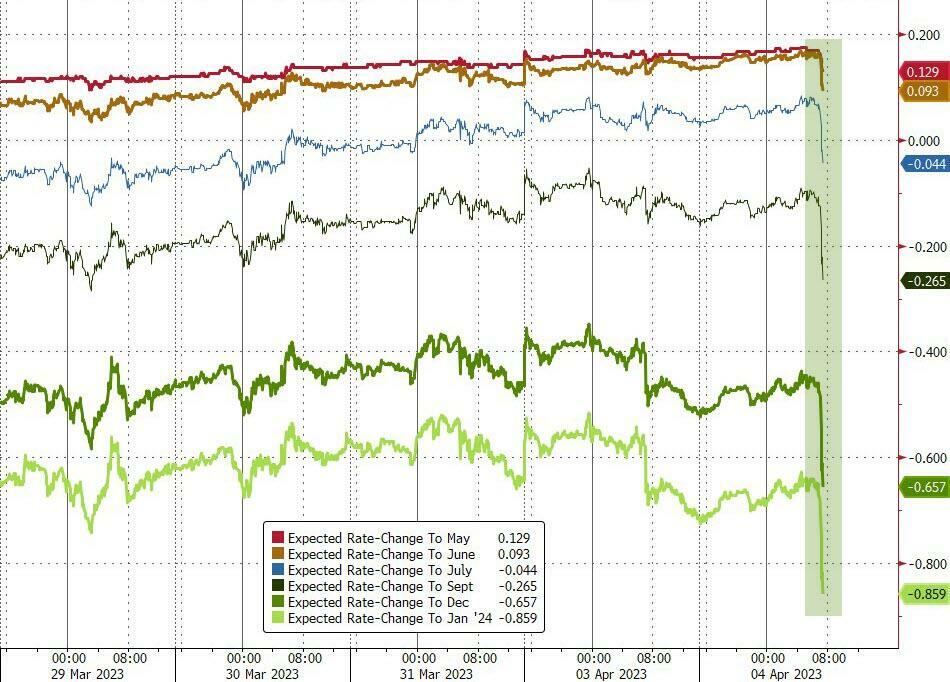

As for the Fed, now that the labor market has officially cracked - because a sub 10mm print means that the rate hikes are finally taking their toll on the economy - no surprise that odds of a May rate hike tumbled back below 50% after the huge JOLTS miss.

(Click on image to enlarge)

Indeed, with Canada and Australia now pausing, we woulnd't be surprised if Powell decides to be the next in line.

More By This Author:

US Factory Orders Tumbled In February As ISM Signals Collapse To ComeThese Were The Best And Worst Performing Assets In March And Q1

Crypto Jumps After Musk Changes Twitter Icon To Dogecoin

Disclosure: Copyright ©2009-2023 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more