2 Blue Chip Canadian Stocks Hit Overbought Territory

One of the most reliable technical indicators is the 14-day relative strength index (RSI). It also happens to be one of the easiest to use and understand. The 14-day RSI is a momentum indicator that lets investors know when a stock is in overbought or oversold territory.

Typically, when a stock enters overbought territory (RSI above 70) there is a risk that it is due for a short term pull back. The opposite is also true. When a stock enters oversold territory (RSI below 30) it may be due for a short term rebound.

While these are never guarantees and there could be fundamental reasons why a stock doesn’t react in such a way, they are usually outliers and due to a specific event.

Today, we are going to take a look a couple of Canadian stocks in overbought territory and see if there is a case for either of them to maintain their positive momentum.

Constellation Software (TSX:CSU)

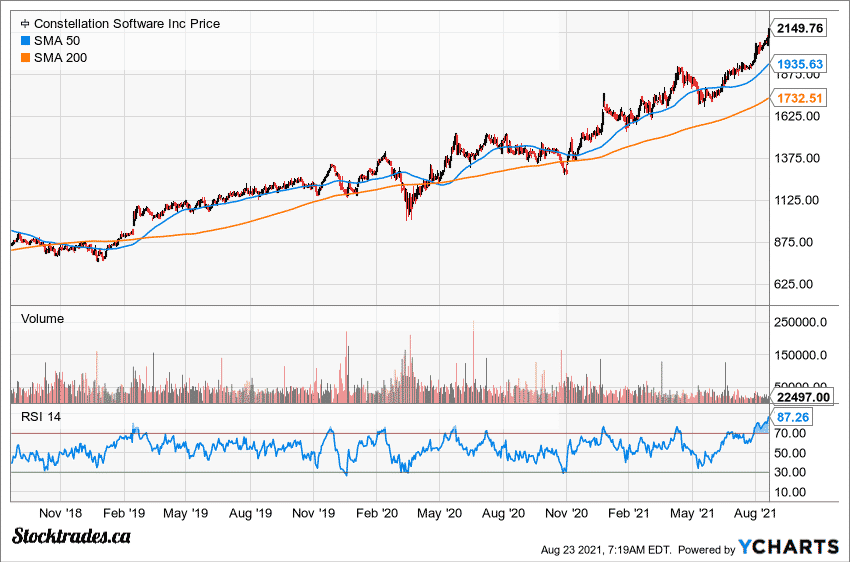

Let’s start with one of the most overbought stocks on the Index, Constellation Software (TSE:CSU)(OTC:CNSWF). Arguably one of the best tech stocks on the Index, Constellation has had a stellar year. The company is up 30% in 2021 and has been among the best performing stocks on the TSX Index over the past decade.

As of writing, Constellation has a 14-day RSI of 87.26 and has been in overbought territory for a few weeks. This is the highest RSI level and the longest its traded in overbought territory in the past five years.

That alone should be enough to exercise caution. Furthermore, Constellation is now trading at a 9% premium to historical valuations. While this isn’t exactly excessive, when you combine the premium valuation with current overbought status – that is a recipe for potential weakness.

All-in-all however, Constellation is one of those rare stocks that investors have been able to buy at any point and reap the rewards. That being said, a better opportunity may present itself in the near future.

BCE (TSX:BCE)

From experienced investors to those just learning how to buy stocks, one would likely be hard pressed to find someone that hasn't heard of BCE (TSE:BCE)(NYSE:BCE).

One of the most widely held stocks in the country, BCE is a cornerstone of many retirement portfolios. It has provided consistent returns and a growing dividend for the better part of the past couple of decades.

BCE has enjoyed a terrific year, up by ~23% in 2021 and is touching all-time highs. For a company the size of BCE, this level of growth is quite impressive.

The question is, can it last? Not likely. The company is now firmly in overbought territory with a 14-day RSI of 79.33. Over the past year, BCE has entered overbought territory three times and each time it resulted in a short-term pullback.

It is also worth noting that BCE is trading at a ~5% premium to historical valuations and at a premium to historical P/E, Forward P/E, P/B, P/S, P/Cash Flow, and EV/EBITDA ratios. It really doesn’t matter which metric you prefer; BCE is expensive compared to historical levels.

Canada’s leading telecom is also trading at a 3% premium to analysts one-year price target of $63.668 per share. Overall, BCE has had a great run but the momentum seems unstainable.

This isn’t a high growth stock posting double-digit growth. It offers mid, single-digit growth and a rock-solid dividend. That being said, BCE is viewed as a buy, set and forget type of stock. This leading blue-chip company is widely accepted as being comfortably held as a foundational piece of one’s portfolio.

Disclaimer: The writer of this article or employees of Stocktrades Ltd may have positions in securities listed below.

Disclaimer: You can read our full disclaimer more