The Performance Of Major Private Equity/LBO Firms

Attracted by the glamour and potential for lottery-like returns, global private equity (PE) assets under management reached $4.2 trillion in 2022. PE involves pooling capital to invest in private companies by providing venture capital (VC) to startups or by taking over and restructuring mature firms via leveraged buyouts (LBOs).

PE investors believe that the benefits outweigh the challenges not present in publicly traded assets—such as complexity of structure, capital calls (and the need to hold liquidity to meet them), illiquidity, higher betas than the market, high volatility of returns (the standard deviation of private equity is more than 100%), extreme skewness in returns (the median return of PE is much lower than the mean), lack of transparency, and high costs. Other challenges for investors in direct PE investments include performance-reporting data, which suffer from self-report bias and biased NAVs and understate the true variation in the value of PE investments.

How well have investors been rewarded? Jeffrey Hooke, author of the August 2023 study “Investment Performance Review of Major PE-LBO Families,” analyzed the performance of 19 of the top 25 PE-LBO fund families. Statistics for the other six were either unavailable or incomplete. He examined funds with vintage years (when a fund began operations) from 2005-2020. As you review his findings, keep in mind two important facts: First, private corporate values should be highly correlated with public ones, and second, given that PE-LBO firms are typically more highly leveraged than public companies, they should fall to a greater degree during public market downturns—reflecting their riskier nature.

The firms in the database included KKR, Blackstone, Carlyle Partners, TPG Partners, Apollo Investments, Thomas Bravo, Bain Capital, Hellman and Friedman Capital Partners, Vista Equity Partners, Clayton, Dubilier and Rice, West Street Capital, GS Capital Partners, Leonard Green & Partners, Fransisco Partners, Thomas H. Lee Partners, Golder Thoma Cressey Rauner, Madison Dearborn Capital Partners, Welsh Carson, Anderson & Stowe, New Mountain Partners, and Veritas Capital.

Following is a summary of his findings:

- The median (average) number of years for the typical fund to invest 60% of its commitments was 2.3 (2.5) years.

- The median (average) number of years for the typical fund to be fully invested was 4.3 (4.3) years.

- It took at least 11 years for funds to realize at least 90% of the total value paid in, (TVPI: the ratio of the current value of remaining investments within a fund plus the total value of cash distributions relative to the paid-in capital). Only 28 of the 72 total funds achieved the 90% figure. Multiple funds that were 8-12 years old had not yet met that threshold.

- The median (average) TVPI, which does not consider the time value of money or whether an investor could have achieved superior returns in the public markets, was 1.9 (2.0), assuming the mark-to-markets of unsold investments was accurate.

- The median and average number of years between a fund and a subsequent follow-on fund was 4.0 years. Thus, investors were committing to new funds without definitive knowledge of the cash return of the prior funds. Hooke noted: “Under current practice, limited partners (and their investment consultants) do not perform independent valuations of the underlying unsold PE-LBO investors of prior funds to confirm the PE manager’s mark-to-markets.”

- For the 60 eligible funds in the database, the median (average) public market equivalent (PME)—a PME indicates the fund achieved the same return as the S&P 500—which assumes the valuation of unsold deals is accurate, was 1.23 (1.27). However, the PME measurements appeared to have ignored the market decline of 2022 and its likely applicability to private investments. Since the S&P 500 lost 18.1% in 2022, it seems likely that the PME would have been much closer to 1.0.

- The forecasted internal rates of return (IRRs) for the non-90% liquidated funds did not fall significantly during the June-December 2022 period even though the S&P 500 fell more than 10% during that period.

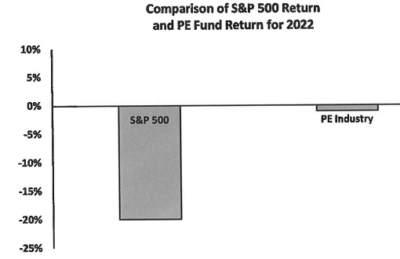

Highlighting the problem of inaccurately reflecting proper valuations, Hooke noted that data from California, New Jersey, and Maryland state pension plans revealed that the PE industry showed a -2% to 0% return in 2022, even as the S&P 500 lost 18.1%. He added: “The PE industry’s lobbying group, the American Investment Council, reported a similar pattern of returns. The PE-LBO sector is roughly two-thirds of the PE industry.” He also noted: “PE-LBO fund returns showed a similar pattern over the last two stock market downturns.”

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index.

Hooke then cited the example of the KKR Fund XII ($13 billion, 2016 vintage), which in December 2022 indicated a 19% IRR that even though just five months later, its largest investment (Envision Healthcare, $3.5 billion in equity) filed for bankruptcy. He also cited the recent sharp drop in the value of Icahn Enterprises LP (IEP) due to concerns about the accuracy of its valuations. IEP was trading above 50 in April but is now trading at about 20, a drop of about 60%.

In light of these findings, Hooke expressed concern about the valuations of Green Equity VI fund ($6.3 billion, 2012 vintage), which had yet to sell 47% of the stated value of the investments (11 years after startup):

“If the underlying investments are so valuable, how come no one wants to buy them? Additionally, despite a stock market downturn of 20% in 2022, the fund’s claimed 14% IRR remained static from 2021 to 2022, so the fund’s 2022 mark-to-market defies economic sense. Similar issues beset the Green follow-up fund ($12 billion in 2020 and $10 billion in 2022).”

Empirical Research Findings on Private Equity Performance

My 2019 article for Advisor Perspectives summarized the research on the performance of private equity. Unfortunately, it was not encouraging—in general, private equity had underperformed similarly risky public equities even without considering their use of leverage and adjusting for their lack of liquidity. But the authors of the 2005 study “Private Equity Performance: Returns, Persistence, and Capital Flows,” offered some hope. They concluded that private equity partnerships were learning—older, more experienced funds tended to have better performance—and there was some performance persistence. Thus, they recommended that investors choose a firm with a long track record of superior performance.

The most common interpretation of persistence has been either skill in distinguishing better investments or the ability to add value post-investment (e.g., providing strategic advice to their portfolio companies or helping recruit talented executives). Research by Verdad, which I reviewed in my August 2023 article for Advisor Perspectives, showed a lack of evidence supporting either hypothesis. But the study does offer another plausible explanation for persistence: Successful firms can charge a premium for their capital.

Robert Harris, Tim Jenkinson, Steven Kaplan, and Ruediger Stucke confirmed the prior research findings of persistence of outperformance in their November 2022 study, “Has Persistence Persisted in Private Equity? Evidence from Buyout and Venture Capital Funds.” However, it was only valid for venture capital (not the full spectrum of private equity), as they found no persistence of outperformance in buyout firms.

Investor Takeaways

There are several key takeaways for investors. First, the claims of superior risk-adjusted performance by the PE industry are exaggerated. Given their lack of liquidity, opaqueness, and greater use of leverage, it seems logical that investors should demand something like a 3-4% IRR premium. Yet, there is no evidence that the industry overall has been able to deliver that. Second, the failure to appropriately mark-to-market investments during public market drawdowns leads investors to underestimate the risk of these investments, as the volatility is significantly understated. Third, investors should expect that much of their capital might be outstanding even well beyond a decade—and that should undoubtedly require a risk premium.

The late David Swensen, a legendary chief investment officer of Yale’s endowment fund, offered this caution on private-equity investing, as noted in my book, The Quest for Alpha: “Understanding the difficulty of identifying superior hedge fund, venture capital, and leveraged buyout investments leads to the conclusion that hurdles for casual investors stand insurmountably high. Even many well-equipped investors fail to clear the hurdles necessary to achieve consistent success in producing market-beating, active management results. When operating in arenas that depend fundamentally on active management for success, ill-informed manager selection poses grave risks to portfolio assets.”

Those who ignore Swensen’s warning still need to understand that, due to the extreme volatility and skewness of returns, it is important to diversify the risks of private equity. This is best achieved by investing indirectly through a private equity fund rather than through direct investments in individual companies. Because most such funds typically limit their investments to a relatively small number, it is also prudent to diversify by investing in more than one fund. And finally, top-notch funds are likely to be closed to most individual investors. They get all the capital they need from the Yales of the world. Forewarned is forearmed.

More By This Author:

Dissecting The Idiosyncratic Volatility Puzzle

The Democratization Of Investing And The Evolution Of ETFs

ESG Preferences Negatively Affecting Market Efficiency

Performance figures contained herein are hypothetical, unaudited and prepared by Alpha Architect, LLC; hypothetical results are intended for illustrative purposes only. Past performance is not ...

more