Fed's Favorite Inflation Indicator Prints Hotter-Than-Expected As Savings Rate Plunges

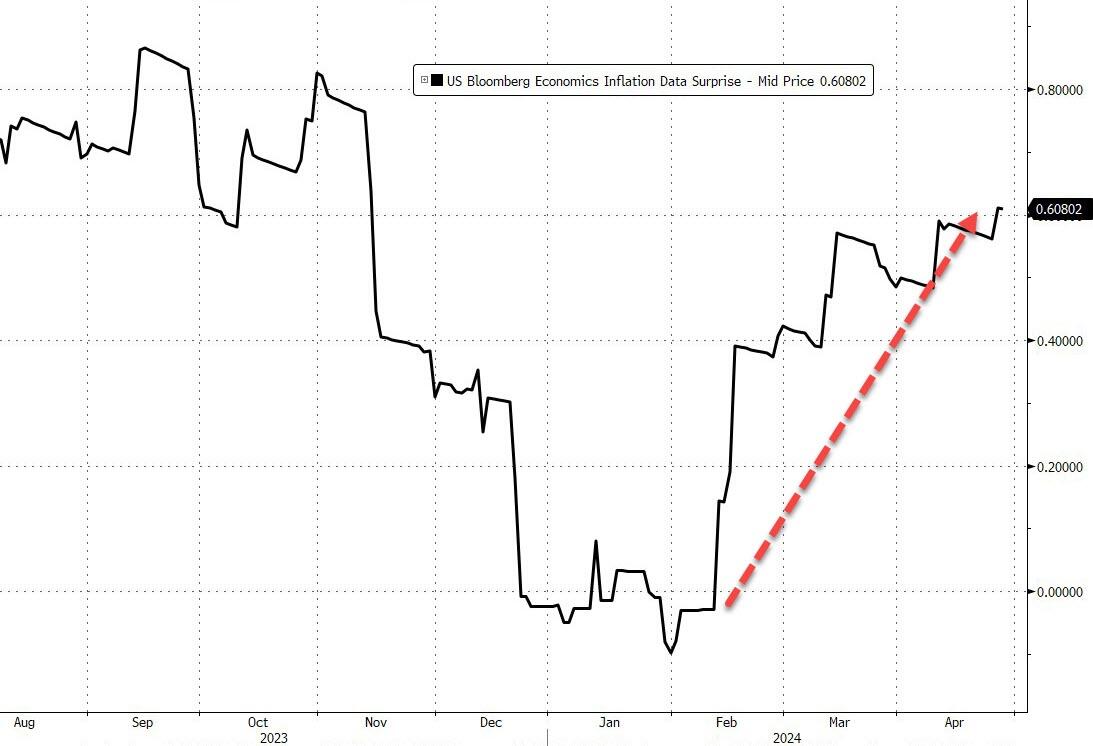

With inflation data surprising to the upside recently...

Source: Bloomberg

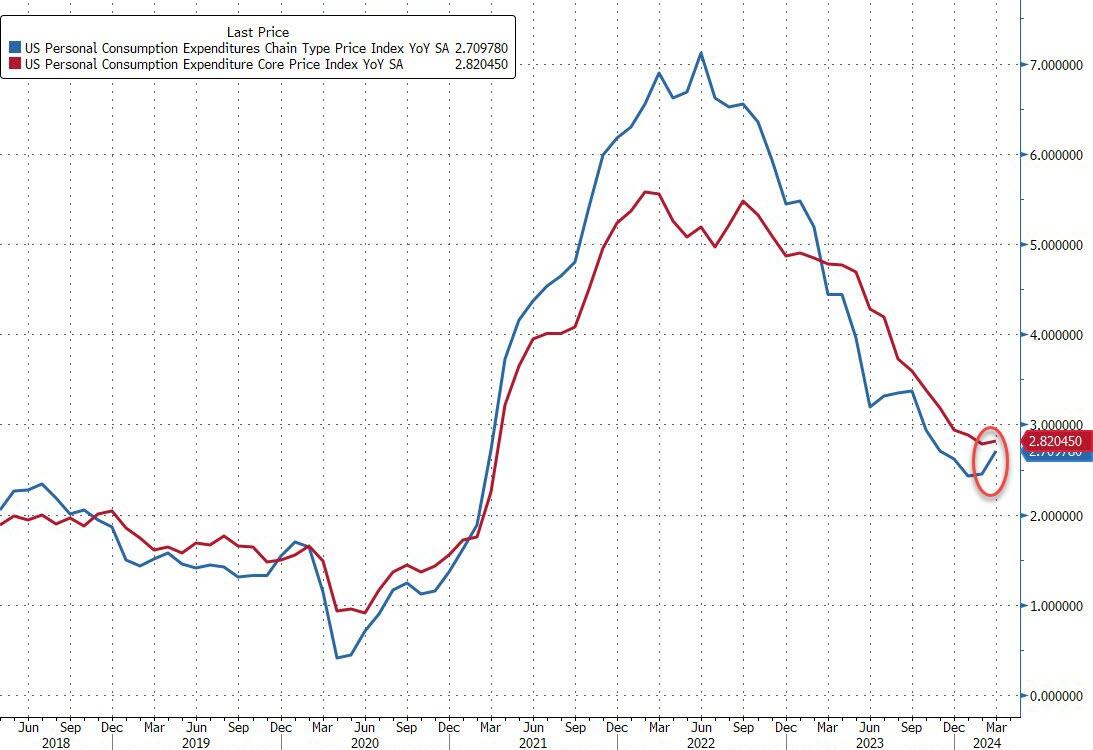

...the doves' last chance for sooner than later rate cuts is today's Core PCE Deflator - often described as The Fed's favorite inflation signal. Last month saw an uptick in the headline deflator and following yesterday's core PCE rise for Q1, all eyes are on the March data released this morning.

However, both the headline and core PCE Deflator data printed hotter than expected (+2.7% vs +2.6% exp vs +2.5% prior and +2.8% vs +2.7% exp vs +2.8% prior respectively)...

Source: Bloomberg

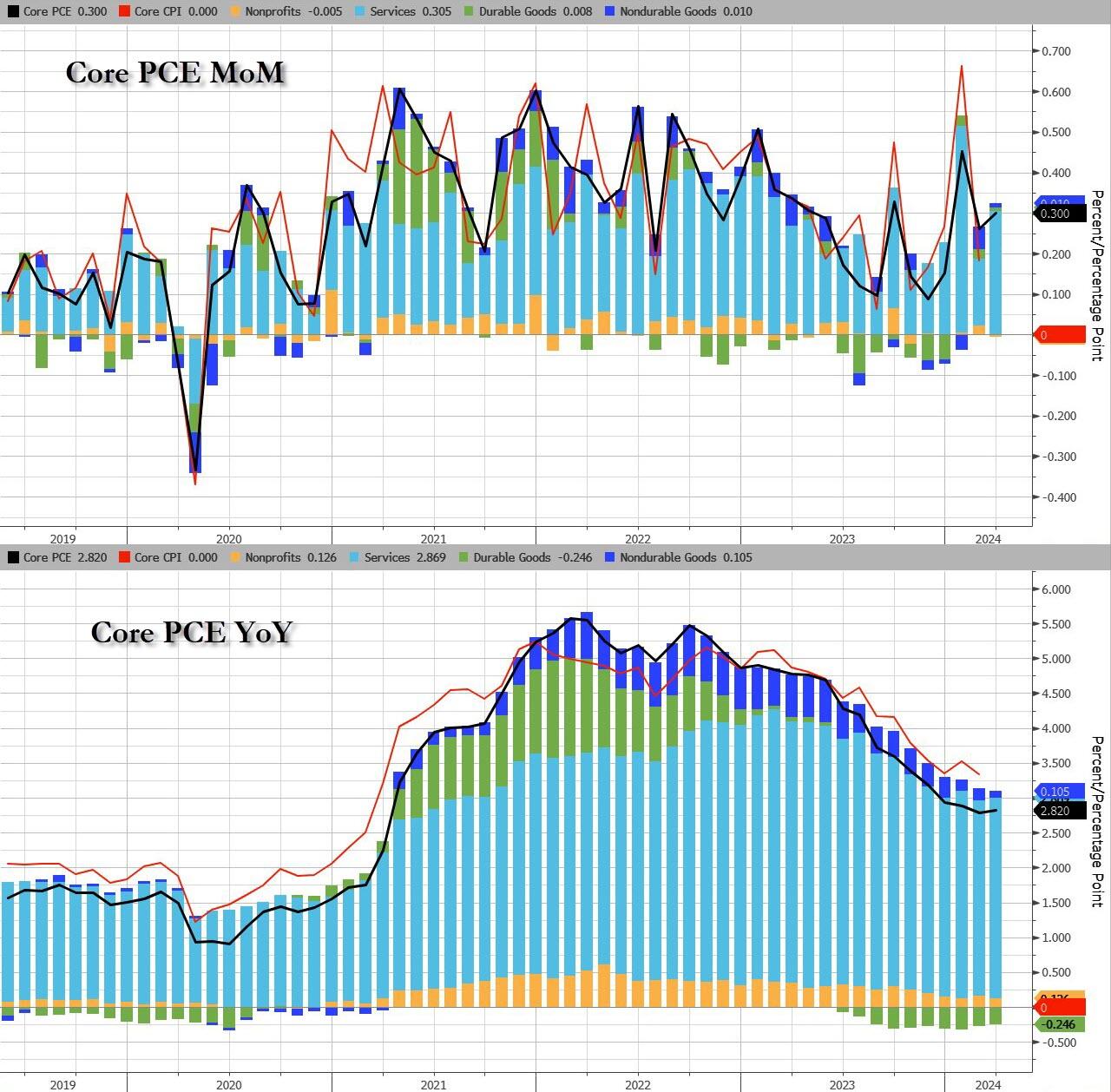

The silver lining is that this hot PCE print is 'dovish' relative to the GDP-based data we saw yesterday, with whisper numbers of +0.4 to +0.5% MoM (vs the +0.3% print).

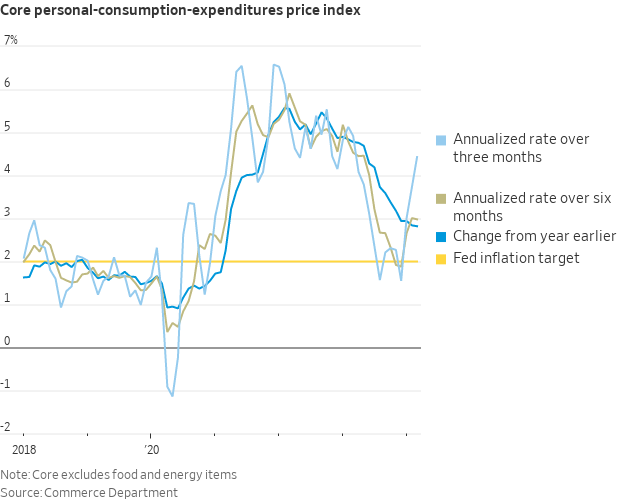

But, as WSJ Fed Whisperer Nick Timiraos notes, the 3-Month annualized core PCE jumped to 4.4%...

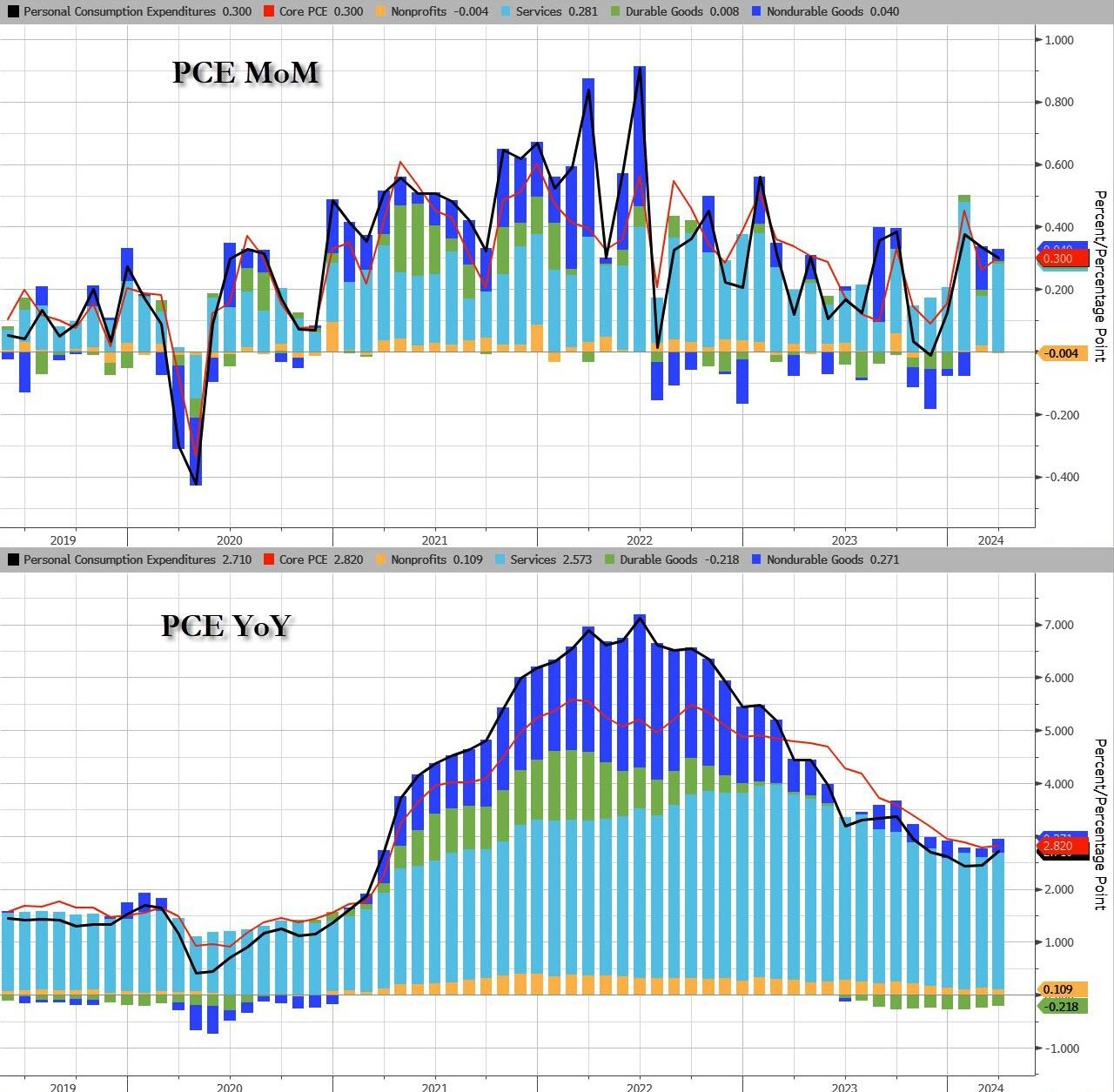

The Service sector led the MoM and YoY acceleration in headline PCE...

Source: Bloomberg

And for Core PCE, it was Services prices too that drove the acceleration...

Source: Bloomberg

The so-called SuperCore - Services inflation ex-Shelter -rose once again, and was revised higher...

Source: Bloomberg

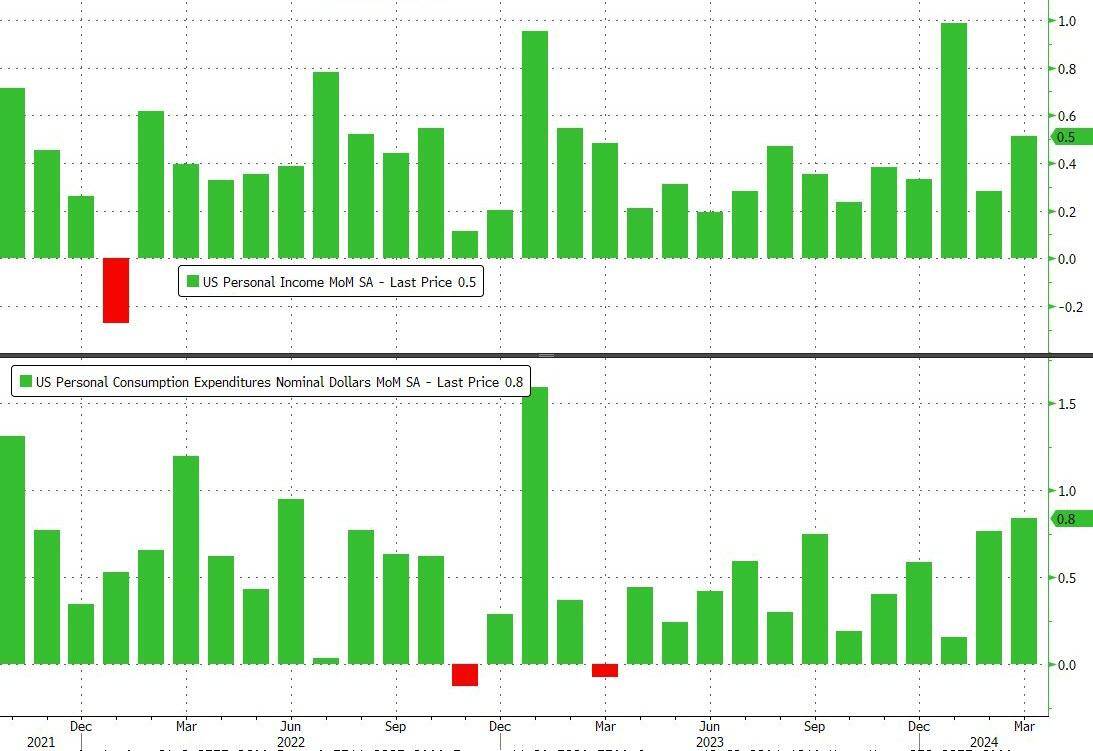

Income and Spending both rose again on a MoM basis with spending outpacing income (again). The 0.8% MoM rise in spending was the highest since Jan 2023...

Source: Bloomberg

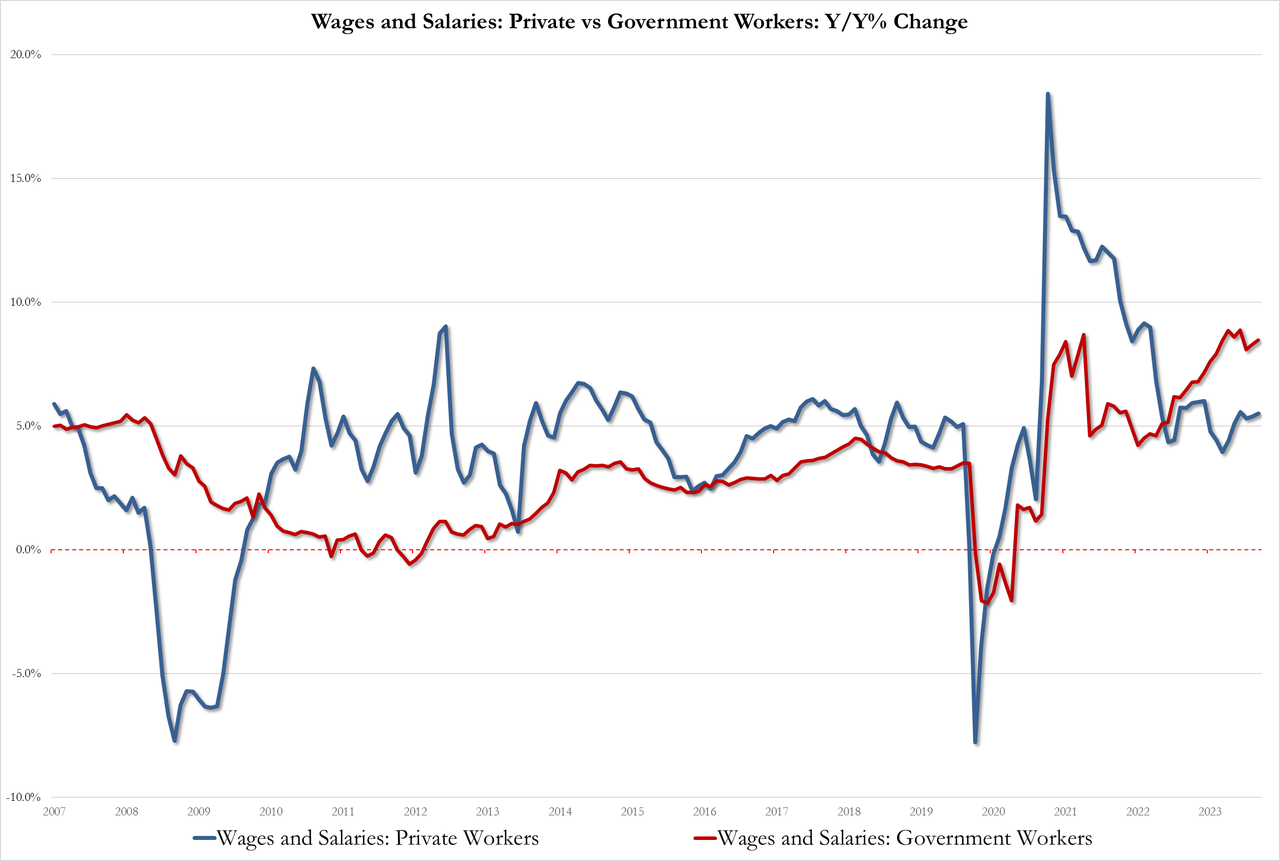

On the income side, government and private wage growth acclerated:

- Govt wages rose to 8.5% YoY, from 8.3%, the highest Dec 22

- Private wages rose to 5.5% YoY, from 5.4%, highest since Dec 22 as well

Source: Bloomberg

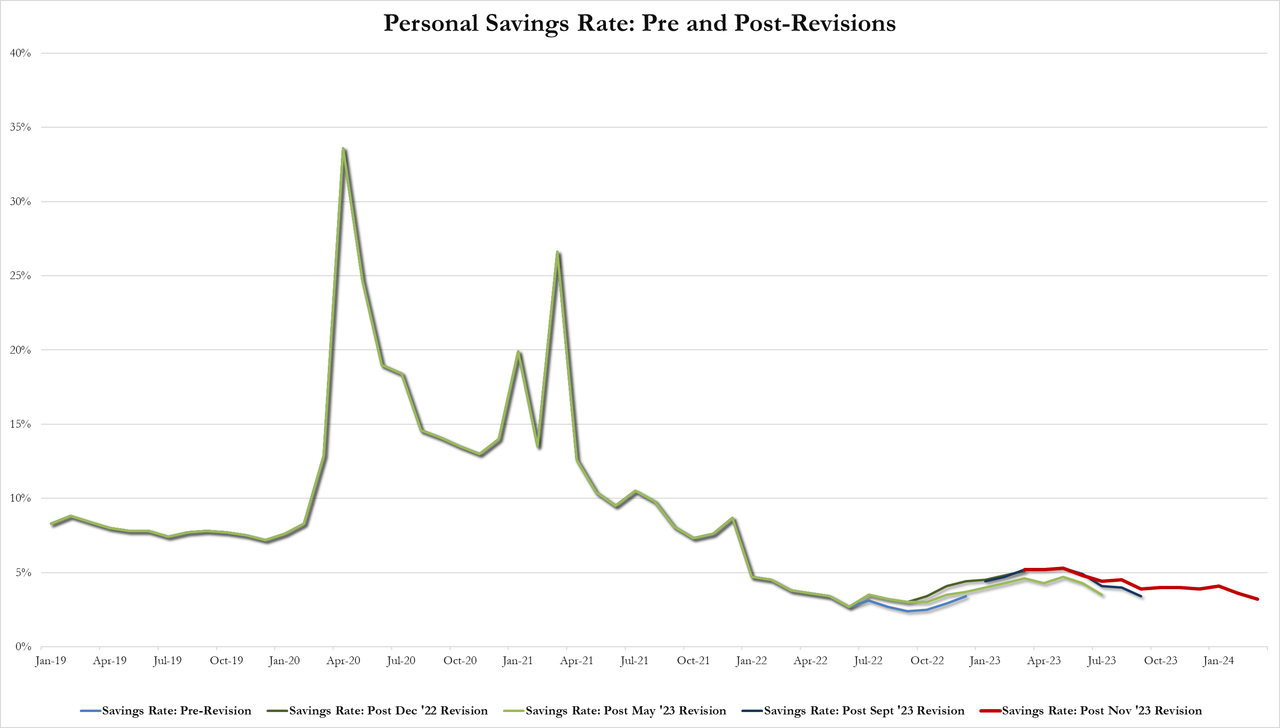

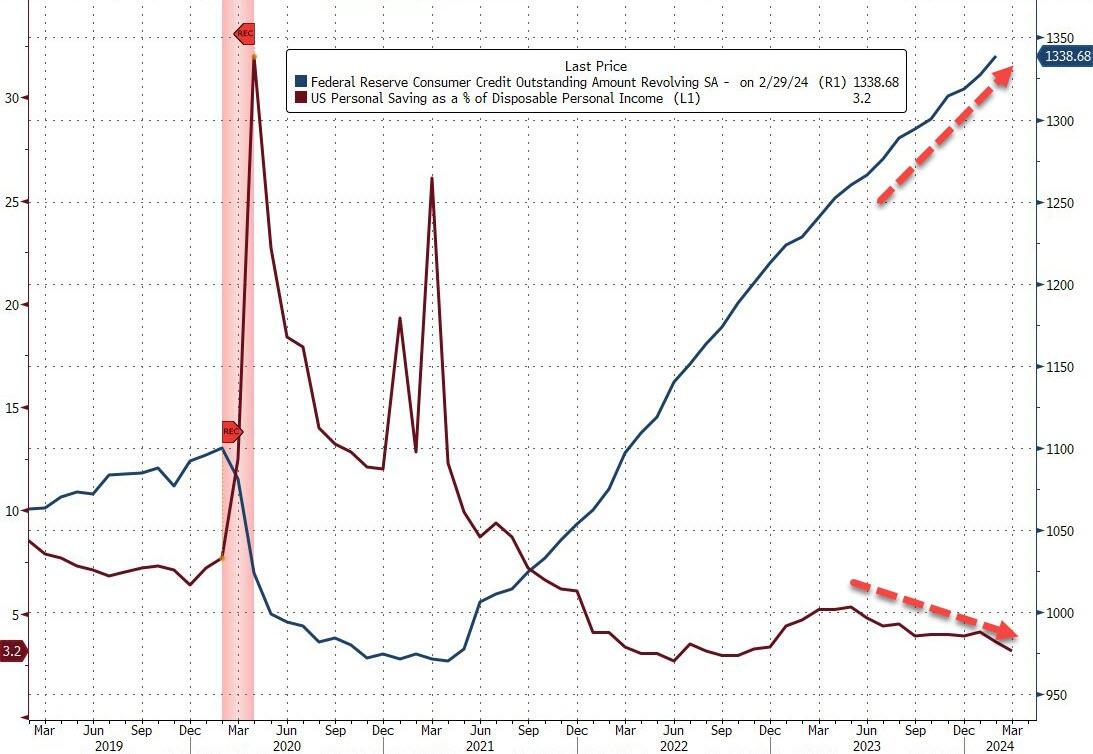

Which meant the personal savings rate plunged to 3.2% from 3.6% - its lowest since Nov 2022...

And the soaring credit card balance explains how people are getting by...

Source: Bloomberg

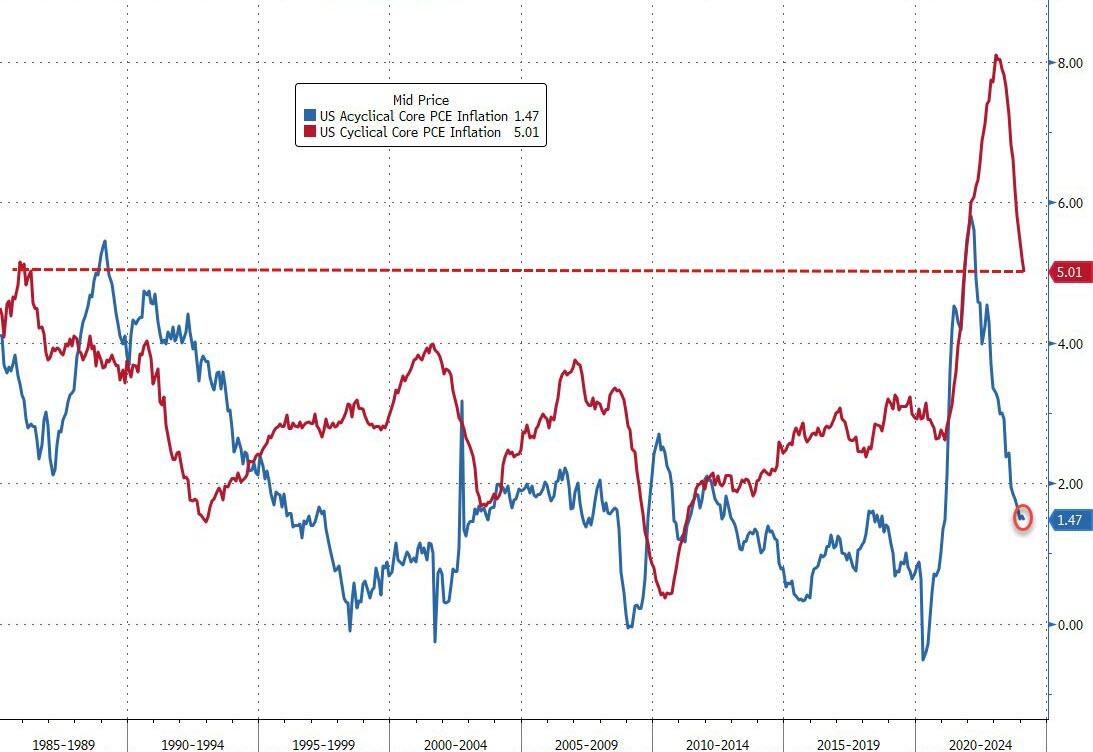

Finally, while the markets are exuberant at the survey-based disinflation, we do note that it's not all sunshine and unicorns. The vast majority of the reduction in inflation has been 'cyclical'...

Source: Bloomberg

Acyclical Core PCE inflation remains extremely high, although it has fallen from its highs.

Is The (apolitical) Fed going to be able to cut at all this year like Joe Biden said they would?

More By This Author:

Microsoft Surges As AI-Growth Drives Across-The-Board Beat

Soggy 7Y Auction Prices On The Screws; Foreign Demand Sags Amid Surge In Directs

Initial & Continuing Jobless Claims Continue To Ignore Reality

Disclosure: Copyright ©2009-2024 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more