What Is The Deal With Transitory Inflation?

The Federal Reserve has called inflation transitionary as they look for the economy to continue to recover and for more people to enter the workforce.

The Fed could be expecting inflation to settle down not only from people returning to work but also with a decrease in programs including the $300 weekly bonus for unemployment along with the last of the stimulus checks sent out.

However, there are a couple of potential problems the Fed is not considering.

Currently, the demand in the economy is strong, yet supply chain disruptions have hindered some growth and continue to do so.

One thought is that because there is a decent amount of people out of the workforce the problem will subside as the right jobs are filled.

This works for specific job types, but it does not work out as easily for companies that had to scale back production.

For example, mining and processing companies suffered large losses from the initial halt in demand and now are expected with a limited amount of capital to scale back up.

On the other hand, some of the supply chain disruptions are not only related to labor needed to increase output but from raw materials that are grown.

Because the agriculture industry works in cycles it could take 2 -3 years to reach normal supply levels.

Therefore, when watching for rising inflation, food has been a key metric as it can only be grown at a set pace and can take time to build up stock.

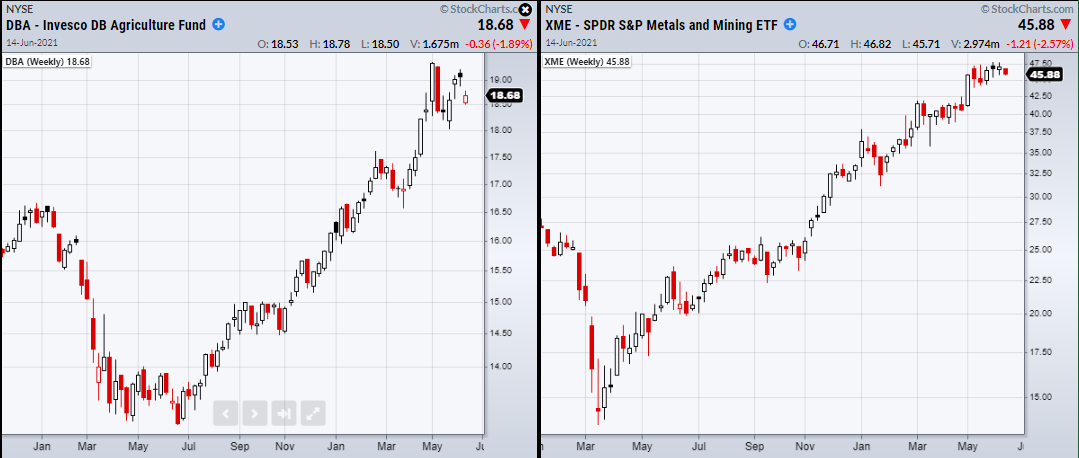

When watching materials such as food, we can look at Invesco Agricultural Fund ETF (DBA).

Additionally, for raw materials, we can watch the Metals and Mining ETF (XME).

If inflation is only a temporary transition, we can keep an eye on both ETFs as they will show us if supply has started to outpace demand.

(Click on image to enlarge)

ETF Summary

S&P 500 (SPY) New highs.

Russell 2000 (IWM) Holding over the 10-DMA at 229.69.

Dow (DIA) 341.61 the 50-DMA.

Nasdaq (QQQ) New highs.

KRE (Regional Banks) Like to see this clear back over 67.49.

SMH (Semiconductors) 245.28 support.258.59 resistance.

IYT (Transportation) 264.70 pivotal area.

IBB (Biotechnology) 159.37 support to hold.

XRT (Retail) Holding the 10-DMA 95.35 with main support the 50-DMA 92.98.

Volatility Index (VXX) Needs to find support.

Junk Bonds (JNK) 109.65 resistance.

XLU (Utilities) Needs to hold 65.77.

SLV (Silver) 25.47 support.

VBK (Small Cap Growth ETF) 288.11 next resistance.

UGA (US Gas Fund) 34.68 pivotal.

TLT (iShares 20+ Year Treasuries) 141 needs to hold.

USD (Dollar) 89.54 support. Resistance 90.68

MJ (Alternative Harvest ETF) Needs to hold 21.06.

LIT (Lithium) Watching to hold 72.70 next resistance area.

XOP (Oil and Gas Exploration) 95 support.

DBA (Agriculture) Holding 18.32 the 50-DMA.

GLD (Gold Trust) Bounced off the 200-DMA at 172.82

Disclaimer: The information provided by us is for educational and informational purposes. This information is based on our trading experience and beliefs. The information on this website is not ...

more