What Is Obvious...is Obviously Wrong

Image Source: Pixabay

The old market adage...

If it is obvious...it is obviously wrong

...is rooted in experience. When so much digital ink is spent promulgating the idea that the market bubble is about to "pop", we know that the bubble is not about to pop. The herd is never right at pivot points. Bull markets grow on fear, and die in confident exuberance. Currently, we are in the "fear of the bubble" phase and must move into "it's different this time" exuberance phase before the bubble actually bursts.

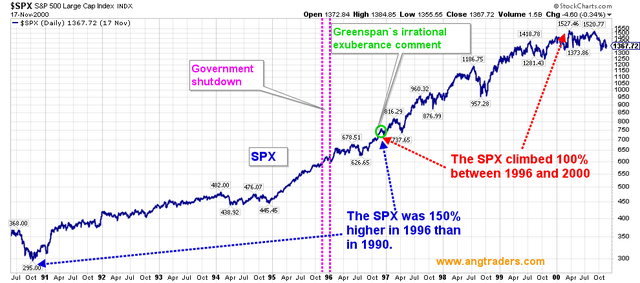

Late in 1996, Greenspan jumped on the 'scare wagon' with his infamous "irrational exuberance" comment. The market had rallied 150% in just six-years, so a statement like his was "obvious". Following that comment, the market doubled in value over the next 3-years as it climbed the 'wall of worry' (chart below).

ANG Traders, stockcharts.com

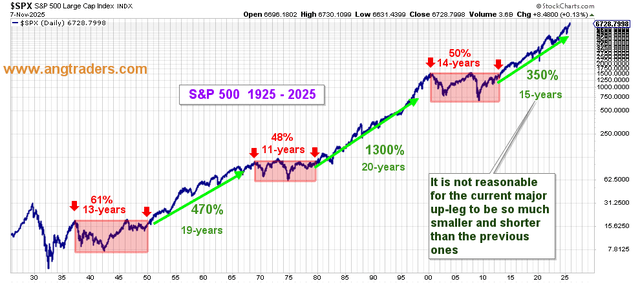

Despite all the headlines about bubbles, the truth is that the current major up-leg has several years left before it reaches the average 19-20 years cycle-length, and is still significantly lower in valuation than the previous cycles. It is not reasonable to expect that this major bull cycle will be so much smaller and shorter in duration than the previous two cycles (green-arrows on the chart below).

ANG Traders, stockhouse.com

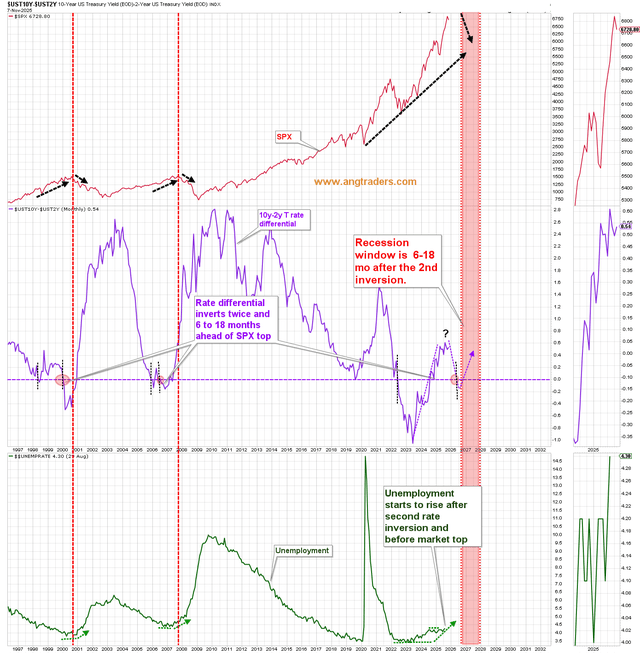

Historically, recessions (and bear markets) start 6-18 months after the second 10y-2y rate differential. Currently, the differential is comfortably positive, which makes a recession in the next 6-12 months very unlikely...and all the talk of the market being in an obvious "valuation bubble", obviously wrong (chart below).

ANG Traders, stockcharts.com

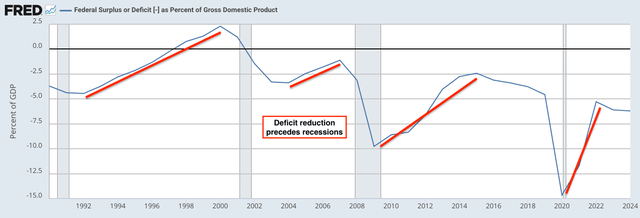

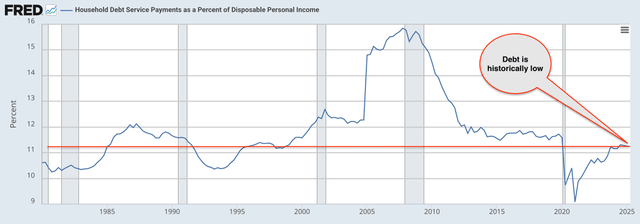

All recessions are preceded by reduced government deficits (first chart below) and triggered by private debt becoming increasingly difficult to maintain which causes assets to be sold in order to reduce private debt. In other words, net money-creation collapses. Currently--the government closure not withstanding--the deficit is still healthy enough (first chart below), and bank credit has room to grow and absorb considerable future deficit reduction (second chart below); money-creation remains active and has room to grow.

FRED, ANG traders

FRED, ANG Traders

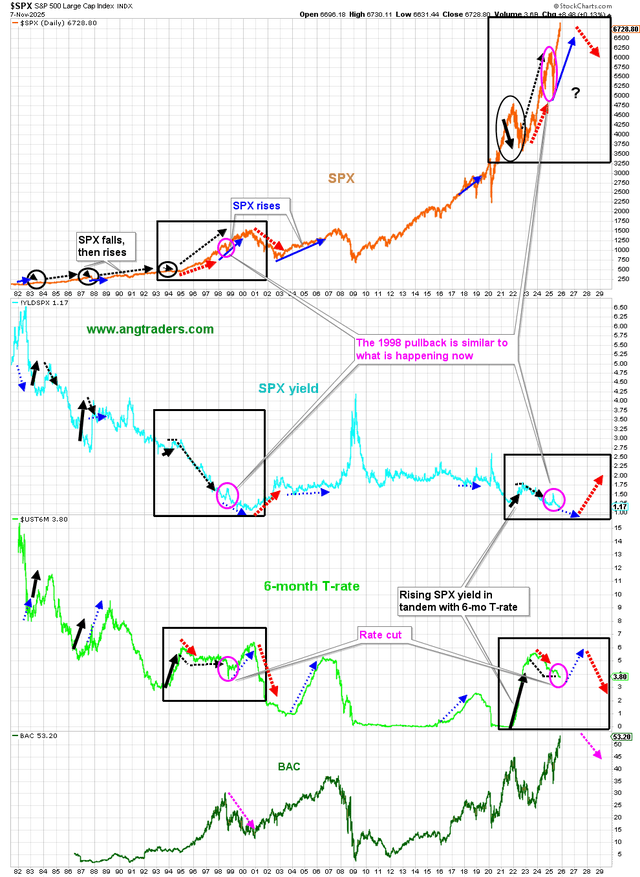

As I have pointed out in the past (here), the current situation is analogous to the 1996-2000 period (black-rectangles below).

ANG Traders, stockcharts.com

Currently, like in the late 1990s, the three requirements for a major bull market remain in place:

1. A disruptive technology.

2. Enough money-creation to release the new technology.

3. Fear and incredulity in the 'herd'.

The cyclical bull market continues and investors should stay invested on the long side and buy the "dip" in technology stocks and the broad index ETFs such as XLK, SOXX, QQQ, and SPY.

More By This Author:

How The Market Behaved During Past Government Shutdowns

Fear, Greed, And Money Reign Supreme — Even Among The Machines

SPX Weakness Likely For The Next Week

ANG Traders makes no guarantees concerning the profitability of our trades. Our trade notification service is not intended as investment advice in any way. It is simply providing information about ...

more