VanEck Gold Miners ETF GDX - Elliott Wave Technical Analysis

GDX Daily Chart Analysis (1D)

Function: Major Trend

Mode: Motive

Structure: Impulse

Position: Wave [iii] navy

Direction: Rally

Details:

Wave 3 has entered its strongest phase — the third of a third of a third.

The next rally is expected to reach around $55.24 for wave [iii], with the potential to extend even higher.

A possible wave extension suggests a long-term bullish move is unfolding.

Key Support Level: $42.00

Invalidation Level: $40.26

(Click on image to enlarge)

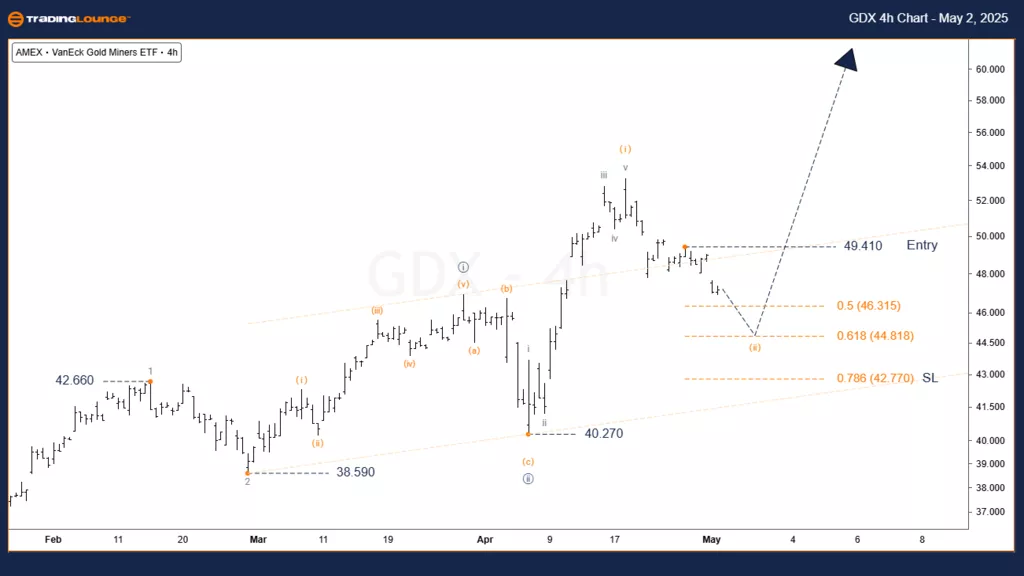

GDX 4-Hour Chart Analysis (4H)

Function: Major Trend (Minor Degree, Grey)

Mode: Motive

Structure: Impulse

Position: Wave (ii) of [iii]

Direction: Mini decline

Details:

Wave (i) of [iii] has completed, and wave (ii) is now forming.

The ongoing decline should find support around the $46.00 level, close to the centerline of the Kennedy Base Channel of wave [i].

A minor final push downward is expected before a strong rally in wave (iii) resumes.

Suggested Entry: $49.410

Stop Loss: Just below $42.770

Invalidation Level: $40.27

(Click on image to enlarge)

Conclusion:

GDX remains in a young and developing uptrend.

The current phase demands patience, as traders wait for a clearer setup to rejoin the rally.

$40.27 serves as the critical invalidation level for the bullish count.

Strict adherence to Elliott Wave rules and attention to invalidation points is essential to minimize trading risks.

Technical Analyst: Simon Brooks

Source: Visit TradingLounge.com and learn from the experts!

Join TradingLounge Today!

More By This Author:

SEI Crypto Price News - Elliott Wave Technical Analysis

Energy Select Sector ETF XLE - Elliott Wave Technical Analysis

Trading Strategies For S&P 500, Nasdaq 100, DAX 40, FTSE 100 & ASX 200

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more