VanEck Gold Miners ETF Elliott Wave Technical Analysis

VanEck Gold Miners ETF – GDX Elliott Wave Analysis

GDX (1D) – Daily Chart Analysis

Function: Major Trend

Mode: Motive

Structure: Impulse

Position: Wave [iii] (navy)

Direction: Rally

Details:

GDX has entered the strongest phase of an impulse wave — the third of a third of a third, known for rapid price movement.

The target price for wave [iii] is $55.24.

$42.00 is the key support level.

Invalidation level: $40.26 — any drop below this would nullify the current wave count.

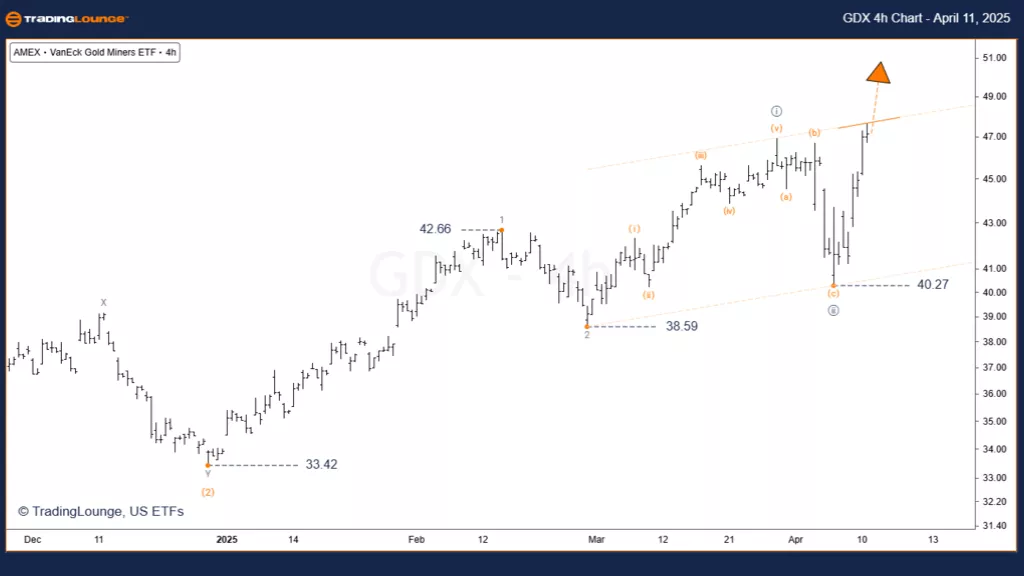

GDX (4H) – 4-Hour Chart Analysis

Function: Major Trend (Minor degree, grey)

Mode: Motive

Structure: Impulse

Position: Wave [iii]

Direction: Rally

Details:

Wave [iii] has confirmed its presence by breaking above $46.71, a significant bullish signal.

To fully validate this wave, watch for a break above the upper boundary of the KCT Base Channel.

Wave [iii] projection: expected to extend 1.618 times wave [i], targeting $55.24.

The invalidation level remains at $40.26.

Conclusion & Strategy

GDX is in the early stages of a bullish impulse, with the most powerful wave segment currently in play.

The rally remains intact, and momentum is building toward the projected $55.24 level.

Traders should track wave development closely and respect the invalidation point ($40.26) to manage risk.

The structure aligns strongly with classic Elliott Wave rules, indicating a high-confidence trade setup.

TradingLounge | Analyst: Siinom

More By This Author:

Elliott Wave Technical Forecast: Suncorp Group Limited

Elliott Wave Technical Analysis: Berkshire Hathaway Inc. - Friday, April 11

Elliott Wave Technical Analysis: Australian Dollar/U.S. Dollar - Friday, April 11

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more