VanEck Gold Miners ETF – GDX Elliott Wave Technical Analysis

VanEck Gold Miners ETF – GDX (1M) Elliott Wave Technical Analysis

Monthly Chart

- Function: Major Trend (Primary Degree – Navy)

- Mode: Motive

- Structure: Post-Triangle Thrust

- Position: Wave (3) of [5]

- Direction: Upside Rally

Details:

- The bullish trend continues as GDX has broken out of a long-term triangle wave [4].

- New all-time highs are expected since the trend is still in its early phase.

- With wave 2 potentially completed, a strong rally is anticipated in the coming weeks or months.

- Invalidation Level: $25.62

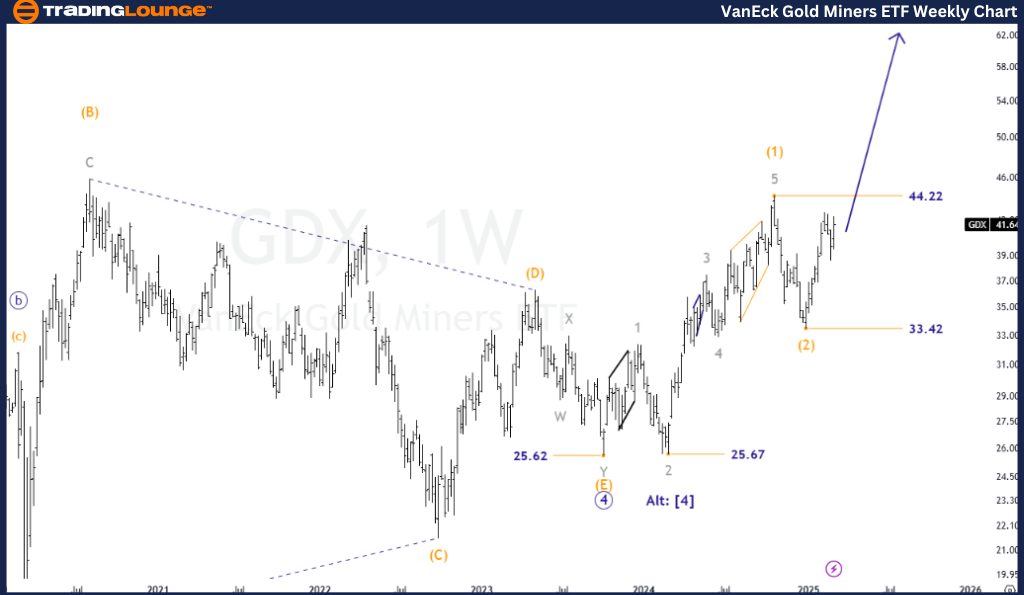

VanEck Gold Miners ETF – GDX (1W) Elliott Wave Technical Analysis

Weekly Chart

- Function: Major Trend (Primary Degree – Navy)

- Mode: Motive

- Structure: Impulse Wave

- Position: Wave 3 of (3)

- Direction: Uptrend

Details:

- If wave (2) correction is over, GDX should rally to higher prices to complete the five-wave upward movement.

- The recent low now serves as critical support, indicating the completion of wave (2).

- The market must break above $44.22 to confirm the uptrend.

- Invalidation Level: $33.42

Conclusion

The summary of the Elliott Wave analyses above highlights:

- GDX ETF is exhibiting strong impulsive waves, signaling long-term rally potential.

- This presents a trading opportunity to ride a wave that could surpass the current all-time high in GDX.

- Following Elliott Wave rules and monitoring invalidation levels is crucial to minimize potential losses.

Technical Analyst: Siinom

More By This Author:

Elliott Wave Trading Strategies: Mastering SP500, Nasdaq & Bitcoin Market Waves

Unlocking ASX Trading Success: James Hardie Industries

Elliott Wave Technical Analysis: McDonald's Corp. - Friday, March 7

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

moreComments

Please wait...

Comment posted successfully

No Thumbs up yet!